Understanding the Factors That Define a Poor Credit Score and When It Becomes a Concern

Navigating the world of personal finance can sometimes feel overwhelming, especially when it comes to understanding how your financial habits impact your overall well-being. Many individuals find themselves puzzled by various metrics that indicate their monetary standing. It’s essential to recognize the signs that your financial history may not be working in your favor, affecting your chances of securing favorable terms for loans or credit options.

In a society where borrowing plays a significant role, having a robust financial profile is increasingly important. Numerous factors contribute to how lending institutions perceive your financial reliability. Awareness of these factors can empower you to take control of your monetary future, ultimately leading to better opportunities for investments or purchases such as a home or vehicle.

Sometimes, realizing that your financial track record isn’t optimal comes as a surprise. Identifying these warning signs early on can save you from potential setbacks in your financial journey. Let’s delve into what might indicate a less-than-ideal financial history and how you can effectively address these concerns.

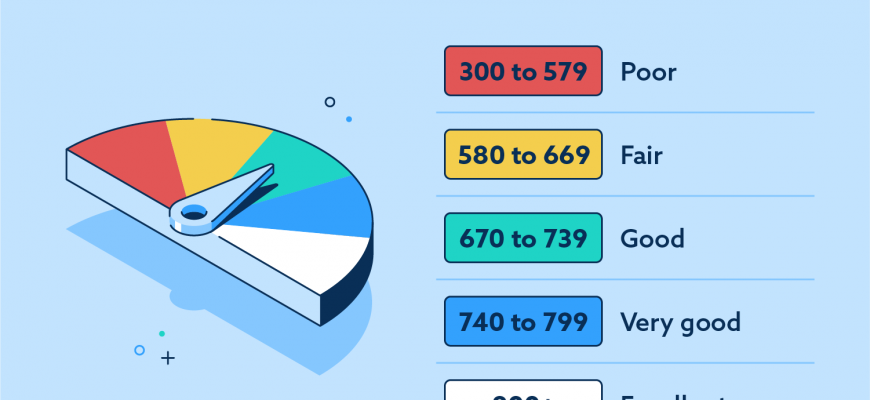

Understanding Poor Credit Scores

Having a low numerical evaluation of financial behavior can significantly impact various aspects of life. This aspect often determines how lenders perceive one’s reliability and willingness to repay borrowed funds. When this metric is less than satisfactory, it may lead to challenges in obtaining loans, securing housing, or even finding employment in certain sectors.

Several factors can contribute to an unfavorable rating, including missed payments, high outstanding debts, and frequent applications for new lines of credit. These elements signal to lenders that one may pose a higher risk, leading to increased interest rates or outright denial of loans. It’s essential to understand these influences to take proactive steps towards improving one’s financial reputation.

Fortunately, there are methods available to enhance this rating over time. Making timely payments, reducing debt levels, and maintaining a balanced mix of credit can gradually update the perception lenders have. By focusing on responsible financial habits, individuals can work toward achieving a more favorable evaluation, opening doors to better opportunities in the future.

Common Reasons for Low Ratings

There are several factors that can lead to less than favorable assessments of one’s financial reliability. Understanding these can help individuals take proactive steps to improve their overall standing. Here are some of the most common culprits.

Missed Payments: Timely payments are crucial. Late or missed payments on loans, credit cards, or other debts can significantly impact one’s standing. It’s essential to stay organized and set reminders to avoid falling behind.

High Utilization: Using a large portion of available credit can raise red flags. Keeping balances low compared to total limits is important for maintaining a healthy financial profile.

Too Many Inquiries: Each time a financial institution checks an individual’s background for potential lending, it may leave a mark. Multiple inquiries in a short period can signal financial distress and harm overall evaluations.

Short Credit History: A limited past can make it difficult for lenders to gauge reliability. Building a robust history over time can create a stronger foundation for future assessments.

Defaults or Bankruptcies: Serious financial missteps, such as defaulting on loans or declaring bankruptcy, have long-lasting effects. These may result in significant hurdles for individuals seeking new lines of credit.

Addressing these issues can pave the way for better assessments and greater financial opportunities down the road. Awareness and proactive management are key to turning things around.

Impact of Poor Financial Standing on Finances

Having a less than ideal financial reputation can lead to a series of challenges that may affect various aspects of life. It’s not just about facing higher interest rates or getting denied for loans; it can also influence day-to-day living, from finding a place to rent to securing insurance. Understanding these consequences is crucial for anyone looking to improve their overall financial health.

One of the most noticeable effects is the limitation on credit options. Most lenders see individuals with a tarnished financial history as higher risks, which means they may either offer loans with steep interest or none at all. This can result in needing to rely on alternative financing methods that often come with unfavorable terms.

Additionally, expenses can escalate unexpectedly. With a weaker financial track record, individuals might have to pay more for necessary services, like insurance premiums or utility deposits. These extra costs can add up quickly, putting more strain on monthly budgets and making it harder to save or invest.

Moreover, emotional stress is another significant consequence that shouldn’t be overlooked. Constant worry about finances can impact mental well-being, leading to anxiety and affecting relationships with family and friends. Finding ways to restore a positive financial status can help alleviate some of this pressure.

Ultimately, safeguarding one’s financial reputation is essential for achieving stability and peace of mind. Seeking advice, making timely payments, and learning about financial management can pave the way towards a much brighter fiscal future.