Understanding the Meaning of a Good Credit Score and Its Importance

Have you ever wondered how financial institutions determine your reliability as a borrower? This intriguing concept involves a specific numerical representation that can significantly impact your ability to secure loans, credit lines, and even rental agreements. It serves as a crucial benchmark, influencing numerous financial decisions and opportunities in your life.

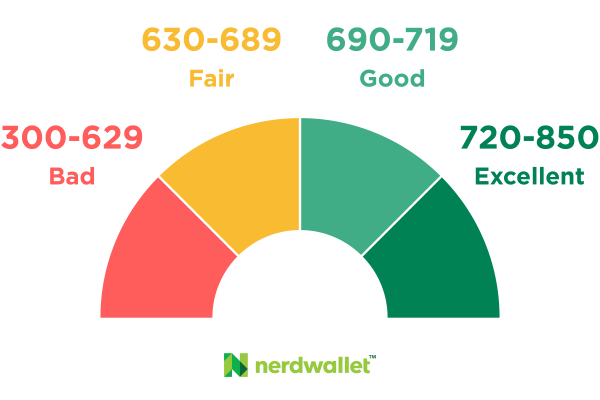

Many people are often surprised to learn that not all numerical indicators are created equal. A higher value typically indicates trustworthiness and financial responsibility, while a lower one may raise red flags for lenders and other entities. Knowing where you stand in this numerical spectrum can help guide your financial choices and improve your prospects.

Learning about these ratings is essential for anyone looking to make informed financial decisions. Whether you’re planning to buy a home, finance a vehicle, or simply want to improve your financial wellness, understanding this key element is a vital part of your journey toward fiscal well-being. Let’s delve into the specifics and uncover what makes these ratings so significant in today’s financial landscape.

Understanding the Importance of Credit Scores

Having a solid understanding of how financial ratings impact your life is crucial for navigating modern financial landscapes. These ratings serve as a reflection of your financial reliability and can influence various aspects, from loan approvals to interest rates and even housing opportunities. Recognizing their significance can empower you to make informed decisions about your finances.

Why are these ratings critical? Essentially, they provide lenders and financial institutions with a quick way to assess risk. A high rating indicates to potential creditors that you are a responsible borrower, while a low rating might raise red flags about your past repayment behaviors. This evaluation can have lasting effects on your financial journey.

Moreover, awareness of your financial standing can help you plan for your future. If you strive for an excellent financial profile, you open doors to better offers and terms, ultimately leading to savings over time. Understanding what contributes to these ratings enables you to build a healthier financial portfolio that can benefit you in various life scenarios, whether you’re applying for a mortgage, a car loan, or even a credit card.

Factors That Influence Your Financial Rating

When it comes to evaluating your financial trustworthiness, various elements come into play. Understanding how these aspects interact can empower you to make informed decisions and enhance your overall standing.

Payment history plays a significant role in shaping your financial reputation. Lenders want to see how reliably you’ve handled payments in the past. Late or missed payments can have a noticeable negative effect on your standing, while a consistent record of on-time payments can boost it significantly.

Credit utilization is another key factor. This refers to the amount of available credit you’re using. Keeping your usage low–ideally under 30%–can positively impact your standing, while high utilization could raise red flags for lenders.

The length of your credit history matters too. Established accounts, especially those with a long and positive track record, demonstrate stability. A younger account or a mix of both new and old can affect your overall standing and perceptions from potential lenders.

Types of credit you have also influence evaluations. A mix of revolving credit, like credit cards, and installment loans, such as car or mortgage loans, showcases your ability to manage different financial responsibilities, which can work in your favor.

Lastly, any new inquiries or applications for new credit can have an immediate impact. When you apply for credit, it indicates your desire for financing; too many inquiries in a short span might suggest financial distress, which could lower your rating.

Steps to Improve Your Financial Standing

Enhancing your financial health is a journey that can lead to greater stability and better opportunities. It involves various strategies and practices that can positively impact how lenders and institutions view your financial behaviors. Here are some effective steps to set you on the right path.

- Understand Your Report: Obtain a copy of your financial record from major agencies. Review it for any inaccuracies and dispute them if necessary.

- Pay Bills Promptly: Timely payments can significantly boost your standing. Set up reminders or automated payments to help stay on track.

- Manage Debt Responsibly: Aim to keep your balances low relative to your available credit. High utilization can negatively affect your rating.

- Diversify Your Credit: Having different types of accounts, such as loans and revolving credit, can be beneficial. Just ensure you manage them wisely.

- Avoid New Hard Inquiries: Each application for new credit can lead to a hard inquiry, which may lower your standing. Be selective and strategic about new applications.

- Maintain Old Accounts: Keeping older accounts active shows a long history of responsible management. If possible, keep those accounts open, even if you’re not using them regularly.

Implementing these strategies takes time and dedication, but the rewards can be significant. A healthier financial profile opens the door to better loan terms, interest rates, and financial opportunities in the future.