Understanding What Constitutes a Good Credit Score and Its Importance in Your Financial Life

When it comes to navigating the world of personal finance, knowing where you stand in terms of industry ratings is essential. These ratings play a crucial role in determining how lenders view your financial health and reliability. A certain threshold can open doors to various opportunities, making it easier to secure loans, negotiate better interest rates, and access premium credit cards. It’s all about recognizing what this benchmark means for your financial journey.

Many individuals often wonder about the implications of their numerical value in this realm. It’s not just a number; it tells a story about your financial habits, obligations, and responsibility. Different entities have unique criteria that play into their evaluation processes, but there’s a consensus on what constitutes an ideal range. This can heavily influence your financial endeavors, so understanding the landscape is key.

In the coming sections, we’ll break down what you should aim for in this context. From insight on interpretations to tips on how to enhance your position, you’ll gain a comprehensive understanding of what it means to be seen as a reliable financial partner. Buckle up as we delve into the details of this vital component of your financial profile.

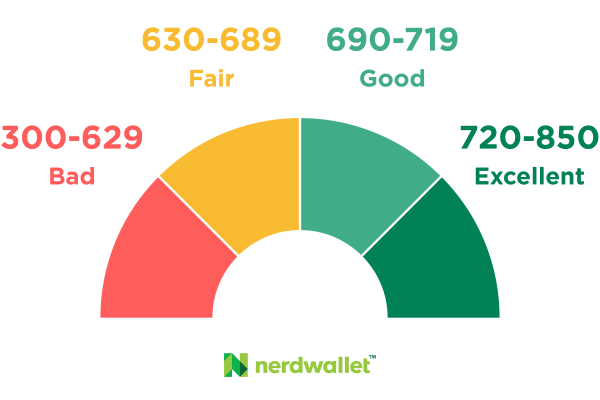

Understanding Rating Ranges

When it comes to personal finances, grasping the different ranges associated with your financial reliability is essential. These ranges play a crucial role in determining how lenders view you. They offer insights into your borrowing habits and financial behavior, influencing decisions on lending or interest rates.

Typically, these assessments can be categorized into several tiers, each reflecting a different level of financial trustworthiness. The highest tier signifies excellent management of financial obligations, while the lower tiers indicate varying degrees of risk. Understanding where you stand within these categories can empower you to take charge of your financial journey.

It’s vital to recognize that each tier comes with its own implications. Those in the upper echelon often enjoy favorable terms and conditions, making it easier to obtain loans with competitive interest rates. On the other hand, individuals in the lower ranges may face challenges, such as higher borrowing costs or denial of applications altogether.

Taking time to familiarize yourself with these categories not only helps you comprehend your financial profile but also guides your steps in improving your overall standing. Whether you’re looking to buy a home, secure a car loan, or simply manage everyday expenses, knowing where you lie within these ranges can be a game-changer.

Factors Influencing Credit Scores

Understanding the elements that play a role in determining your financial reputation can feel overwhelming, but it doesn’t have to be. Several key aspects contribute to how your financial behavior is assessed. These components not only shape your overall standing but also impact the opportunities available to you in the future.

One major factor includes payment history. This reflects how reliably you meet your financial obligations. Timely payments signal responsible management, while late or missed payments can raise red flags. Another crucial element is the amount of debt you carry; a lower balance relative to your available limits often enhances your standing.

Length of credit history is also significant. The longer you’ve maintained a responsible financial profile, the more trustworthy you appear to lenders. Additionally, the diversity of your financial accounts matters; a mix of different types of credit can demonstrate your ability to manage various obligations effectively.

Lastly, recent inquiries into your financial behavior can influence how you are perceived. Multiple requests for new credit in a short span can suggest risk, prompting lenders to exercise caution. Recognizing these influences will empower you to make savvy financial choices and improve your overall standing.

Benefits of a High Credit Rating

Having a solid financial standing opens up a world of possibilities and advantages. It not only enhances your borrowing power but also leads to better terms and conditions when you’re looking to secure loans or credit lines. An impressive assessment of your financial reliability can significantly impact your overall economic wellbeing.

Firstly, individuals with a strong financial background often enjoy lower interest rates on loans, which can save hundreds or even thousands of dollars over time. This means more money in your pocket for other expenses or investments. Additionally, lenders are more likely to grant larger loan amounts, accommodating bigger purchases like homes or vehicles without extensive scrutiny.

Moreover, a robust rating can enhance your chances of approval for rental applications. Many landlords check these standings before making decisions, and a high rating can put you ahead of the competition. Furthermore, it can sometimes lead to lower security deposits, making moving into a new place more affordable.

Insurance companies may also consider your rating when determining premiums. A favorable financial history can lead to lower costs on various insurance products, from auto to homeowner insurance. This way, maintaining a great rating contributes not just to loan affordability but also to ongoing savings in other areas of life.

Lastly, having a strong position can provide peace of mind. It allows you to take on financial commitments with confidence, knowing that you’re in a solid place to manage your obligations. This sense of security can lead to better overall financial planning and more informed decision-making in the future.