Understanding the Child Tax Credit and Its Benefits for Families

In today’s world, providing for a family often comes with its own set of challenges and expenses. As parents navigate through various costs, from education to healthcare, there are mechanisms in place designed to ease some of that financial burden. These benefits aim to support households in maintaining a decent standard of living while raising their young ones.

One such initiative is focused on enhancing the financial stability of families with youngsters. This program involves a reduction in the total amount owed, effectively putting more money back into the pockets of guardians. The essence of this benefit lies in its intent to help those who dedicate their lives to nurturing and educating the next generation.

As we delve deeper into this topic, we’ll explore how these financial adjustments work, the eligibility criteria, and the potential impact on daily life. With a clearer understanding, families can make informed decisions to better secure their economic future.

Overview of Benefits for Dependents Financing

When it comes to supporting families, there are some fantastic advantages designed to ease financial burdens associated with raising young ones. These benefits provide essential assistance that can help parents manage expenses more effectively. From alleviating some costs for necessities to providing a bit of breathing room in tight budgets, this financial aid plays a crucial role in supporting households.

One of the key perks of this financial support is its potential to boost overall family income, allowing for more investments in children’s education, healthcare, and daily necessities. It can be a game changer for many, helping to ensure that kids have access to better opportunities. Moreover, it might even encourage saving for future needs, offering a safety net for unforeseen circumstances.

In addition, these incentives can stimulate the economy by putting more money in the hands of families, enabling them to spend on goods and services. This ripple effect contributes positively to local businesses and communities, reinforcing a healthier economic environment for everyone.

Overall, the support for families raising dependents stands out as a vital resource, fostering not only individual well-being but also promoting a thriving society. Understanding these benefits is essential for maximizing the positive impact they can have on your family’s financial landscape.

Eligibility Requirements for Families

To qualify for financial assistance aimed at supporting households with dependents, there are several key criteria that families must meet. Understanding these stipulations can help ensure that you take full advantage of the benefits available to you and your loved ones.

First and foremost, the applicant’s income plays a significant role. Generally, families with lower to moderate earnings are more likely to qualify for this support. However, eligibility often begins to phase out at higher income levels, so it’s crucial to know where you stand financially.

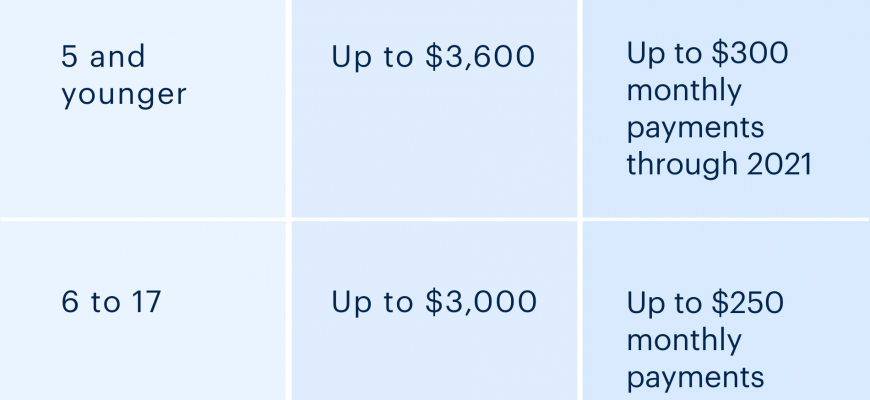

In addition to income, the age and relationship of the dependents are important factors. Typically, benefits are available for minors under a certain age, often up to 17 or 18 years. Also, the dependents must be related to the claimant, whether as biological children, adopted kids, or even stepchildren.

Residency is another essential condition. Families usually need to reside in the same household as the dependent for a specific period. This ensures that the support genuinely assists those who have direct responsibility for the child’s upbringing.

Lastly, filing status on your annual return can impact eligibility. Different categories–such as single, married, or head of household–can affect the amount of assistance you receive, so it’s worth looking over the requirements based on your situation.

How to Claim the Financial Benefit

Understanding how to access this financial support can feel like a daunting task, but it doesn’t have to be! By following a few straightforward steps, you can ensure that you’re receiving the assistance you qualify for. Whether you’re filling out forms or gathering necessary documents, having a clear plan will help streamline the process.

First and foremost, familiarize yourself with the eligibility criteria to confirm that you meet the requirements. Next, you’ll want to collect pertinent information such as your earnings, dependent details, and tax status. Keeping everything organized will save you time when it comes to submitting your information.

When you’re ready, the next step is to complete your income declaration. Most individuals report this during the annual filing process, so make sure you’re utilizing the correct forms for your situation. It’s wise to double-check all entries for accuracy to avoid any issues later.

If you’re uncertain about how to proceed, seeking help from a tax professional can be invaluable. They are equipped with the knowledge to guide you through the nuances and ensure that nothing is overlooked. Once you submit your application, all that’s left is to wait for confirmation and enjoy the benefits that come with it!

I could watch your videos all day long! You’re so talented;and this one was especially amazing.