Essential Criteria and Conditions for Obtaining a Credit Card

Entering the world of plastic money can feel like navigating a maze, especially when it comes to figuring out the necessary steps to embark on this financial journey. It’s crucial to grasp the essential elements that pave the way for an empowered spending experience. Whether you’re aiming to make everyday purchases or planning a big-ticket investment, knowing the prerequisites is the first step toward achieving your financial goals.

In this discussion, we’ll explore various aspects that influence your readiness to obtain this financial tool. From the importance of your financial history to the impact of stable income, each element plays a pivotal role in determining how smoothly you can advance. Understanding these criteria not only prepares you for the application process but also enhances your confidence as you take charge of your financial future.

Engaging with this subject can open doors to numerous opportunities. With the right knowledge, you can position yourself favorably and make informed decisions that align with your aspirations. Let’s dive deeper into the specifics and uncover what influences your ability to access this versatile financial resource.

Understanding Basic Credit Card Criteria

When diving into the world of plastic money, there are several fundamental aspects that one should consider. These key elements play a significant role in determining eligibility and functionality. Grasping these factors not only helps you make informed decisions but also empowers you in managing your finances responsibly.

First off, income plays a crucial role. Lenders want to ensure that you have a steady stream of cash to handle your obligations. This is often assessed through your employment status and overall financial health. Additionally, your credit history cannot be overlooked. It reflects how you’ve handled previous financial commitments, showing lenders your reliability.

Age and residency status are often crucial as well. Most institutions require applicants to be of legal age to enter binding agreements. Understanding these basic components can demystify the process and set you on the path to securing the right type of plastic for your needs.

Essential Documents for Application Approval

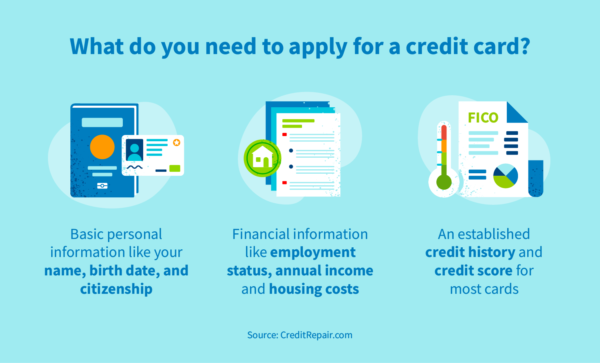

When you’re looking to secure a card, gathering the right paperwork is a crucial step in the process. These essential items help lenders evaluate your financial standing and determine whether you qualify for approval. Without the proper documentation, your application could face delays or even rejection.

To start, having proof of identity is vital. This could include a government-issued ID, such as a driver’s license or passport. Additionally, you’ll need to provide details about your income sources. This often involves sharing pay stubs or tax returns, which demonstrate your ability to manage payments.

It’s also beneficial to show your current financial commitments. Bank statements or existing loan agreements can paint a clearer picture of your financial health. Some issuers might ask for employment verification, so being ready with a contact or a pay slip can smooth out the process.

Lastly, considering your credit history can be advantageous. If you possess any previously issued statements or reports, it may help understand your standing in the eyes of potential lenders. By having all these documents ready, you can enhance your chances of a swift and successful application experience.

Factors Influencing Card Eligibility

The journey to securing a plastic payment tool can be an intriguing one. Various elements come into play when assessing who qualifies for these financial instruments. Understanding these components can greatly enhance your chances of being accepted.

Credit History plays a pivotal role. Lenders closely examine your past borrowing behavior to gauge reliability. A solid track record can open doors, while a blemished history may complicate matters.

Another crucial aspect is your income level. Stability and sufficiency in your earnings can greatly influence decisions. A steady paycheck tends to reassure issuers about your ability to manage payments.

Debt-to-Income Ratio is also important. It reflects how much of your income goes towards servicing existing debts. Keeping this ratio balanced signals fiscal responsibility, which can boost your application.

Moreover, employment status can sway outcomes. Being in a stable job with a reliable employer typically works in your favor, suggesting a consistent flow of income.

Age can also be a determining element, as many institutions have minimum age thresholds. Being of a certain age often indicates maturity in handling financial matters.

Finally, your geographic location might affect eligibility. Some regions may have diverse economic conditions, influencing the criteria set by issuers. Always check local policies and market norms.