Exploring the Features and Benefits of the Universal Credit Calculator

In today’s world, navigating the landscape of financial assistance can feel overwhelming. With various types of support available, many individuals find themselves unsure of what they qualify for or how much they can expect to receive. This is where a handy tool comes into play, helping users get a clearer picture of their potential benefits.

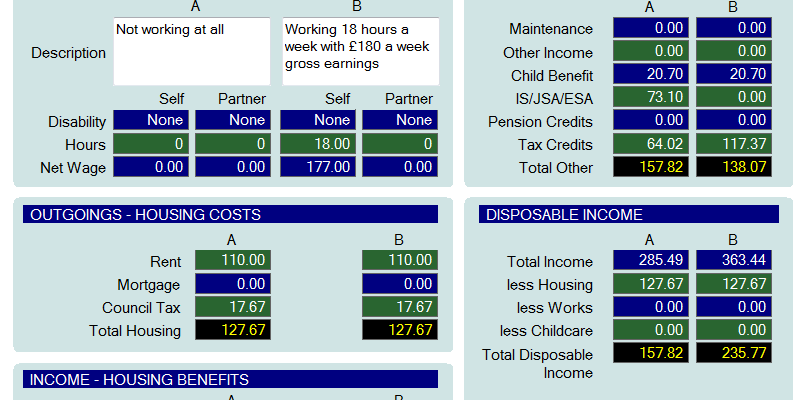

Using this estimator, you can input your personal information and financial situation to receive a tailored assessment of assistance you might be eligible for. It’s an invaluable resource that takes the guesswork out of the equation, making it easier to plan for your financial future.

Whether you’re a new applicant or looking to adjust your existing claim, understanding the potential outcomes can significantly ease the anxiety that often accompanies financial planning. By leveraging this tool, you can gain confidence in your knowledge and make more informed decisions about your situation.

Understanding the Support System

Grasping how the assistance framework operates can seem daunting at first. It’s designed to help individuals and families navigate through challenging financial times, offering a safety net that adapts to various circumstances. With a little insight, you can better understand the benefits available to you.

This support mechanism is not just about providing monetary help; it aims to empower recipients by promoting greater independence and improving living standards. Applicants can receive tailored support based on their unique situations, including considerations for personal circumstances, housing needs, and overall financial stability.

To fully comprehend how the system functions, one must explore the criteria for eligibility and the processes involved in applying. Understanding these elements allows individuals to make informed decisions and effectively navigate the available resources. It’s all about maximizing potential support and ensuring you make the most of what’s out there.

How to Estimate Your Benefits

Understanding how much support you might receive can be crucial in planning your finances. There are tools available that can help you get an idea of the amount you could potentially qualify for. It’s important to take into account various factors such as your income, living situation, and any additional needs you may have.

To start, gather all necessary information about your finances, including earnings, savings, and household circumstances. With this data at hand, you can use online resources designed to guide you through the estimation process based on your specific situation.

Many of these tools will ask you a series of questions to customize the estimate. Make sure to provide accurate details to get the best possible indication of what you may be eligible for. After you input your information, the tool will give you an idea of the support amount you might receive, helping you make more informed decisions about your finances.

Remember, while these estimates can be helpful, they are not definitive. A more precise assessment can be made through formal applications, but this initial step can give you a clearer picture of your potential benefits.

Benefits of Using a Financial Estimator

Using a financial estimator can significantly enhance your financial planning. It allows you to get a clearer picture of what assistance you may be eligible for, helping you make informed decisions about your budget and spending habits.

One of the key advantages is the ability to quickly assess your potential benefits. Instead of sifting through complex guidelines and figures, you can enter your information and receive instant feedback. This simplicity empowers you to understand your options without feeling overwhelmed.

Additionally, these estimators often account for various factors like income, expenses, and family circumstances, giving you a more tailored prediction. This personalized approach can lead to better financial outcomes, as it encourages you to optimize your resources and explore available support.

Moreover, utilizing such tools promotes financial literacy. By regularly engaging with these estimators, you become more familiar with the different types of assistance programs and their regulations. This knowledge can prove invaluable in the long run, enabling you to navigate your resources with confidence.

Overall, embracing a financial estimator not only streamlines the process of figuring out your entitlements but also builds your awareness and control over your economic situation. It’s a smart step towards ensuring you’re making the most of available support.