Exploring Projections and Predictions for Gold Prices in 2025

As we peer into the crystal ball of financial markets, many enthusiasts and investors find themselves pondering the potential trajectory of valuable collectibles. Factors influencing these fluctuations range from global economic trends to geopolitical shifts, making the landscape both intriguing and complex.

Speculations around where these commodities may land in the coming years capture the attention of market watchers. Factors such as inflation rates, currency strength, and investment demand play crucial roles in shaping expectations. Engaging in discussions about how these elements intertwine can help form a clearer picture of what may lie ahead for enthusiasts and seasoned traders alike.

While it’s impossible to predict with absolute certainty, analyzing past movements and current data can offer valuable insights. The beauty of investment lies in its unpredictable nature, encouraging professionals and novices to seek out trends, consult expert analyses, and stay informed about shifts in the marketplace.

Factors Influencing Gold Prices in 2025

Understanding the dynamic environment that surrounds precious metals offers insight into their potential evolution. Several elements play significant roles in shaping market trends and investor sentiment, making it essential to delve into these aspects for anyone interested in this valuable commodity.

First and foremost, global economic conditions cannot be overlooked. Economic stability, inflation rates, and currency fluctuations often create ripples in the market, impacting how people view investments in this asset. When uncertainty looms large, many turn to this asset as a safe haven, driving demand and, hence, value.

Geopolitical events also make their mark on its worth. Tensions among nations, trade wars, or shifts in government policies can lead to increased speculation. Investors may flock to this metal in times of unrest, altering perceived worth significantly and rapidly.

Moreover, changes in mining production influence supply and demand dynamics. Discoveries of new deposits or advancements in extraction technologies can enhance availability, while environmental regulations may constrain output, affecting the overall market landscape.

Investor behavior, along with market sentiment, plays a crucial role too. Trends in financial markets, shifts in investment strategies, and even social media influence can sway opinions and drive buying or selling actions. Keeping an eye on these behaviors can provide valuable insights into future outlooks.

Lastly, advancements in technology, especially in sectors that use this asset for manufacturing or digital applications, can create new avenues for demand. As industries evolve, so too does the relationship with this cherished element, potentially leading to new trends that impact its future standing.

Market Trends and Predictions for Precious Metal

In recent years, the landscape of valuable commodities has undergone significant transformations, influenced by various economic indicators and global events. Observers are keenly watching these shifts, as they provide insights into future movements in this vibrant sector. Understanding these trends is crucial for investors and enthusiasts alike, ensuring informed decisions in an ever-evolving market.

Experts suggest that a combination of geopolitical factors, inflation rates, and currency fluctuations play pivotal roles in shaping expectations for precious metal assets. As uncertainties mount in international relations and economies strive for stability, many turn to these assets as safe havens. This reactionary behavior reflects a deeper psychological impulse to seek security in times of turbulence.

Furthermore, advancements in technology and changing consumer habits are poised to impact demand. The integration of precious metals in emerging industries, such as electronics and renewable energy, may create new avenues of growth. Investors are closely monitoring these developments, as they could signal shifts in availability and market dynamics.

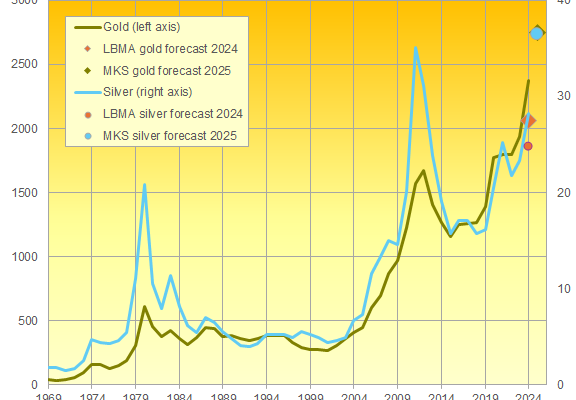

Projections based on historical data and current trends indicate a complex interplay of factors that could influence future valuations. Market analysts emphasize the importance of staying updated on global economic conditions, as these elements will likely shape the outlook for valuable assets in the coming years.

Investment Strategies for Future Gold Buyers

As more individuals consider committing their resources to precious metals, it’s essential to explore effective approaches to navigate this market. Whether you’re stepping in for diversification or as a hedge against inflation, understanding various tactics can significantly enhance your experience.

Here are several strategies to consider:

- Diversification: Don’t place all your capital into one asset. Spread investments across different assets within the commodity sector to reduce risk.

- Dollar-Cost Averaging: Instead of investing a lump sum at once, consider regularly purchasing smaller amounts. This approach helps to mitigate the effect of volatility.

- Physical Ownership: Acquiring bullion or coins allows you to hold the asset directly. It can offer security during uncertain times, plus it has a tangible nature.

- Exchange-Traded Funds (ETFs): These funds track the value of precious metals, providing a convenient and liquid alternative without the need for physical storage.

Additionally, staying updated on market trends can play a pivotal role in decision-making processes. Analyzing geopolitical events, currency fluctuations, and economic indicators can help anticipate future movements effectively.

- Research: Always investigate before committing. Look for data from reputable sources on historical performance and forecasts.

- Consult Professionals: Engaging financial advisors who specialize in commodities can provide personalized insights tailored to individual goals.

- Review Regularly: Adjust your strategy as the market evolves. Keeping track of your portfolio’s performance allows you to remain agile.

Investing in precious metals can be rewarding when approached thoughtfully. By utilizing these strategies, new buyers can navigate the complexities of this market with greater confidence.