Understanding the Timing of Your Credit Score Updates

Navigating the world of personal finance can often feel like decoding a complex puzzle. One of the key elements that plays a significant role in your financial journey is the numerical representation of your trustworthiness. This figure, influenced by various factors, fluctuates over time. Have you ever wondered how and when these changes occur? Let’s dive into this intriguing topic together.

It’s essential to recognize that numerous elements contribute to this evolving number. From your payment history to your utilization of available funds, each aspect can leave its mark. But the burning question remains: how frequently can you expect to see modifications in this important indicator of financial health? This article aims to shed light on the rhythm of these adjustments so you can stay more informed and empowered.

Staying in the loop is not just a matter of curiosity; it’s a crucial step toward making better financial decisions. Understanding the timing and nature of these fluctuations can help you plan your activities wisely, be it applying for a loan or managing your expenses. Get ready to learn how to time your moves effectively in the landscape of your financial standing!

Understanding Your Credit Score Cycle

Managing your financial health involves more than just knowing your income and expenses. There’s a dynamic system at play that influences how your financial behavior is tracked and represented. This process unfolds over time, reflecting your actions and decisions. It’s essential to be aware of this rhythm, as it can affect your financial opportunities and overall well-being.

Your financial profile is usually assessed regularly by various agencies, typically on a monthly basis. Each activity–be it a payment, new debt, or utilization–contributes to a larger picture. Familiarizing yourself with the periodic nature of these evaluations allows you to align your practices for better outcomes.

Throughout this cycle, several key factors come into play. Timely payments help to build a positive reputation, while high balances might create concerns. Monitoring this ebb and flow is crucial for staying in control. All in all, maintaining awareness of how your profile changes over time ensures that you make informed decisions that lead to more favorable terms and rates in the future.

Factors Influencing Rating Adjustments

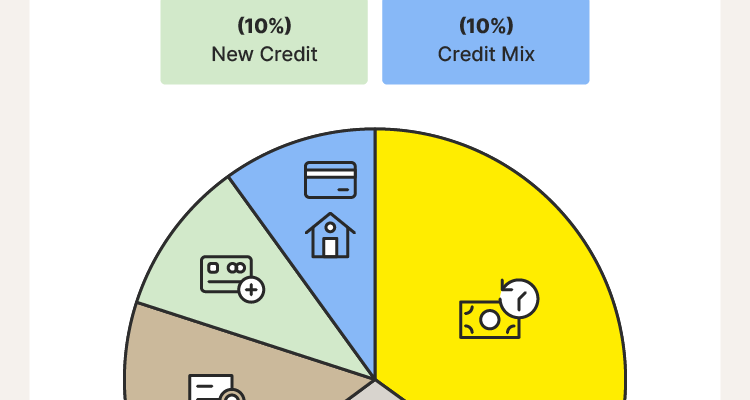

Understanding what impacts your financial evaluation can be quite enlightening. This information can help you navigate through the complex world of personal finance and make informed decisions. Various elements play a pivotal role in determining how your standing may fluctuate over time.

First off, payment history is crucial. Consistently settling obligations on time not only reflects responsibility but also boosts your evaluation. On the contrary, late payments can have a negative effect, lingering on your profile for several years.

Another important aspect is the total amount of debt. If you carry high balances in relation to your available credit, it can hinder your evaluation. A lower utilization ratio generally signals to lenders that you manage your finances wisely.

Additionally, the length of your financial history matters. A longer track record can enhance your standing, showcasing your experience in managing various types of credit. New accounts can also play a part; while they may initially lower your standing, responsible management over time can lead to improvements.

Lastly, inquiries into your finances can have a short-term impact. Each time a lender checks your file, it can slightly reduce your overall assessment. However, this effect diminishes over time, especially when you maintain good habits.

By being mindful of these elements, you can better maneuver through your financial journey and make choices that positively influence your standing.

How Often Reports are Updated

In the world of personal finance, the frequency at which your financial records are refreshed can have significant implications. Various factors influence how regularly these documents are revised, impacting everything from loan applications to interest rates.

Generally, major financial institutions relay information to reporting agencies on a monthly basis. This means that any new activity, such as payments, balance changes, or new accounts, tends to appear within a month. However, some lenders may submit information more frequently, while others might do so less often. Timing can vary based on the lender’s internal processes.

It’s important to note that not all updates are equally prompt. If you make a payment today, it may not reflect in your records immediately. Sometimes, it can take a few weeks for the changes to be visible. Therefore, keeping track of your financial habits is essential to ensure accuracy.

Additionally, there are various types of entities supplying data. Not only traditional banks but also credit unions, mortgage lenders, and even utility companies might contribute to these records. Each of these can have their own timelines for reporting.

Understanding this cycle is crucial for anyone who wants to maintain a healthy financial profile. By being aware of how often your information is refreshed, you can make more informed decisions and better manage your financial journey.