Understanding the Repayment Terms for Financial Aid and When Payments Are Required

Managing education expenses is a key concern for many students and their families. Often, there are options available to help alleviate some of the financial burdens that come with pursuing higher learning. However, navigating these options can sometimes feel overwhelming, especially when it comes to understanding the obligations associated with various forms of support.

It’s essential to be informed about the specific circumstances under which assistance may require reimbursement. Different forms of support have their own guidelines, and recognizing the conditions that trigger repayment can make a significant difference in financial planning. Being well-versed in these aspects not only helps avoid unexpected costs but also promotes responsible budgeting.

In this discussion, we’ll explore the various scenarios that may lead to a commitment for reimbursement, shedding light on the intricacies that come along with these forms of support. By the end, you’ll have a clearer picture of what to expect, allowing you to make informed decisions about your educational journey and associated expenses.

Understanding Financial Aid Types

Navigating the world of educational funding can feel overwhelming at times. There are various options available, each with its unique characteristics and stipulations. Gaining insight into these different forms helps in making informed choices about what’s best for your situation.

Grants represent one of the most appealing forms of support. They are often awarded based on financial necessity and do not require reimbursement, making them a popular choice among many. Scholarships, on the other hand, are generally merit-based and awarded for achievements in academics, athletics, or other areas. Like grants, these funds also do not need to be returned.

Loans are another option you might encounter. Unlike the aforementioned types, these funds come with the expectation of repayment. Understanding the specific terms and interest rates associated with each loan is crucial to avoid potential pitfalls down the line. Carefully considering your borrowing choices can greatly influence your financial future.

Lastly, work-study programs offer an opportunity to earn money through part-time employment while studying. This approach not only provides financial relief but also valuable work experience. By exploring all these options, you can better position yourself for success in your educational pursuits.

Repayment Terms for Student Loans

Understanding the conditions surrounding repayment can help borrowers navigate their responsibilities more effectively. These agreements often come with specific guidelines that outline how and when one must return the borrowed funds. It’s essential to familiarize yourself with these terms to avoid any unexpected surprises down the road.

Typically, the repayment plan kicks in after a grace period during which no payments are required. This break usually lasts a few months, allowing borrowers to settle into their post-college lives. After this phase concludes, regular monthly installments commence according to the outlined schedule.

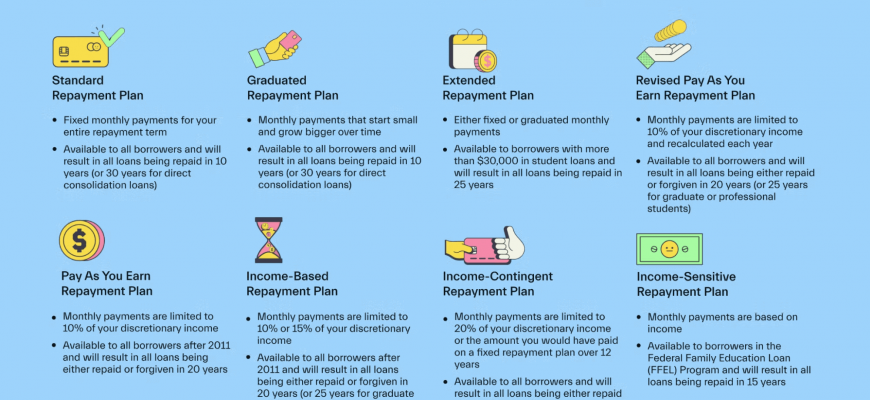

Moreover, the structure of these repayments can vary widely. Some programs offer fixed payments that remain constant over time, while others may provide flexibility by allowing borrowers to adjust their payment amounts based on income levels or life circumstances. This adaptability can make a significant difference in managing personal budgets.

Another aspect to consider is whether there are options for deferment or forbearance. These provisions can temporarily suspend payments under certain conditions, like financial hardship or further education. Understanding how to apply for such relief can be invaluable during challenging times.

In addition, it’s crucial to be aware of potential penalties for late payments or defaults. Falling behind could lead to increased interest rates or damage to credit scores, impacting future borrowing opportunities. Therefore, staying informed about one’s obligations can promote financial wellbeing and peace of mind.

Grants and Their Non-Repayment Rules

Grants are a form of support that can significantly alleviate the burden of educational costs. Unlike loans, these funds are typically provided with the understanding that recipients won’t be required to return the money. This characteristic makes grants an attractive option for students seeking assistance in their academic pursuits.

Understanding grants is essential when exploring options for educational support. They usually come from various sources such as government entities, non-profit organizations, or educational institutions. The primary goal is to help individuals successfully navigate their studies without the stress of repayment looming over them.

Eligibility criteria for these funds vary, but they often consider factors like financial need, academic achievements, and specific fields of study. Once a grant is awarded, recipients can generally rest assured that, as long as they meet the necessary requirements, there is no obligation to repay the amount received.

One important aspect to keep in mind is that while grants are non-repayable, failing to comply with conditions tied to the funding–such as maintaining a certain GPA or completing coursework–could result in losing the grant or being required to return the funds. Thus, fulfilling the stipulated obligations is crucial to fully benefit from this kind of financial support.