| Compare | First free* | Max amount | Min amount | Max term |

|---|---|---|---|---|

| Yes | 1200 € Contratar | 50 € | 5-62 day |

| Compare | Processing time | Max amount | ARP(%)* | Min amount | Age limit | Max term | Schedule |

|---|---|---|---|---|---|---|---|

| 10 min. | € 300 Get | 10 % | € 3000 | 18-75 | 1-3 years | 08.00 - 20:00 10:00 - 20:00 |

Understanding Universal Credit and Its Impact on Individuals and Families

In today’s world, navigating the complexities of financial assistance can be overwhelming. Many individuals and families face unexpected challenges that can strain their resources. This evolving scheme aims to streamline the support process, making it easier for those in need to access vital funds without the hassle of multiple applications.

This initiative combines various forms of aid into a single package, designed to simplify the experience for applicants. It focuses on providing essential help that can adapt to the changing circumstances of people’s lives. By consolidating different benefits, it allows recipients to manage their finances more effectively and with greater confidence.

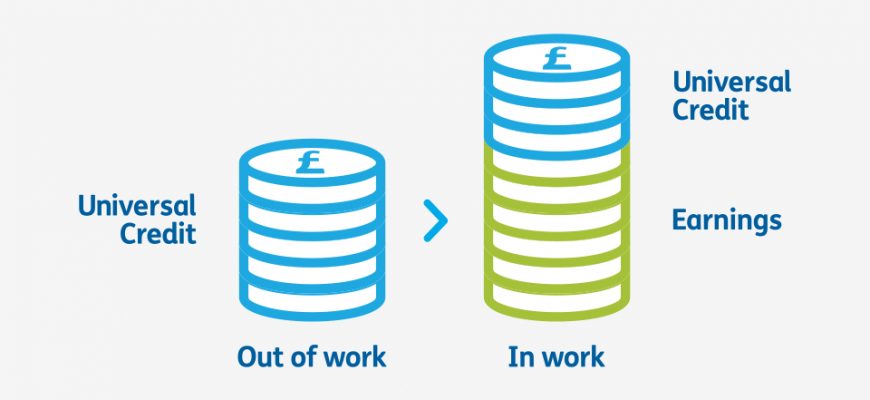

Moreover, this program emphasizes the importance of encouraging individuals to seek work and improve their situations. It offers a safety net while motivating participants to take steps towards financial independence. With a user-friendly approach and a focus on inclusivity, it aims to support a wide range of people from various backgrounds and income levels.

Understanding Universal Credit Benefits

Let’s dive into the world of financial assistance that aims to support individuals and families in need. This system consolidates several types of government aid into a single payment, making it simpler for people to access the help they require. It’s designed to ensure that those facing financial difficulties can maintain a decent standard of living while they work towards improving their situation.

This support mechanism is particularly beneficial for those who may find traditional employment challenging due to various circumstances, such as caring responsibilities or health issues. It encourages job seekers by offering additional funds that can be adjusted based on their income, helping to alleviate the stress of financial instability. Understanding the nuances of this aid can empower you to make informed decisions and take full advantage of the resources available to you.

For many, it’s not just about receiving funds, but about the broader picture of fostering independence and stability. This program can also assist with housing costs, ensuring that individuals and families can keep their homes while they navigate through tough times. It’s a vital lifeline that combines compassion with practicality, aiming to uplift and support those who need it most.

How to Apply for Financial Assistance

Getting started with your application for financial support can seem daunting, but it doesn’t have to be. This process is designed to help you navigate through the steps needed to receive the financial backing you may be entitled to. Whether you’re facing a temporary setback or in need of long-term solutions, understanding how to initiate your application is key.

1. Gather Necessary Information: Before you dive into the application, it’s essential to collect all required documents. This might include details about your income, savings, housing situation, and any other relevant information regarding your financial status. Having everything on hand will make the process smoother and quicker.

2. Online Application: The easiest way to apply is through the official government website. They provide a straightforward online form where you can input all your information. This method allows you to save your progress, so you don’t have to complete it all in one go.

3. Verification Process: Once submitted, your application will undergo a verification process. Don’t worry if you’re asked for additional documents or information; this is a standard procedure to ensure that you meet the eligibility criteria.

4. Awaiting Decision: After you’ve submitted everything, there will be a waiting period while your application is reviewed. During this time, it’s essential to remain patient and keep an eye on your email or mail for any updates regarding your application status.

5. What to Do If Denied: If, by chance, your application is not approved, remember that you have the right to appeal the decision. The official guidelines will provide you with steps on how to formally challenge the outcome.

Applying for assistance can truly make a difference in tough times. By following these steps, you’re taking a proactive approach to securing the help you need!

Eligibility Criteria for Assistance

When it comes to accessing financial support, understanding the requirements is crucial. This program provides aid to individuals facing various challenges, and there are specific conditions that must be met to qualify. It’s all about making sure that the assistance reaches those who really need it.

First and foremost, applicants should be over 18 years old but under the retirement age. Additionally, residency plays a key role; you need to have settled status in your country. This means being a citizen or having the right to reside here legally. Keep in mind that temporary residence or short-term stays don’t count.

Moreover, your financial circumstances are taken into account. If you’re working, there are income thresholds that determine whether you can receive support. If you’re unemployed or working fewer hours than you’d like, this may open the door to assistance, too.

It’s also essential to have a health assessment if you have a disability or long-term illness, as this may influence your eligibility. Finally, your personal situation, such as whether you have children or are a single parent, can impact the kind and amount of support you can receive.