Understanding What Constitutes an Excellent Credit Score and When You Achieve It

Achieving a prime standing in the realm of personal finance is a goal many aspire to. It’s not just about having access to funds; it’s about securing favorable terms and rates that can significantly impact one’s financial journey. The significance of maintaining a remarkable rating cannot be overstated, as it opens doors to opportunities that can enhance one’s purchasing power and overall economic well-being.

Numerous factors come into play when evaluating this key aspect of financial health. Individuals often find themselves curious about what constitutes a top-tier rating. Beyond mere numbers, it reflects one’s financial responsibility and the ability to manage obligations effectively. In essence, a stellar standing is synonymous with trustworthiness in the eyes of lenders, insurers, and even potential employers.

As we delve deeper into the benchmarks and characteristics that define such a standing, it’s crucial to understand the nuances involved. Being aware of the intricacies can empower individuals to take proactive measures, ensuring they remain in that sought-after category. Ultimately, striving for this distinction is not just a financial endeavor; it is a lifestyle choice that can lead to greater stability and peace of mind.

Understanding the Credit Score Scale

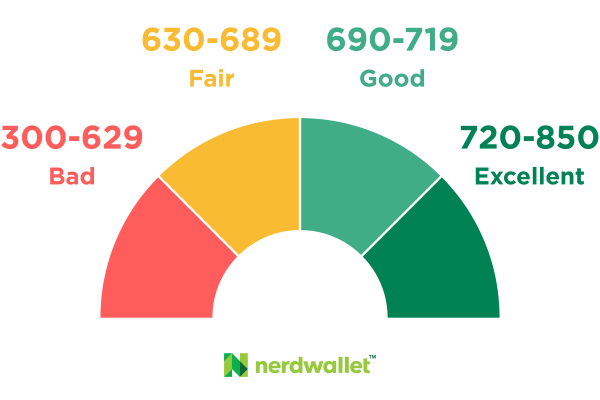

When it comes to financial health, grasping the measurement system that reflects your trustworthiness is essential. This scale offers insights into how lenders perceive individuals seeking loans or credit. Each range signifies different levels of reliability, shaping your access to various financial products.

Ranges vary significantly, typically categorized from poor to exceptional. This spectrum allows banks and other institutions to make informed decisions regarding extending credit. Knowing where you stand can empower you to manage your finances better and potentially unlock better interest rates over time.

Within this framework, lower tiers often highlight potential risks, while higher tiers reflect greater assurance. Individuals aiming to climb the ladder should focus on timely payments, responsible borrowing, and maintaining a balanced mix of account types. Understanding this landscape can pave the way toward achieving favorable financial outcomes.

Factors That Influence Your Credit Rating

Your financial reputation is shaped by a variety of elements that contribute to the overall picture of your borrowing behavior. These components work together, impacting how lenders perceive your reliability in fulfilling financial obligations. Understanding these aspects can empower you to make better decisions and enhance your standing.

Payment History: One of the most significant factors is how consistently you meet your payment deadlines. Regular, timely payments reflect positively on your financial habits, while missed or late payments can lead to a decrease in your standing.

Credit Utilization: This aspect refers to the ratio of your current debt to your available credit. Keeping this percentage low demonstrates responsible management and can enhance your financial image.

Length of Credit History: The duration of your financial activities matters too. A longer history shows that you have experience with managing various accounts, indicating reliability to potential lenders.

Types of Credit: The diversity of credit accounts, such as loans, mortgages, or revolving accounts, provides insight into your ability to handle different types of debt. A varied portfolio can be a positive sign.

Recent Inquiries: When you apply for new credit, it typically results in an inquiry on your report. Multiple inquiries in a short time frame can be seen as a red flag, suggesting that you may be in financial distress.

By staying aware of these influential elements, you can take proactive steps toward enhancing your financial reputation and increasing your chances of favorable lending outcomes.

Benefits of Maintaining an Exceptional Rating

Having a top-tier rating brings a plethora of advantages that significantly enhance your financial well-being. When your assessment is high, the doors to various opportunities swing wide open, allowing for better terms and more favorable conditions in your financial dealings.

First and foremost, lenders often shower individuals with appealing offers. With a solid standing, you can enjoy lower interest rates, which translates to considerable savings over time. This advantage isn’t just limited to loans; it extends to credit cards and other types of financing as well.

Insurance companies pay attention to these evaluations too. A high standing can lead to reduced premiums, ultimately lowering your overall expenses. This means more money in your pocket for things that matter.

Another perk worth mentioning is the boost in negotiating power. When you possess a stellar evaluation, you can leverage it in discussions about loans or credit agreements, allowing you to secure terms that are more aligned with your financial goals.

Additionally, having a pristine rating enhances your chances of approval for various financial products and services. Whether you’re considering purchasing a home, leasing a vehicle, or just seeking a credit line, a strong evaluation increases your eligibility.

Lastly, it provides peace of mind. Knowing that your financial reputation is solid can alleviate stress and provide a sense of security in your financial decisions. You’re better equipped to face unexpected expenses and make significant life choices when you’re confident in your standing.

I can’t believe how good this was! You truly have a talent for making fun and engaging videos.