Understanding the Timing and Implementation of Credit Policy

Have you ever wondered about the strategic frameworks that govern lending practices? This topic delves into the essential aspects that shape the decisions made by financial institutions regarding borrowing and lending. It’s fascinating how these frameworks influence not only organizations but also individuals like you and me.

Timing is key in the world of financial agreements. Various triggers and circumstances dictate when actions are taken or adjustments are made. By analyzing these factors, we can gain insight into how organizations adapt to changing economic climates and market demands.

In the following sections, we will explore the nuances of these strategic frameworks. Understanding their structure and timing can help you make informed decisions, whether you’re a borrower seeking assistance or just curious about the mechanisms at play in the financial landscape. So, let’s embark on this journey and uncover the critical elements together.

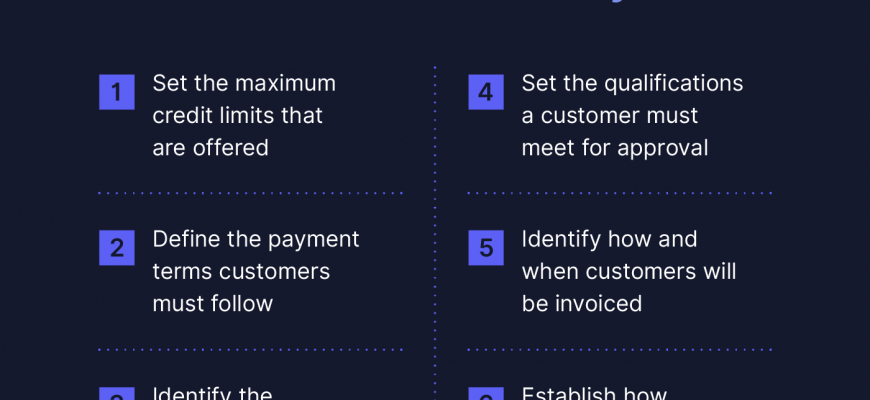

Understanding Credit Policy Fundamentals

Getting a grasp on the principles behind lending regulations can make a significant difference in how individuals and businesses navigate financial decisions. It’s essential to understand the foundational aspects that shape access to funds and repayment procedures. These guidelines are not just rules; they play a critical role in fostering trust and stability in financial systems.

At its core, this framework sets the stage for determining who qualifies for financial assistance and under what terms. Factors such as risk assessment, interest rates, and repayment plans come into play, influencing the strategies employed by lenders and borrowers alike. This structured approach ensures that transactions are fair and aligned with the broader economic environment.

Moreover, recognizing the impact of these governing principles on personal finance is crucial. Individuals armed with knowledge about these standards can make informed choices, unlocking better opportunities and managing their liabilities effectively. Understanding this framework empowers borrowers, helping them navigate the complexities that come with obtaining financial support.

In summary, familiarizing oneself with the essential aspects of these guiding rules can lead to more prudent financial decisions. Whether it’s planning for the future or addressing immediate needs, being aware of these principles positions individuals and businesses for success in their financial endeavors.

The Role of Financial Guidelines in Finance

In the vast landscape of finance, certain frameworks guide how organizations manage their resources and engage with their clients. These frameworks are essential in shaping lending practices and the overall financial environment. They ensure that institutions can maintain stability while fostering growth and trust in their relationships.

One of the primary functions of these frameworks is to assess risk. By evaluating potential borrowers, organizations can make informed decisions that prevent losses and encourage responsible borrowing. This process not only protects the lender but also helps individuals and businesses to better understand their financial standing and obligations.

Additionally, these approaches contribute to economic stability. By regulating the flow of funds, they influence market conditions and help prevent financial crises. When applied effectively, they can promote fair access to financing, ensuring that various segments of the population can benefit from financial resources without jeopardizing the system’s integrity.

Moreover, these guidelines can adapt to changing market dynamics. With the rise of technology and new financial products, institutions must continually refine their methods to stay competitive and relevant. This adaptability fosters innovation and encourages a healthier economic environment where all participants can thrive.

Ultimately, the frameworks that govern financial transactions play a crucial role in promoting responsible behavior among lenders and borrowers alike. By establishing clear expectations and standards, they create a culture of accountability that benefits everyone involved in the financial ecosystem.

Impact of Lending Strategy on Consumers

Understanding how an institution’s approach to borrowing influences everyday individuals is crucial in navigating financial options. The way organizations structure their loan offerings can significantly shape consumer behavior, spending habits, and overall financial well-being. It’s fascinating to see how these guidelines can create opportunities or obstacles for people seeking assistance.

For many, the terms associated with obtaining funds play a substantial role in decision-making. Favorable arrangements can encourage individuals to invest in homes, education, or business ventures, boosting economic growth. Conversely, stringent conditions can deter potential borrowers, leading to missed opportunities and a stagnation of personal achievement.

Moreover, the nuances of these financial frameworks can impact the psychology of consumers. Clear and accessible information about loan options fosters confidence and empowers individuals to make informed choices. On the flip side, complicated and vague terms may breed mistrust and hesitation, ultimately affecting their financial health.

Changing lending practices also reflect broader economic trends, influencing consumer sentiment. A shift toward more lenient terms can signal a thriving economy, motivating individuals to engage in more significant financial commitments. Alternatively, tightening measures may evoke caution, altering spending patterns and savings behavior.

Ultimately, the design and implementation of lending practices extend far beyond the financial realm; they touch lives and shape futures. By fostering a better understanding of these mechanisms, consumers can better navigate their choices and seize opportunities for growth and stability.