Understanding the Components and Impact of the Average Financial Aid Package

Many students and their families find themselves curious about how institutions support those pursuing higher education. These support systems can significantly ease the burden of expenses associated with tuition, housing, and other academic costs. With so many variables at play, it’s essential to dive into what these assistance options typically entail and how they can impact students’ decisions.

When it comes to securing help, numerous elements come into play, from grants and scholarships to loans and work-study opportunities. Each component plays a vital role in shaping a student’s overall experience and ability to focus on their studies without overwhelming financial stress. Understanding how these elements interact makes it easier to navigate the sometimes complex world of educational support.

As we explore these assistance arrangements, you’ll discover common themes and figures that can provide a clearer picture of what to expect. Grasping this knowledge not only prepares families for budgeting but also positions students to make informed choices about their educational journeys. So, let’s unpack this topic together and uncover the essentials of these valuable resources.

Understanding Financial Aid Basics

Navigating the complexities of educational assistance can feel overwhelming, but it’s essential for students and families to grasp some foundational concepts. Knowing how various forms of support work provides clarity and enables better planning for college expenses. This section aims to simplify these ideas and highlight the importance of seeking help when it comes to funding an education.

At its core, assistance encompasses different types of support that can ease the burden of tuition and other related costs. These often come from diverse sources, including government initiatives, private organizations, and institutions themselves. Understanding the distinctions among grants, scholarships, loans, and work-study options is crucial for anyone preparing for post-secondary studies.

Moreover, recognizing eligibility requirements and application processes is vital. It’s not just about filling out forms; it involves understanding deadlines, necessary documentation, and how your financial situation impacts your options. Taking the time to learn about these elements can significantly enhance one’s chances of receiving valuable support.

As students explore these opportunities, it’s also worth remembering that help comes in many forms. While some may cover a portion of tuition, others may provide funds for books, housing, or even living expenses. Being well-informed creates a path to a more manageable experience during one’s educational journey.

In short, grasping the fundamentals of support options lays a strong foundation for making educated decisions. Embrace the exploration of available resources, and don’t hesitate to ask questions along the way; every bit of knowledge can lead to better support during your time in school.

Components of Support Packages

Understanding how different elements come together to create assistance for students can seem overwhelming. Each component plays a vital role in shaping the overall support available, making it essential to recognize their functions and impacts. From grants to loans, these financial resources help bridge the gap between education costs and available funds.

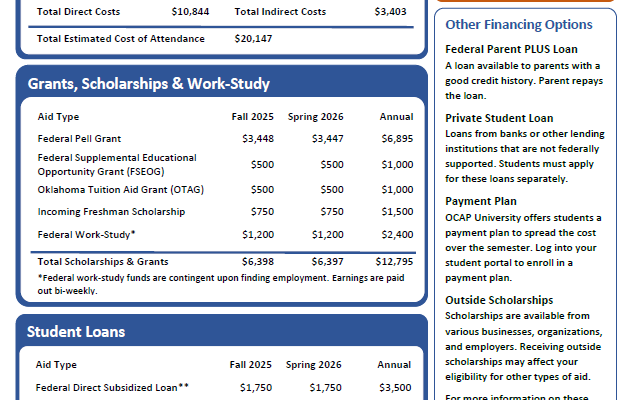

One key element is grants, which provide money that students do not need to repay. They often come from federal, state, or institutional sources, serving as a significant source of funding for many individuals. Scholarships are similar, offering financial relief based on merit or need, and can significantly reduce out-of-pocket expenses for tuition and other costs.

Another important aspect involves loans, which are funds borrowed with the expectation of repayment after graduation. These can vary in terms of interest rates and repayment plans, influencing how manageable debt will be in the future. Additionally, work-study programs offer students the chance to earn money through part-time employment, helping them contribute toward their educational expenses while gaining valuable experience.

Lastly, personal savings or family contributions can supplement these resources, ensuring that students have adequate support as they pursue their academic goals. By understanding these various elements, students can better navigate their options and make informed decisions about financing their education.

Determining Your Eligibility for Assistance

Understanding how to assess your qualifications for support can feel overwhelming, but it’s a crucial step in the journey to financing your education. Many factors play a role in this decision-making process, from personal circumstances to academic performance. By familiarizing yourself with the various elements involved, you’ll be better equipped to navigate through different options available to you.

First off, it’s important to recognize that institutions often look at your household’s financial situation. This includes income, assets, and the number of dependents in your family. Additionally, your academic achievements, extracurricular involvement, and even your chosen field of study can influence the support you may qualify for. Each of these aspects acts as a piece in the eligibility puzzle.

Next, filling out necessary forms accurately is vital. Common documents include the FAFSA or similar state-specific applications, which provide the schools with essential information to evaluate your situation. Be diligent and attentive; even small errors can have a significant impact on the outcome.

Lastly, remember that eligibility is not static. Changes in your financial circumstances, such as job loss or significant medical expenses, can open doors for more favorable support. Don’t hesitate to reach out to your school’s financial assistance office if you have any questions or need clarification. They’re there to help you understand your options and to ensure that you can make informed decisions for your educational future.

Wow;just wow! She’s not just beautiful;she’s magnetic. This video is a masterpiece of elegance and grace.