Understanding What Constitutes a Perfect Credit Score

When it comes to managing your financial health, the level of trust that institutions place in you is paramount. There’s a specific metric that defines how lenders view your borrowing history and future risk, influencing everything from loan approvals to interest rates. Many people strive for that coveted level of excellence, but what does it really mean to achieve it? Let’s dive into the nuances and implications of holding a distinguished status in the financial landscape.

Aiming for an exemplary rating is more than just a personal achievement; it opens doors to incredible opportunities. Individuals with outstanding evaluations often enjoy lower costs for borrowing, higher limits, and a level of prestige that can elevate their financial journey. But the path to attaining such a distinguished standing is paved with careful decisions and a solid understanding of what contributes to those favorable assessments.

In this discussion, we’ll explore the traits that characterize a highly esteemed financial evaluation. By unraveling the components that lead to this elevated standing, you’ll be better equipped to navigate the complexities of financing and work towards that exceptional level that commands attention and respect in the financial realm.

Understanding Credit Scores and Their Ranges

Grasping the intricacies of financial assessments can be quite beneficial. These evaluations serve as indicators of how well individuals manage their obligations over time. Many people often wonder about the benchmarks that define excellent standing versus areas needing improvement.

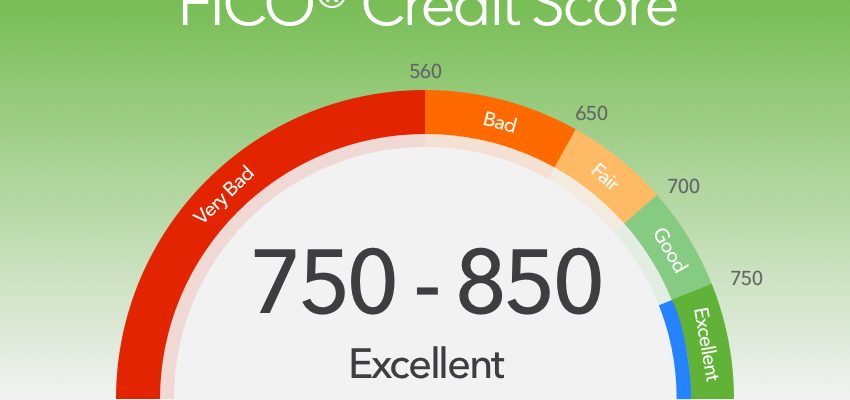

Typically, these assessments fall within various categories, which reflect different levels of reliability. Here’s a breakdown of the typical ranges:

- Poor: 300 – 579

- Fair: 580 – 669

- Good: 670 – 739

- Very Good: 740 – 799

- Exceptional: 800 – 850

Understanding where one falls within these classifications can impact many aspects of life, from loan approvals to interest rates. Here are some factors that influence one’s position:

- Payment history: On-time payments greatly enhance reliability.

- Utilization ratio: How much of available credit is being used?

- Length of credit history: The longer your accounts are open, the better.

- Types of accounts: A mix of revolving and installment accounts can be beneficial.

- Recent inquiries: Too many applications in a short time may hinder progress.

By identifying these aspects, individuals can take actionable steps to improve their financial standing. Whether it’s making timely payments or managing credit limits wisely, even small changes can lead to significant advancements over time.

The Importance of a High Credit Rating

Having a strong financial reputation plays a crucial role in our lives. It affects various aspects, from securing loans to determining interest rates and even influencing rental applications. This intangible asset can open doors or create obstacles, making it essential to understand its significance.

A high rating demonstrates reliability and responsibility, which lenders and service providers value greatly. When applying for a mortgage or a personal loan, a favorable evaluation can lead to better terms and lower repayment amounts. Moreover, individuals with solid financial histories often enjoy perks such as higher credit limits and exclusive offers.

Beyond borrowing, a robust financial history also impacts everyday life. Many employers check financial backgrounds as part of their hiring process, especially in roles that involve financial responsibilities. Thus, maintaining a positive standing can enhance job prospects and professional growth.

Furthermore, achieving a commendable rating can reduce worries during emergencies. In times of unexpected expenses, having access to credit can provide a safety net, allowing for peace of mind. Cultivating this aspect of one’s financial profile is, therefore, not just about meeting standards but about ensuring a secure and stable future.

How to Achieve Excellent Ratings

Obtaining top-notch evaluations is a journey that involves mindful decision-making and consistent habits. By understanding the essential factors that contribute to these assessments, anyone can work toward enhancing their financial reputation. It’s all about cultivating responsible behaviors that reflect positively on your financial history.

First and foremost, it’s crucial to stay on top of your payment obligations. Timely bill payments not only help build a strong track record but also signal reliability to potential creditors. Setting up reminders or utilizing automatic payments can significantly reduce the risk of late submissions.

Managing existing balances is equally important. Keep your debt levels low compared to your available limits. This ratio plays a vital role in how financial institutions view your borrowing habits. Aim to use no more than 30% of your available credit at any given time to maintain a healthy standing.

Periodically checking your financial records is another effective strategy. Errors can occur, and they might negatively impact your overall standing. Access your reports at least once a year to identify and dispute any inaccuracies promptly.

Diversifying your types of financial engagement can also enhance your standing. Having a mix of installment loans, credit cards, and other forms of credit demonstrates your ability to manage various financial responsibilities. However, be cautious not to overextend yourself; only add accounts that you can maintain effectively.

Lastly, cultivating patience is essential. Building a stellar financial reputation doesn’t happen overnight. Regularly practicing responsible habits and making informed financial decisions will gradually lead to the outcomes you desire. Stay committed, and soon enough, you’ll see the positive results of your efforts.