An In-Depth Exploration of PayPal Credit and Its Benefits

In today’s fast-paced world, managing finances can sometimes feel like a juggling act. With various options available for online transactions, it’s crucial to explore alternatives that provide flexibility and convenience. One such option has gained popularity among consumers seeking financial solutions that fit their lifestyle. This approach allows for a seamless shopping experience while offering the freedom to manage payments in a more adaptable manner.

Whether you’re making a small purchase or planning a larger investment, navigating the realms of payment solutions can be overwhelming. Many people desire the ease of purchasing items upfront without the immediate financial strain. This alternative presents a method that enables consumers to spread their payments over time, ensuring they have the resources available when needed.

As you delve deeper into this financing option, you’ll discover its benefits, features, and how it has transformed the way consumers approach spending. Understanding how this system works can empower you to make informed decisions and maximize your purchasing power.

Understanding PayPal Credit Features

When it comes to managing your finances while shopping online, having flexible payment options can make a significant difference. This system offers a convenient way to make purchases without immediately dipping into your bank account. With various benefits and features, it can enhance your shopping experience, allowing you to spread the cost of items over time.

One standout aspect is the ability to get instant approval for transactions, providing you with the purchasing power when you need it most. Plus, you often have access to promotional offers that can give you even more time to pay without interest. This can be especially useful during sales or when making larger purchases.

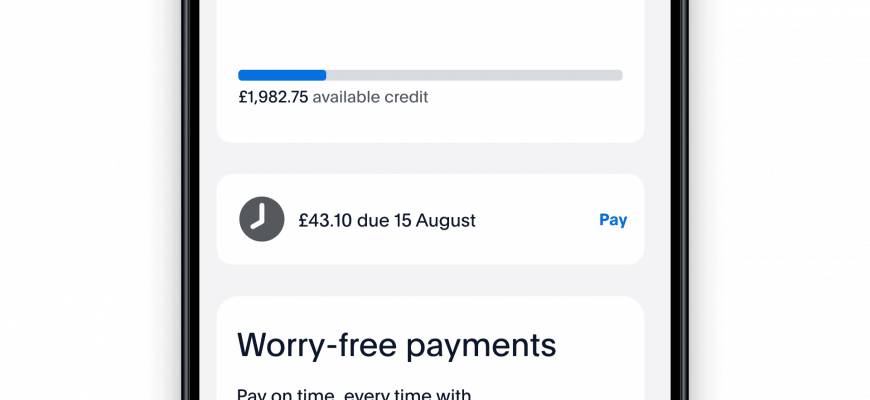

Another feature to consider is the seamless integration with your existing accounts. It’s easy to keep track of your spending, as everything is neatly organized in one place. Not only can you check your available balance, but you can also manage payment due dates and monitor past transactions, all through a user-friendly interface.

Security is also a prime concern, and this system uses advanced technology to protect your information while you’re making transactions. Enjoy the peace of mind that comes with knowing your financial data is safeguarded, allowing you to shop with confidence.

Benefits of Using Financing Options

When it comes to making purchases, having flexible payment alternatives can really enhance your shopping experience. Utilizing a financing solution offers consumers the chance to manage their expenses more effectively while taking advantage of immediate purchases. This approach allows you to enjoy what you want today without the burden of upfront costs.

One of the main advantages is the accessibility. Many financial platforms provide easy approval processes, enabling users to get started quickly without hassle. This convenience means that you can focus more on enjoying your purchases and less on complicated applications.

Another significant benefit is the potential for promotional offers, such as interest-free periods. These specials can lead to substantial savings, making larger buys more manageable and less intimidating. It’s all about maximizing your purchasing power while minimizing financial stress.

Using these financing solutions can also help build a positive payment history. Responsible management of payments may lead to improved credit scores over time, which can open doors to better loan terms in the future. It’s a smart way to invest in your financial health while enjoying the benefits of your purchases.

Lastly, this method often comes with additional consumer protections. Many platforms offer buyer protections that can safeguard your transactions, giving you peace of mind. You can shop with confidence, knowing that you have layers of security in place to protect your hard-earned money.

How to Apply for PayPal Credit

Applying for a financial solution that allows you to make purchases and pay over time can be a straightforward process. This option gives you the flexibility to shop online while managing your budget more effectively. Here’s a simple guide to help you get started with your application.

First, make sure you have an active account with the service. If you don’t have one, you’ll need to create it before proceeding. Once you’re logged in, look for the applicable section that discusses financing options. There will typically be a clear call-to-action to apply for an installment plan.

Next, be prepared to provide some personal information during the application process. This may include your income details, residence address, and social security number. These details help assess your eligibility for the program. Make sure to fill out everything accurately to avoid delays.

After submitting your information, you’ll usually receive an instant decision regarding your application. Depending on the outcome, you may be approved for a certain spending limit, which you can start using immediately for your online purchases.

Remember to review the terms and conditions before accepting the offer. This will ensure that you understand any fees or interest rates associated with the financing option. Once you’re familiar with the details, you can start enjoying the benefits of your new purchasing power.