Exploring the Year in Which the Child Tax Credit Was Established

Navigating the world of financial assistance can often feel overwhelming, especially when it comes to programs designed to support families. Numerous initiatives exist aimed at easing the burden of raising children, which can make a significant difference in household budgets. Understanding the timeline of these benefits provides essential context for those looking to maximize the resources available to them.

Throughout various eras, governments have implemented diverse schemes to help parents shoulder the costs associated with nurturing their young ones. By looking back at historical moments when these initiatives were introduced, families can gain insight into their evolution and learn how to strategize around them. This exploration not only sheds light on previous offerings but also paves the way for discussions about current and future support systems.

It’s important to examine the specific instances when these financial relief programs were put into action, as they often reflect the societal values and priorities of their time. Delving into these details allows families to appreciate how far we’ve come and what still lies ahead in our collective journey toward improving the well-being of younger generations.

The History of Child Tax Credit

Throughout the years, families have faced various financial challenges, and support measures have evolved to help them manage these difficulties. One such initiative emerged to provide much-needed assistance, particularly aimed at easing the burden of raising youngsters. Over the decades, this program has undergone significant changes, reflecting shifts in societal needs and government priorities.

Initially introduced in the late 20th century, this initiative aimed to alleviate some of the financial pressures on parents. Over time, adjustments were made to its structure, expanding the eligibility criteria and altering the benefits offered. As economic conditions fluctuated, lawmakers recognized the importance of adapting this support, ensuring it remained relevant and effective for families across the nation.

From modest beginnings to substantial enhancements, this financial aid has played a vital role in countless households. Policymakers have continuously revisited its framework, trying to find the perfect balance between assistance and accountability. As a result, many families have come to rely on this program as a cornerstone of financial planning and budgeting.

Looking ahead, discussions about future reforms and improvements are already underway. Advocates and officials alike emphasize the ongoing relevance of this critical support, particularly in today’s economic landscape. As more families seek stability and security, the evolution of this financial aid initiative will likely remain a focal point in public policy debates and community discussions.

Major Changes in Tax Law

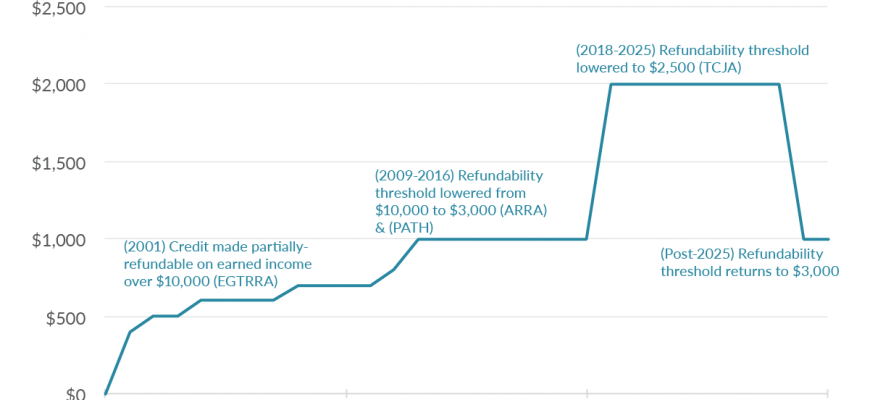

Over the past few decades, legislation surrounding financial benefits for families has undergone significant transformations. These adjustments often reflect broader economic trends and changing societal needs. Understanding these shifts can help individuals navigate their financial planning more effectively.

Some noteworthy modifications include:

- Increased financial support aimed at families with dependents.

- Adjustments to income limits, enhancing eligibility for different income brackets.

- Expansion of available benefits for lower and middle-income households.

- Incentives aimed at encouraging work and self-sufficiency.

These alterations have made a profound impact on how families manage their finances, providing more resources to assist in child-rearing and education. Keeping abreast of these developments is essential to maximizing potential benefits.

- Yearly updates in guidelines and eligibility criteria.

- Temporary measures introduced in response to economic crises.

- New programs designed to offer added support during challenging times.

As these laws continue to evolve, individuals must stay informed about both the opportunities and responsibilities they present.

Eligibility Criteria Over the Years

Understanding the requirements to receive benefits for dependent children can be quite the journey, as these standards have evolved significantly over time. Numerous factors play a role in determining who qualifies, impacting families in different ways.

In earlier times, eligibility hinged primarily on income levels and the number of dependents claimed on tax returns. As time progressed, adjustments were made to include more families by broadening income thresholds and introducing varying forms of assistance.

More recently, changes have introduced stipulations based on ages of dependents, and there have been discussions around temporary enhancements during economic fluctuations. This has led to increased benefits for some and eligibility extensions for a wider audience.

Ultimately, the criteria have shifted, aiming to better support families navigating financial responsibilities while raising children. Staying informed about these evolving guidelines is essential for making the most of available provisions.