Understanding What Constitutes an Excellent Credit Score

When it comes to managing personal finances, the significance of having a robust assessment cannot be overstated. A strong rating opens up numerous opportunities, from securing loans at favorable terms to being an attractive prospect for landlords and service providers. Ultimately, it reflects an individual’s financial responsibility and reliability.

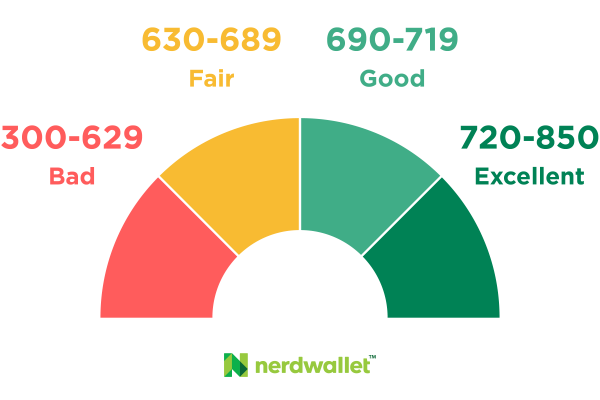

It’s fascinating how different systems measure this aspect, assigning values that indicate one’s overall financial health. The benchmark for what constitutes an impressive rating can vary, but certain thresholds are widely recognized for their positive implications. Achieving a high standing not only boosts one’s chances of approval for credit applications but also paves the way for lower interest rates and better offers.

In this discussion, we’ll delve into the nuances of these financial evaluations, exploring what traits characterize a highly regarded classification. By understanding these parameters, individuals can set targets and work towards attaining an enviable financial profile.

Understanding Credit Ratings and Their Impact

Having a solid understanding of financial evaluations is crucial in today’s world. These assessments play a significant role in determining various aspects of your financial life, from loan approvals to interest rates. Knowing how these evaluations are calculated and what influences them can help you make informed decisions and improve your financial standing.

Your financial history, including payment habits and outstanding debts, contributes to your overall evaluation. Lenders often rely on these assessments to gauge risk before extending loans or credit lines. Hence, maintaining a healthy profile can open up better opportunities, whether you’re looking to buy a home, finance a vehicle, or simply secure a favorable interest rate on a card.

It’s also important to recognize the elements that make up these assessments. Factors like the length of your financial history, types of credit you possess, and levels of outstanding debt all play a part. By being proactive and monitoring these elements, you can enhance your financial reputation and position yourself for future success.

Factors Influencing Your Credit Rating

Several elements play a significant role in determining how lenders view your financial behavior. Understanding these aspects can empower you to take control and make informed choices. The overall picture is shaped by various traits in your financial history.

Payment History: This is arguably the most critical aspect. Consistently making payments on time paints a positive picture of your responsibility. Late payments or delinquencies can harm your standing, so it’s essential to remain vigilant.

Credit Utilization: This refers to the ratio of your outstanding balances to your available credit limits. Keeping this percentage low signals to lenders that you manage your borrowing well. Aim to use less than 30% of your available credit to maintain a healthy perception.

Length of Credit History: The age of your accounts contributes to the overall assessment. A longer history, especially with diverse types of accounts, demonstrates stability and reliability.

Types of Credit: Lenders typically prefer a mix of different financial products, like revolving credit lines and installment loans. This diversity shows that you can handle various types of debt responsibly.

Recent Inquiries: When you apply for new credit, it generates a hard inquiry on your report. Multiple inquiries in a short period can suggest riskiness to potential lenders, so it’s wise to space out applications.

By keeping an eye on these factors, you can enhance your financial profile and increase your chances of favorable lending terms in the future.

Benefits of Having Outstanding Financial Trustworthiness

Achieving high standing in financial assessments can open up a world of advantages that many people may not fully realize. When your financial profile shines, it brings about numerous opportunities that enhance both your lifestyle and your peace of mind.

- Lower Interest Rates: One of the most immediate perks is the ability to secure loans or credit lines at more favorable rates. This can lead to significant savings over time.

- Improved Loan Approval Rates: Lenders are more inclined to approve applications when they see a solid history of responsible financial behavior, making it easier to obtain mortgages, car loans, and more.

- Premium Credit Cards: Those with high ratings often gain access to exclusive credit cards that offer rewards, cashback, and other enticing benefits.

- Bargaining Power: A great financial profile puts you in a better position to negotiate terms, whether it’s for loans, insurance, or even rental agreements.

- More Housing Options: Landlords frequently check financial records; having a strong status can be the key to securing your dream home.

These advantages highlight just how beneficial it can be to maintain a stellar financial reputation. It’s not just about numbers; it’s about creating opportunities that can enhance your overall financial well-being and lifestyle.