Exploring the Concept of Financial Aid in the United States

Navigating the world of education can be a daunting task, especially when it comes to affording the costs associated with higher learning. Many individuals find themselves in need of support, as expenses continue to rise and budgets become stretched. This segment provides a closer look at the various resources available to help students alleviate their financial burdens as they pursue their academic dreams.

There are numerous programs designed to help learners access the funds necessary for their studies. From scholarships that reward academic achievement to loans that provide immediate cash flow, the options can be overwhelming. Each program comes with its own set of guidelines and requirements, so it’s essential to research and find the right fit for your situation.

In addition to traditional funding sources, there are also various community initiatives and grants aimed at assisting specific groups of students. These unique opportunities may cater to those with particular backgrounds or interests, thus widening the scope of possibilities for obtaining support. Understanding the landscape of educational assistance not only empowers students but also opens doors to a brighter future.

Understanding Financial Aid Basics

When it comes to achieving higher education, navigating the landscape of support options can feel overwhelming. Familiarizing yourself with the essentials of assistance can make a significant difference in your academic journey. This section is all about shedding light on the various types of support available, helping you grasp how to make the most of them.

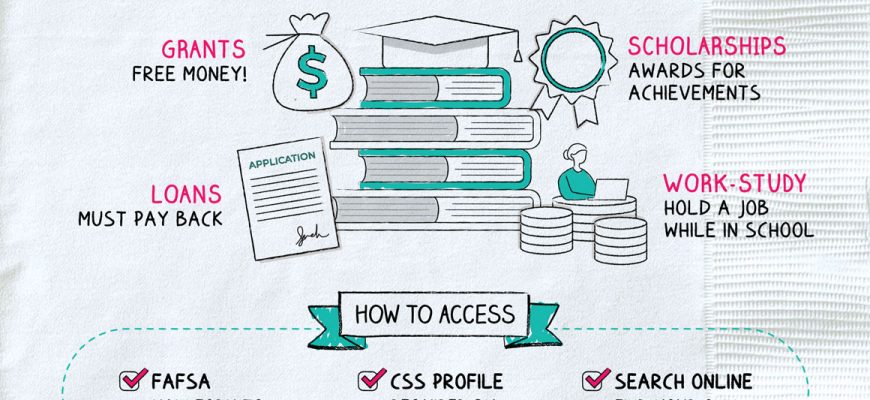

Support mechanisms come in several forms, each designed to alleviate the burden of educational expenses. From grants that provide funds without requiring repayment to loans that need to be paid back with interest, knowing how these options work is crucial. Additionally, there are work-study programs that allow students to earn while they learn, striking a balance between academic responsibilities and financial needs.

Before diving into specific resources, it’s essential to recognize the importance of planning ahead. Understanding deadlines, eligibility criteria, and the application process can save time and minimize stress. Engaging with school counselors or financial support offices can provide insights that will guide you through the maze of choices.

Ultimately, being informed about the different forms of assistance empowers you to make wise decisions that can lead to a more manageable educational experience. Embrace the journey, explore your options, and take control of your academic funding!

Types of Financial Assistance Available

When it comes to funding education or other important expenses, there are various options that individuals can explore. Each type has its own characteristics and benefits, catering to different needs and circumstances. Understanding these choices can help you make informed decisions about managing your resources effectively.

Grants are a popular option, often provided by government entities or private organizations. These resources typically do not require repayment, making them an excellent choice for those seeking support without the burden of debt. Scholarships, on the other hand, are awarded based on academic merit, talents, or specific criteria. Like grants, they do not need to be repaid and can significantly ease the financial strain.

Loans are another avenue to consider, often issued by banks or credit unions. While these funds can cover immediate costs, they come with the responsibility of repayment, usually with interest. For many, government-backed loans offer more favorable terms, including lower interest rates or deferred payments while in school.

Work-study programs provide a pathway to earn income while studying. These roles allow students to gain relevant work experience and help offset educational expenses. Lastly, employer tuition assistance programs can offer support to employees seeking additional training or education, demonstrating the importance of investing in workforce development.

Navigating the Application Process

Diving into the process of securing support for your educational journey can feel a bit overwhelming at first. There are numerous steps to tackle, each requiring careful attention. However, with a bit of organization and preparation, you can simplify the journey ahead.

Here are some steps to help you navigate the application process effectively:

- Research Available Options: Begin by exploring various resources. This can include government programs, institutional offerings, and private grants.

- Understand Eligibility Criteria: Each program comes with its own set of requirements. Make sure you review these carefully to identify what applies to you.

- Prepare Necessary Documents: Gather essential documents such as tax returns, income statements, and personal identification. Having everything ready will streamline your submissions.

- Fill Out Applications Accurately: Take your time when filling out forms. Double-check for any errors to avoid delays or complications.

- Meet Deadlines: Mark key dates on your calendar. Submitting applications on time is crucial for consideration.

- Follow Up: After submitting, it’s wise to check the status of your application. This shows your continued interest and helps you stay informed.

By taking these steps, you’ll equip yourself to tackle the process head-on, making it a more manageable experience. Stay focused, organized, and optimistic as you pursue the resources that can help you achieve your academic goals.