Exploring the Pinnacle of Credit Scores Throughout History

Ever been curious about those elusive figures that reflect one’s financial reliability? It’s fascinating how these benchmarks play a crucial role in the world of loans, mortgages, and even job applications. They serve as a window into an individual’s financial behavior, showcasing their ability to manage debts and make timely payments. Understanding these ratings can empower individuals to improve their financial standing and unlock better opportunities.

Throughout the years, many have aimed for that coveted pinnacle. Achieving an extraordinary rating is no simple feat; it requires discipline, strategy, and a bit of patience. Numerous factors contribute to this ultimate achievement, including payment history, credit utilization, and the age of credit accounts. Knowing these elements can help anyone on their journey toward financial excellence.

Curiosity naturally arises regarding what that top figure entails and who has ever managed to attain it. Discovering the peak can inspire and motivate those striving to enhance their financial profile. It’s not just about numbers; it’s about the possibilities that come with exceptional financial credibility. Let’s explore this intriguing topic and see what lies at the top of the financial ladder.

Understanding Credit Score Ranges

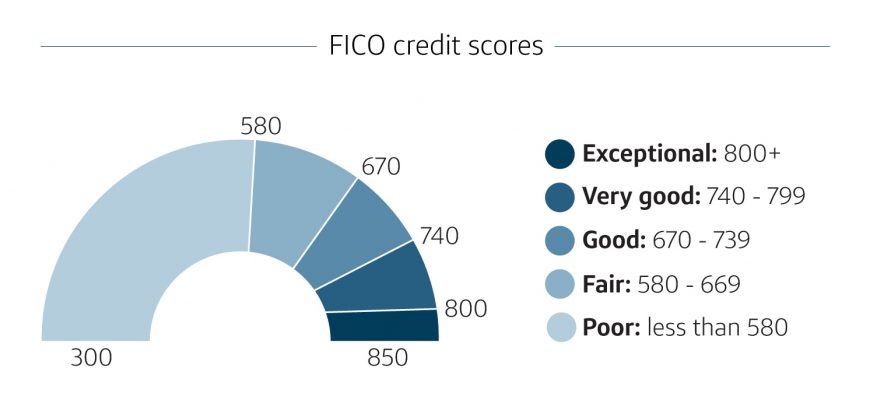

When diving into the world of personal finance, one key concept you’ll encounter is the measure of your financial reliability. This notion plays a significant role in how lenders view your trustworthiness when it comes to borrowing money. Each individual is categorized within a spectrum that reflects their fiscal behavior and history, influencing everything from loan approvals to interest rates.

These measurements typically fall within specific bands, each signifying a different level of risk associated with lending to a person. Understanding where you stand on this ladder can help you navigate financial decisions more effectively. These classifications can range from exceptional to poor, giving a clear picture of your financial profile and guiding you in achieving your monetary goals.

Knowing what each range entails allows you to gauge your own standing and take appropriate steps if necessary. It’s not just about numbers; it’s about how those numbers affect your opportunities in the financial landscape. Awareness of each category empowers individuals to make informed choices and even improve their financial situation over time.

Factors Influencing Your Creditworthiness

Your financial reputation relies on several key elements that shape how lenders perceive you. Understanding these aspects can significantly impact your overall standing in the eyes of financial institutions. Let’s dive into what these influential components are and how they interact with one another.

First up is payment history. Consistently making timely payments on loans and bills showcases your reliability as a borrower. Late payments, on the other hand, can leave a mark that might affect future lending opportunities.

Next, consider your credit utilization, which measures the ratio of your outstanding balances to your available credit limits. Keeping this ratio low indicates that you’re able to manage your debts without maxing out your limits, which is generally viewed positively.

Then, there’s the length of your credit history. A longer track record of responsible borrowing can enhance your image, showcasing your experience and reliability over time. Conversely, a short credit history might signal potential risk to lenders.

The diversity of your credit accounts–a mix of installments and revolving credit–can also play a role. This variety may demonstrate your ability to handle different types of debt effectively, which lenders may appreciate.

Finally, recent inquiries into your financial background can have an immediate impact. When you apply for new credit, those inquiries get noted, and multiple requests within a short time frame may suggest to lenders that you’re in a precarious financial situation.

By keeping these factors in mind, you can take proactive steps to improve your financial standing, ultimately leading to better opportunities when seeking credit in the future.

Benefits of a High Credit Score

Having a stellar rating can open up a world of opportunities for individuals. It often leads to better financial options, making it easier to achieve life goals like purchasing a home or securing a car loan. The advantages are not just monetary; they significantly enhance peace of mind and financial security.

One major perk is the ability to access lower interest rates. Lenders are more likely to offer favorable terms to those with impressive ratings, which means you save a bundle on repayments. Over time, this can lead to substantial savings, allowing you to invest in other areas of your life.

Furthermore, a great rating often translates into higher chances of approval for various loans or credit lines. When you apply for a mortgage or a personal loan, having a strong value behind you can be the difference between acceptance or rejection.

Another significant advantage is insurance. Many insurance providers take your financial history into account, so a strong rating can lead to lower premiums for auto and home coverage. This means you not only pay less upfront but also enjoy savings over time.

Lastly, this impressive standing can bolster your negotiating power when it comes to financial products. Whether discussing rates with your bank or seeking more favorable terms on a loan, a high rating gives you leverage in conversations, making it easier to advocate for your financial needs.