Understanding the Concepts of Debit and Credit in Accounting Fundamentals

In the realm of financial management, there exists a systematic method that allows individuals and businesses to track their monetary movements. This process is essential for understanding how funds flow within an organization, ensuring that every transaction is accounted for. Grasping these concepts is vital for anyone looking to maintain a healthy fiscal environment, whether for personal budgeting or larger business operations.

At the heart of these principles lies a dualistic approach that highlights the interconnectedness of financial transactions. Each entry made within this framework serves a purpose, providing insight into the overall financial health of an entity. This not only aids in ensuring accuracy but also enhances clarity when making informed decisions based on the financial information at hand.

Exploring this dual system will reveal how values shift within records, illuminating the balance between different financial aspects. Understanding this balance can empower individuals and organizations to manage their resources more effectively and make sound financial choices. It’s time to dive deeper into the mechanics of this indispensable part of financial literacy.

Understanding the Basics of Debits

Every financial transaction is a dance of numbers, where different components move in harmony. One of these key participants plays a crucial role in ensuring the accuracy and clarity of your financial records. Getting to know this element helps in making sense of how businesses track their money flow, revealing a deeper insight into the financial narrative.

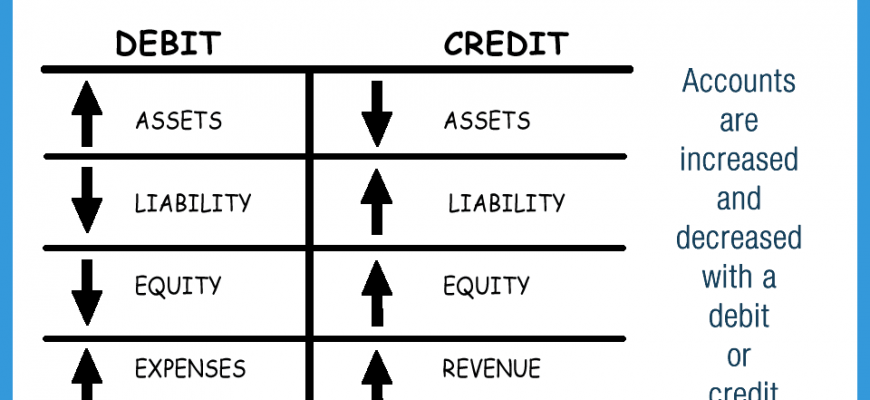

This component typically represents an increase in assets or expenses, making it essential for understanding how resources are allocated. When you record this element, you’re essentially reflecting the acquisition or enhancement of something valuable for your organization. It’s like marking the moments when you welcome new possessions or acknowledge costs required for operations.

Moreover, recognizing this aspect helps in grasping the overall structure of financial entries. Each time it appears, it indicates a specific change in the financial landscape, paving the way for a balanced and coherent representation of monetary actions. It’s fascinating how something so simple can hold such significant sway in the world of financial management.

Credits: Their Role in Financial Records

When we dive into the world of financial documentation, it’s fascinating to see how different components interact to create a clear picture of an organization’s economic activities. One of these key elements plays a pivotal role in balancing transactions, ensuring transparency and reliability in data representation. Understanding its importance is crucial for anyone looking to grasp the fundamentals of financial management.

This essential factor often symbolizes value moving out of a given account, impacting the overall financial standing of a business. By recording these movements, organizations can maintain a balanced approach to their financial dealings. It’s much more than just a number on a page; it’s about reflecting the true flow of resources within the entity.

Furthermore, this component helps in tracking revenue and liabilities, offering insights into a company’s performance. It acts as a guide, helping stakeholders make informed decisions about investments and expenditures. When losses or gains occur, this element works to depict those changes accurately, providing a foundation for further analysis and planning.

In summary, grasping the nuances of this financial tool is vital. It not only aids in maintaining the equilibrium within records but also supports long-term strategic decisions. Recognizing its significance allows for a sharper understanding of the intricate dance of financial processes.

How Debits and Credits Affect Reports

Understanding how entries impact financial statements is essential for anyone involved in managing finances. These fundamental components play a crucial role in shaping the overall picture of an entity’s financial health. Whether you’re analyzing profitability, liquidity, or overall performance, these elements provide insight into the operations of a business.

Entries serve as the backbone of reports, influencing how transactions are recorded. Each transaction involves at least two sides, ensuring that the accounting equation remains balanced. This duality allows for a more comprehensive view of financial activities, making it easier to identify trends and anomalies.

The interplay between these two types of entries reflects the dynamic nature of a company’s financial landscape. For example, when a business incurs expenses, it will directly affect profitability reports, highlighting shifts in performance over time. Conversely, increases in assets or revenue can signal growth and investment opportunities.

In summary, grasping the impact of these essential elements is vital for accurately interpreting financial statements. They form the bedrock of reporting practices and assist stakeholders in making informed decisions about future actions and strategies.

This video was the highlight of my day! I loved every second of it;keep up the amazing work.