Understanding the Maximum Credit Score and Its Importance for Your Financial Health

In today’s world, your ability to secure favorable financial opportunities often hinges on a numerical representation of your reliability. This figure serves as a beacon, illuminating how credible you are as a borrower and guiding lenders in their decision-making processes. As we delve into the nuances of this measurement, it becomes essential to grasp its significance and impact on various aspects of financial life.

Many individuals find themselves curious about how to achieve the best possible rating in this system. After all, maintaining a top-tier level of financial reputation can open doors to lower interest rates, premium credit offerings, and enhanced financial trust. But what does it take to reach this esteemed level? Understanding the factors that contribute to this evaluation can demystify the journey for anyone aiming for the pinnacle of financial responsibility.

As we explore this topic, we will uncover the criteria that play a crucial role in determining where someone stands on the spectrum of fiscal integrity. From responsible borrowing habits to timely repayments, various elements intertwine to shape the final figure. By the end of our discussion, you will have a clearer picture of what it takes to reach this ultimate benchmark in the world of finances.

Understanding Credit Score Ranges

When it comes to evaluating financial trustworthiness, people often refer to a specific numerical system. This system categorizes individuals into various tiers, indicating their reliability in managing financial obligations. Knowing these classifications can empower you to make informed choices about your financial journey.

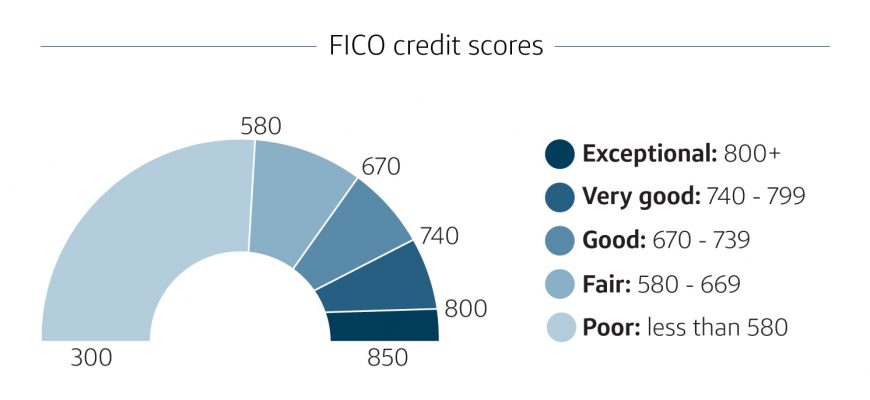

The tiers typically range from low to high, reflecting different levels of risk associated with lending money or extending credit. Here’s how these categories are generally divided:

- Poor: Those in this range may struggle to access loans or credit cards.

- Fair: Individuals here might receive offers, but often at higher interest rates.

- Good: A solid position indicating reasonable risk for lenders, often leading to favorable terms.

- Excellent: This is the most desired range, where individuals typically enjoy the best rates and offers.

Each range carries unique implications for securing loans, mortgages, or even leasing agreements. Understanding where one stands can motivate improvements and assist in achieving greater financial opportunities.

Monitoring your ratings regularly can reveal trends and help you address any inaccuracies. It’s crucial not just to be aware of these classifications, but also to understand how they can impact your financial choices in real time.

Factors Influencing Your Financial Rating

Understanding what impacts your numerical representation of creditworthiness can be quite enlightening. Many elements play a significant role in determining this figure, and being aware of them can help you make informed decisions and improve your overall financial health.

Payment History: One of the most crucial factors is how reliably you have paid back borrowed funds in the past. Late payments, defaults, or even just the absence of a solid payment history can negatively affect your standing.

Utilization Ratio: This is the relationship between your existing balances and the limit of your available credit. Keeping this ratio low demonstrates responsible borrowing habits and is viewed favorably by evaluators.

Length of Credit History: A longer history generally benefits your standing. It shows lenders a track record of managing financial products responsibly. New entrants into the credit world may find their ratings affected until they establish a solid history.

Types of Credit: The variety in the types of accounts you have can also influence your figure. Having a mix, such as installment loans and revolving credit, can showcase your ability to manage different types of debt.

New Credit Inquiries: Whenever you apply for new funds, a hard inquiry is generated. Numerous inquiries in a short time can be perceived as a sign of financial distress and may lower your standing.

By focusing on these components, you can take proactive steps to enhance your financial rating and, ultimately, gain better access to lending options in the future. Making informed decisions in these areas can lead to more favorable outcomes down the line.

Benefits of Achieving a High Score

Attaining an excellent reputation in the financial world can open up a plethora of opportunities for individuals. When you have a top-notch standing, lenders see you as a low-risk candidate, which can lead to more favorable terms across various financial products.

One of the most immediate advantages is the ability to secure lower interest rates. This means that when you borrow money or take out loans, you’ll pay significantly less in interest over time. It can save you hundreds, if not thousands, of dollars, especially with big purchases like homes or vehicles.

Moreover, a stellar status can enhance your negotiating power. Whether you’re looking for a mortgage, personal loan, or even credit card with high rewards, having a great standing provides leverage to request better conditions tailored to your needs.

Additionally, some insurance companies take your financial standing into account when determining premiums for car or home insurance. A solid track record can lead to lower costs, making for a more affordable lifestyle overall.

Lastly, maintaining an impressive standing can lead to peace of mind. Knowing that you’re viewed as a responsible borrower can help you feel more secure in your financial decisions, enabling you to focus on your goals without the stress that often accompanies monetary uncertainty.