Understanding the Details Found on Your Credit Card Statement

When managing your personal finances, having a clear picture of your spending habits is essential. One important document that plays a significant role in this process is a detailed record of your transactions. It provides insights into how and where you allocate your funds over time, offering both clarity and guidance for future budgeting decisions.

As you dive into this financial overview, you’ll encounter various entries that reveal different aspects of your expenditures. From everyday purchases to more significant investments, each line item contributes to an overall understanding of your financial landscape. This helps you identify patterns in your spending behavior, which can lead to smarter financial choices.

Furthermore, this overview often includes essential information beyond just numbers. Details such as dates, merchant names, and transaction types provide a comprehensive context, allowing you to track your habits more effectively. Understanding these elements empowers you to take control of your finances and make informed decisions moving forward.

Understanding Transactions

Diving into the world of electronic purchases can be both exciting and a bit daunting. Every interaction leaves a trace, detailing what you spent your funds on, where, and when. This guide aims to peel back the layers of these financial activities, providing clarity on how they appear in your records and what they mean for your budgeting and spending habits.

When you make a purchase, you’re not just buying an item or a service; you’re engaging in a transaction that gets recorded for your review. Each entry highlights various aspects, from the merchant’s name to the total amount spent. Recognizing these components helps in managing your finances effectively and ensures you stay on top of your expenses.

Moreover, understanding these entries can prevent surprises. You may find unfamiliar transactions or unexpected fees that warrant further exploration. Knowing how to interpret these records can empower you to address discrepancies and make adjustments to your financial behavior.

In summary, becoming familiar with these financial movements equips you with the tools needed for successful money management. It paves the way for responsible spending, ensuring you remain in control of your financial journey and make informed decisions moving forward.

Key Elements of Your Statement

When you take a closer look at your financial record, you’ll find several crucial components that reveal a lot about your spending habits and financial health. Understanding these elements can help you stay on top of your expenses and manage your finances more effectively.

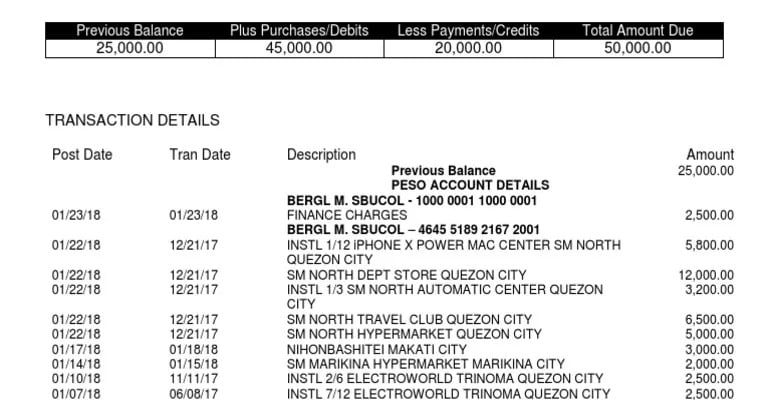

Transaction Details: Each entry provides information about the date and amount of your purchases. This data helps you track where your money is going, making it easier to identify both necessary and unnecessary expenses.

Balance Summary: You’ll typically see an overview of your overall balance, including total dues. This summary is essential for knowing how much you owe and planning your payments accordingly.

Payment Due Date: Knowing when your funds need to be settled is vital for avoiding late fees. This date serves as a reminder to help you manage your obligations on time.

Minimum Payment: This section outlines the least amount you can pay to stay in good standing. It’s important to note that paying only this amount can lead to accumulating interest, so be mindful of this option.

Rewards and Points: If your account offers rewards, you’ll find information about your earned points or cashback options here. Tracking these can help you maximize benefits for future purchases.

By keeping an eye on these significant aspects, you’re setting yourself up for better financial decisions and a clearer understanding of your spending landscape.

How to Analyze Statement Charges

Understanding your monthly expenses can feel overwhelming at times, especially when you glance at the long list of transactions. However, breaking it down can provide clarity and help you gain control over your finances. The key is to approach the review methodically, paying attention to each entry and what it represents in your spending habits.

Start by categorizing your purchases. Group similar expenses together such as dining, groceries, or entertainment. This will give you a clearer picture of where your money is going each month. You may notice patterns that can inform future budget adjustments or highlight areas where you might be overspending.

Next, take a moment to verify each transaction. Make sure that every entry aligns with your memory or receipts. If something seems off, investigate further. Discrepancies could indicate unauthorized charges or simple errors that need correction.

Don’t forget to look for recurring fees. Subscriptions can easily slip through the cracks and drain your resources without you realizing it. If there are services you no longer use, it’s wise to cancel them to free up funds for more essential needs or savings.

Finally, reflect on your overall financial health. Think about how your expenses align with your income and savings goals. This reflective practice not only helps you understand current spending but also sets the stage for smarter financial decisions in the future.