Understanding What Constitutes a Good Credit Score and Its Importance

Many people wonder what constitutes a favorable standing in the world of personal finance. This aspect of financial health plays a crucial role in various transactions, affecting everything from loan approvals to interest rates. As we navigate this topic, it’s essential to grasp the ranges and factors that determine a robust reputation in fiscal matters.

Achieving a solid standing is not simply about hitting a particular mark; it involves understanding the elements that contribute to a positive evaluation. From payment history to the types of credit utilized, each piece forms part of a larger picture that lenders and financial institutions review. As we delve deeper, we’ll uncover what traits define a thriving financial profile.

In today’s financial landscape, it’s vital to recognize the benchmarks that signify a healthy reputation. These thresholds can vary based on different entities and their specific criteria. By familiarizing ourselves with these parameters, individuals can better navigate their financial journeys and make informed decisions.

Understanding Credit Score Ranges

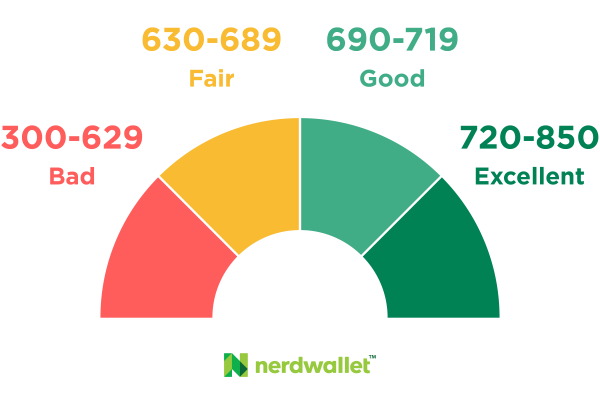

When it comes to assessing your fiscal health, ranges play a pivotal role in giving insight into where you stand. Different categories allow lenders and others to gauge risk levels, helping them make informed decisions about lending or extending services. These brackets transform complex numbers into understandable metrics that can guide individuals toward financial empowerment.

Typically, the classifications fall into several tiers, each representing varying levels of financial reliability. From top-tier to less favorable ranges, each category affects not just borrowing opportunities but also the conditions attached, such as interest rates and repayment terms. Knowing where your figures land can help you navigate the financial landscape more effectively.

For many, aiming for the upper segments is ideal as it usually reflects a history of responsible monetary behavior. Conversely, lower brackets might signal potential trouble, indicating a need for improvement. Improving one’s position involves prudent management of borrowing, timely payments, and maintaining a healthy balance of credit types.

Understanding these categories is the first step in taking control of your financial future. Staying informed empowers individuals to not only meet but exceed their fiscal goals. By familiarizing yourself with the ranges, you can map out a clear path toward better financial outcomes.

Factors Influencing a Positive Financial Reputation

Building a solid financial reputation isn’t just a matter of luck; it’s about understanding the various elements that contribute to it. Many aspects come into play, each playing a vital role in shaping how lenders perceive your financial habits. By paying attention to these key factors, you can significantly enhance your overall standing.

Payment history is one of the most crucial factors. Consistently paying your bills on time indicates responsibility and reliability. On the flip side, late payments or defaults can quickly tarnish your reputation.

The amount of debt you carry relative to your available credit also speaks volumes. High balances can signal potential risk, while low utilization ratios often suggest you manage your finances wisely. It’s all about striking that perfect balance.

Length of credit history matters too. The longer your accounts have been active, the better it reflects on your overall profile. Keeping older accounts open, even if not used frequently, can positively influence your standing.

Additionally, the variety of accounts you have can enhance your reputation. A mix of credit types, such as revolving accounts and installment loans, showcases your adaptability in managing different financial commitments.

Lastly, frequency of applications for new credit can be a red flag. Multiple inquiries within a short period can indicate riskier behavior, so it’s wise to be strategic with your applications. By focusing on these elements, you can work towards a more favorable perception among lenders.

Benefits of Maintaining Strong Credit

Having a solid financial standing opens up a world of advantages that can significantly enhance your life. It’s not just about numbers; it’s about the opportunities and convenience that come your way. Individuals with a robust financial reputation often find themselves in a much better position to achieve their aspirations and manage their finances effectively.

Here are some key benefits of maintaining a strong financial profile:

- Lower Interest Rates: A favorable financial reputation typically leads to reduced interest rates on loans. This can save you a significant amount of money over time.

- Better Loan Approval Chances: Banks and lenders are more likely to approve your applications when you have a reliable financial history, making it easier to secure the funding you need.

- Increased Credit Limits: With a strong standing, you may receive higher credit limits, offering you greater flexibility in managing your expenses.

- Enhanced Renting Opportunities: Landlords often check financial histories, and a good standing improves your chances of being approved for rental properties.

- Insurance Premium Savings: Some insurance companies consider financial stability when calculating premiums, potentially leading to lower rates.

- Easier Approval for Security Deposits: A reliable standing can minimize or even eliminate security deposits for utilities and rental agreements.

- Greater Financial Negotiation Power: When your financial reputation is strong, you may have a stronger position to negotiate better terms on loans and credit cards.

In summary, nurturing and maintaining a robust financial reputation not only opens doors to better borrowing options but can also lead to substantial savings and increased flexibility in various aspects of life. It’s an investment in your financial well-being that pays off in numerous ways.