Promising Stocks Expected to Rise in 2025 and Beyond

As we approach a new era in the financial landscape, many investors are turning their eyes to potential high-flyers in the equity realm. The anticipation of which entities might experience significant growth creates both excitement and uncertainty. Understanding market trends and the underlying factors that drive value can help steer savvy decision-makers in the right direction.

In this exploration, we’ll delve into various sectors and emerging themes that could influence which players are poised for impressive advancements. From technological innovations to shifts in consumer behavior, numerous elements contribute to shaping the trajectories of future contenders. The key lies in identifying not just the numbers, but the stories that surround these evolving companies.

As we gear up for the changes ahead, staying informed and alert to market dynamics will be essential. Whether you’re a seasoned investor or just starting on this journey, the potential for growth in forthcoming years offers an opportunity to reassess strategies and make informed choices. Let’s take a closer look at what may be on the rise.

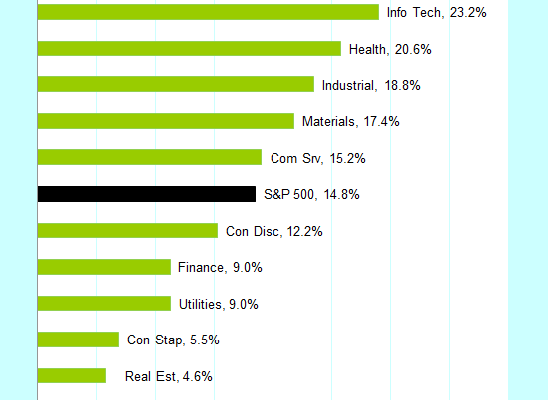

Top Industries Likely to Thrive in 2025

As we look ahead, several sectors are poised to flourish due to emerging trends, innovative technologies, and evolving consumer demands. Embracing change and adapting to new realities, these industries are setting the stage for future growth and success.

Technology continues to dominate, with artificial intelligence and machine learning redefining how we approach business and daily life. Companies that harness these tools are expected to see significant advancements. The rise of automation and digital transformation contributes to a heightened need for tech solutions across all sectors.

The renewable energy sector is also gaining momentum. As the world shifts towards sustainable practices, companies focused on solar, wind, and other alternative energy sources are likely to experience substantial growth. Consumers and governments alike are prioritizing eco-friendly solutions, positioning this industry for a bright future.

Healthcare remains crucial, especially with the ongoing advancements in biopharmaceuticals and telemedicine. Enhanced accessibility and personalized medicine are trends that will likely lead to a more robust healthcare landscape. As populations age and health concerns rise, innovative healthcare solutions will be in high demand.

Lastly, the e-commerce realm is showing no signs of slowing down. With more consumers opting for online shopping, businesses that adapt to this shift will benefit greatly. Enhanced logistics and customer experiences are paramount for success in this evolving marketplace.

In summary, focusing on these dynamic sectors can unveil promising opportunities for those looking to navigate the future landscape of investments.

Promising Technologies Shaping Future Investments

As we look towards the horizon of investment opportunities, new advancements in technology are increasingly taking center stage. Embracing innovation is becoming crucial for investors hoping to unlock potential growth and profitability. With emerging trends and revolutionary ideas making waves, it’s an exciting time to explore the future landscape of the financial world.

Artificial Intelligence has rapidly transformed various industries, and its potential is far from being fully realized. From enhancing customer service through chatbots to optimizing supply chains, this technology promises increased efficiency and smarter decision-making. Companies adopting AI solutions are likely to gain a competitive edge and could attract attention from investors aiming for long-term gains.

Renewable Energy is another area that’s capturing the interest of savvy investors. With global emphasis on sustainability, businesses focusing on solar, wind, and other clean energy sources are positioned to thrive. Transitioning to eco-friendly practices isn’t just a trend; it signifies a profound shift in how industries operate, making this sector a fertile ground for potential returns.

Blockchain Technology is gaining traction beyond its initial association with cryptocurrencies. Its ability to create secure, transparent transaction systems has applications across finance, healthcare, and supply chains. As industries begin to recognize the importance of decentralized systems, entities that incorporate blockchain could be paving the way for significant growth.

Lastly, consider biotechnology, which is poised for remarkable advancement in the healthcare field. With innovations in genetic research and personalized medicine, companies in this sphere are setting the stage for breakthroughs that could change lives. Investment in biotech firms could be immensely rewarding, especially as they work on cutting-edge solutions to pressing health issues.

In this ever-evolving landscape, staying informed about these pioneering technologies can help guide investment strategies. As the world continues to innovate, identifying and understanding the potential of these sectors may pave the way to fruitful opportunities.

Market Trends That Influence Stock Growth

Investors often find themselves navigating a complex landscape where various factors can significantly affect value appreciation. Understanding these influences can provide clarity when making decisions. The interplay of economic indicators, consumer behavior, and global events shapes market dynamics, impacting performance directly.

Economic Indicators play a crucial role in signaling potential growth. Metrics like GDP growth, unemployment rates, and inflation figures guide investors in assessing the overall health of an economy. A thriving economy typically instills confidence, leading to increased investments and a positive cycle of improvement.

Consumer Behavior is another key player in market trends. When individuals feel optimistic about their financial situations, they tend to spend more, propelling companies that cater to increasing demand. Trends in consumer preferences also influence which sectors may thrive, as businesses adapt to meet evolving needs.

Global Events, such as geopolitical tensions or natural disasters, can create waves in the financial markets. Investors must remain vigilant, as such occurrences often lead to volatility and uncertainty, yet they can also present unique opportunities for those ready to act swiftly.

Overall, staying informed on these trends and understanding their interconnections equips investors with a solid foundation to anticipate future movements. Fostering a proactive approach will not only enhance decision-making but also position one favorably in an ever-changing market landscape.