Understanding the Employee Retention Credit and Its Importance for Businesses

In today’s competitive landscape, organizations are constantly exploring ways to support their workforce and ensure their long-term sustainability. One area that has gained attention recently involves various financial incentives aimed at helping businesses nurture their human resources during challenging times. These programs can provide significant relief, allowing companies to focus on their core operations while also taking care of their dedicated teams.

This financial advantage is particularly relevant for those navigating the complexities of a fluctuating economy. By leveraging these available resources, businesses can not only bolster their financial health but also create a more stable environment for their staff. A deeper understanding of these incentives can unlock opportunities that both optimize operations and enhance employee satisfaction.

As we delve into this topic, we will explore the mechanics behind this intriguing support system, shedding light on how it works, who can benefit, and the overall impact it has on the workforce. By taking a closer look, we’ll uncover key insights and practical tips that can help businesses navigate this financial landscape effectively.

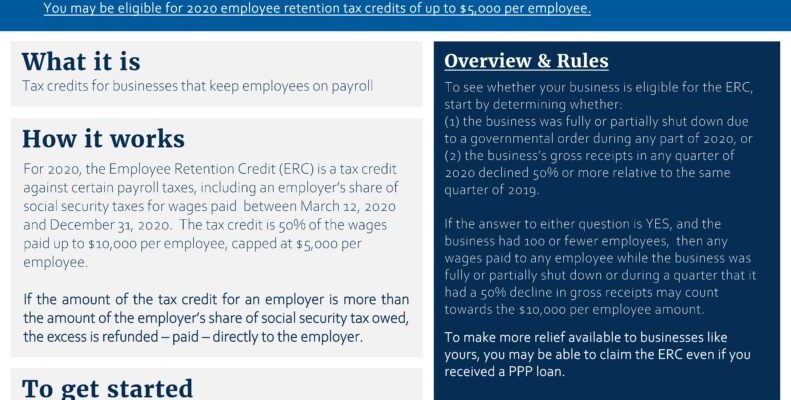

Understanding Employee Retention Credit Basics

The concept we’re diving into here revolves around a financial incentive designed to help businesses maintain their workforce during challenging times. It’s all about encouraging organizations to keep their valued team members on board, even when the economic landscape is less than favorable. This initiative aims to bolster stability and provide much-needed support to those who find themselves navigating turbulent waters.

At its core, this assistance is aimed at reducing the financial burden on employers while ensuring that their skilled labor force remains intact. By offering significant reimbursements, it allows companies to allocate funds elsewhere, whether it be for growth, investing in new projects, or simply staying afloat. This initiative fosters a sense of security for both businesses and their staff, ultimately benefiting the economy as a whole.

The eligibility criteria are crucial to understand for anyone considering taking advantage of this program. Organizations must meet specific guidelines to qualify, which often include the size of the business and the impact of recent economic events. By keeping track of these requirements, firms can effectively navigate the application process.

Furthermore, the application procedure has been streamlined to make it more accessible for interested parties. An informed approach allows businesses to maximize their benefits while minimizing potential pitfalls. Adopting a proactive stance in understanding these foundational elements not only enhances the chances of receiving support but also empowers organizations to thrive amidst uncertainty.

Benefits of the Employee Retention Credit

This financial incentive can significantly affect businesses, providing both immediate relief and long-term advantages. By encouraging organizations to hold onto their workforce, it fosters stability and continuity, which are crucial during challenging economic times.

One of the most notable advantages is the increased cash flow. Organizations can allocate resources to other essential areas, such as expanding operations or investing in new projects. This infusion of funds can help maintain a competitive edge in the market.

Moreover, retaining staff leads to lower turnover costs. When companies keep their trained personnel, they save on recruitment, onboarding, and training expenses associated with new hires. This means a more cohesive team and improved morale, which directly enhances productivity.

Additionally, organizations that take advantage of this support demonstrate a commitment to their workforce. This not only improves employee loyalty but also strengthens the company’s reputation. A positive workplace culture is key to attracting new talent and retaining existing team members.

Lastly, tapping into this opportunity can have tax implications that benefit business owners. It allows for potential offsets against other liabilities, translating into further financial relief. Overall, utilizing this initiative can pave the way for sustainable growth and resilience in the face of economic uncertainties.

How to Apply for the Incentive

Getting access to this financial benefit may seem daunting, but the process can be straightforward if you follow the right steps. This section will guide you through the necessary procedures to ensure you can take advantage of the available allowances for your business.

First, gather all relevant documents that demonstrate your eligibility. This includes payroll records, tax filings, and any other supporting paperwork that highlights how your organization has been impacted financially during the specified period. Having these materials organized will streamline your application process.

Next, you’ll need to determine the appropriate forms to complete. Typically, this involves filling out specific tax forms that pertain to the benefits sought. It’s crucial to ensure accuracy while providing all requested information, as discrepancies can lead to delays or complications in receiving your allowance.

Once your forms are ready, you can submit them electronically or via mail, depending on the guidelines provided. After submission, be prepared to wait for a processing period. Patience is key, as it may take some time for officials to review applications and issue approvals.

Finally, keep track of your application status. If there are any follow-up requests for additional information, respond promptly to avoid any setbacks. By staying organized and proactive, you increase your chances of successfully obtaining the benefit for your organization.