Exploring the Various Ways to Utilize Care Credit for Your Financial Needs

In today’s fast-paced world, managing healthcare expenses and unexpected bills can be quite challenging. Individuals often seek alternatives to traditional payment methods, providing them with the freedom to focus on well-being without the burden of financial stress. A particular financing option has emerged as a popular choice, offering versatility in handling various expenses while accommodating personal budgets.

This innovative solution opens doors to a wide array of services and treatments that might otherwise seem out of reach. From essential medical procedures to wellness services, many professionals accept this form of financial assistance, allowing patients to pursue essential care without immediate upfront costs. Furthermore, the convenience of monthly payments can transform how individuals approach their health and wellness, making it easier to plan for vital expenditures.

With a plethora of possibilities available, understanding the various applications of this funding can empower individuals to make informed decisions. Whether it’s dental work, vision care, or even cosmetic procedures, exploring these options is essential for anyone navigating the complexities of healthcare financing. Embracing this financial tool can lead to better health outcomes and greater peace of mind.

Dental Expenses Covered by Care Credit

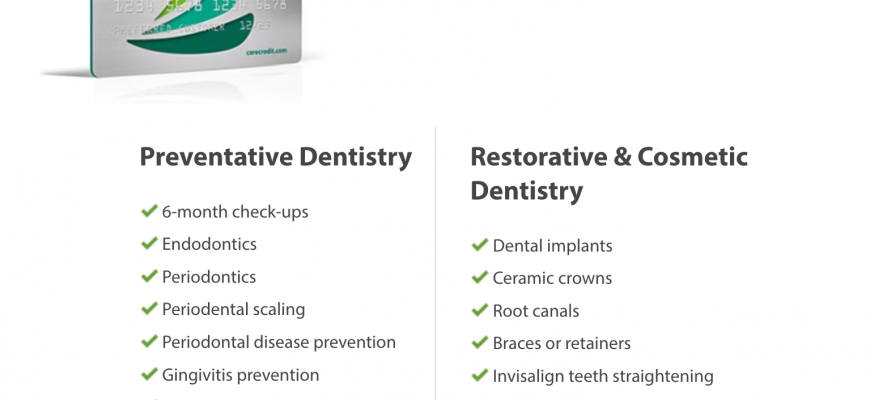

This financial option provides a means to manage dental costs, making it easier for patients to access the treatments they need without the stress of immediate payment. From routine check-ups to more complex procedures, there’s a range of dental services that can be financed.

Common treatments that fall under this plan include preventive care such as cleanings and exams, which are essential for maintaining oral health. Additionally, restorative procedures like fillings, crowns, and bridges can be included, ensuring that patients do not delay necessary repairs due to budget constraints.

Moreover, orthodontic treatments, including braces and aligners, are often covered, helping individuals achieve that perfect smile. Cosmetic procedures, such as veneers and teeth whitening, also find their place within this financing option, allowing for enhanced aesthetics without the burden of high costs up front.

Emergency dental care, which can often arise unexpectedly, is also considered, providing a safety net for those urgent situations. Overall, this approach is designed to ease the financial strain and promote timely dental care for all individuals.

Financing Medical Procedures with Care Credit

When it comes to managing healthcare expenses, many individuals find themselves in need of flexible payment options. Medical procedures can be costly, and unexpected expenses often arise, making financial planning essential. Finding a solution that eases the financial burden while ensuring access to necessary treatments is vital in today’s world.

Utilizing a financing solution allows patients to handle various healthcare costs efficiently. Whether it’s a routine dental exam, a surgical procedure, or cosmetic enhancements, having the ability to spread out payments over time can make these services more accessible. It provides peace of mind knowing that essential care does not have to be compromised due to budget constraints.

Furthermore, understanding the benefits of financing helps individuals make informed decisions regarding their health and wellness. It opens the door to a wider range of services, ensuring that everyone can seek the care they need without undue stress about payment obligations. As such, exploring available financing options is an important step in managing healthcare expenses effectively.

Utilizing Care Credit for Veterinary Services

Taking care of a pet often comes with unexpected expenses, especially when it involves their health and well-being. Veterinary visits can sometimes be costly, making it challenging for pet owners to manage finances. Fortunately, financial solutions exist that can help alleviate some of the burden during these times.

Many animal clinics now accept financing options specifically designed for pet healthcare. This allows guardians of furry friends to spread out payments over a longer period, making it easier to afford necessary treatments or routine check-ups. Not only does this financial support provide peace of mind, but it also ensures pets receive the care they need without delay.

Having access to such financial resources can be particularly beneficial in emergencies, where immediate treatment might be crucial. This assistance helps ensure that pets receive timely medical attention, ultimately contributing to their overall well-being. Understanding available financing options is key to making informed decisions when it comes to pet healthcare.