Understanding the Timing of Financial Aid Disbursements

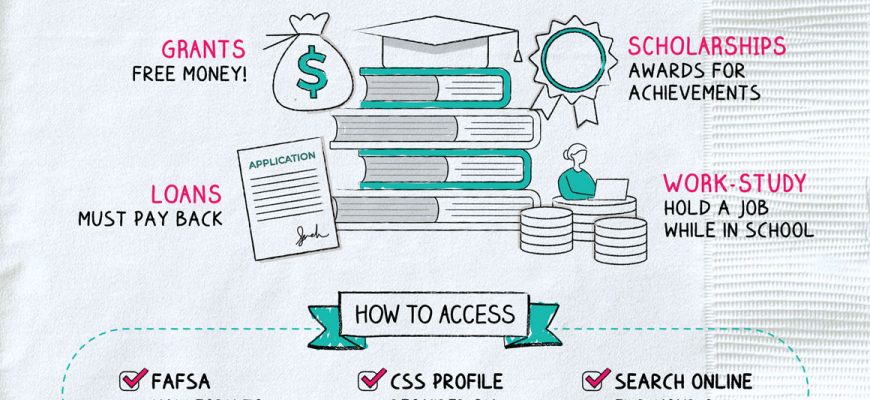

Navigating the world of support for education can feel overwhelming at times. Many individuals find themselves wondering about the timeline of monetary resources that can help ease costs associated with tuition, books, and living expenses. Knowing when those funds arrive is critical to effectively managing your finances and avoiding unexpected pitfalls along the way.

While it might seem straightforward, the disbursement process can vary based on numerous factors, such as institution policies, type of support received, and personal circumstances. Understanding these nuances can significantly improve your planning and help you make informed decisions regarding your budget.

Exploring the different stages and timing of monetary assistance can empower you to take control of your educational journey. From application submission to the actual arrival of those crucial funds, being well-informed allows for a smoother transition into your academic pursuits.

Understanding Financial Aid Disbursement Timelines

Timing is crucial when it comes to assistance programs that support educational expenses. Knowing how the process works can help students plan their finances effectively. Various factors influence when these resources become available, and it’s important to stay informed about what to expect as the semester progresses.

Disbursement schedules are typically set by the institution, and they may vary widely. Traditionally, payments occur at the start of a new term, but there are instances where disbursements might be staggered throughout the semester. Understanding your school’s calendar can make a significant difference in budgeting for tuition, books, and other related costs.

Students often receive notifications regarding their eligibility and the specific timeline for release of funds. Staying in touch with the financial services office can provide clarity on any required actions that might affect when resources are allocated. It’s advisable to check for any outstanding prerequisites that might delay the process.

In conclusion, navigating the timeline for educational support is essential for successful financial planning. By staying proactive and informed, students can ensure that they have the necessary resources when they need them the most.

Factors Affecting Your Financial Assistance Status

Several elements can influence the standing of your monetary support journey. Understanding these aspects can help you navigate the complexities of receiving support effectively. Various external and internal factors come into play, shaping your access to funds.

Your academic performance is a crucial component. Many providers consider your grades, enrollment status, and course load when determining eligibility. Staying on track academically not only boosts your chances but can also open additional opportunities for support.

Another significant aspect is your family’s financial situation. Changes in income, assets, or household size can alter the amount of assistance you qualify for. It’s vital to keep your application’s information updated, ensuring that it reflects your current circumstances.

The type of educational institution you choose also matters. Different schools have distinct funding opportunities and criteria for awarding resources. Additionally, state and federal regulations may impose their own requirements that affect your status.

Lastly, being proactive and aware of deadlines is essential. Missing important dates can hinder your chances significantly. Staying informed and prepared allows you to maximize your possibilities and minimize stress.

Steps to Access Your Financial Assistance

Unlocking your support can feel like navigating a maze, but breaking it down into clear actions makes the journey a lot easier. Knowing how to secure your benefits opens the door to opportunities, easing the burden of expenses while you focus on your studies.

1. Research Eligibility

Start by exploring what options are available to you. Check the requirements for various programs to see which ones you qualify for based on your personal situation, such as income level, enrollment status, or specific criteria determined by each program.

2. Prepare Documentation

Gather necessary paperwork that may include tax returns, proof of income, and enrollment verification. Having these documents ready can streamline the application process and help avoid delays.

3. Complete Applications

Fill out the applications thoroughly. Pay close attention to details, as any inaccuracies might slow down the processing time. If you’re unsure about any part, don’t hesitate to reach out for assistance.

4. Monitor Application Status

After submitting your applications, check their status regularly. Keep an eye on emails or notifications for any updates or additional information that may be required.

5. Review Offers

Once you receive responses, carefully review the offers. Understand the terms and conditions attached, as well as disbursement timings. This will help you plan your finances effectively.

6. Follow Up

If you have questions or need clarification regarding any aspect of your support, don’t hesitate to reach out. Staying engaged shows you are proactive and ensures you’re on top of your requirements.

Following these steps can significantly enhance your experience and ensure you effectively access the resources necessary to support your academic journey. Remember, persistence is key!