Essential Questions to Consider When Exploring Financial Aid Options

Stepping into the realm of education can be both exciting and overwhelming, especially when it comes to securing necessary resources to fund your journey. With various options available to lighten the financial burden, it’s crucial to gather the right insights to make informed choices. This exploration will help unveil the essential inquiries that can guide you towards optimal assistance tailored to your unique circumstances.

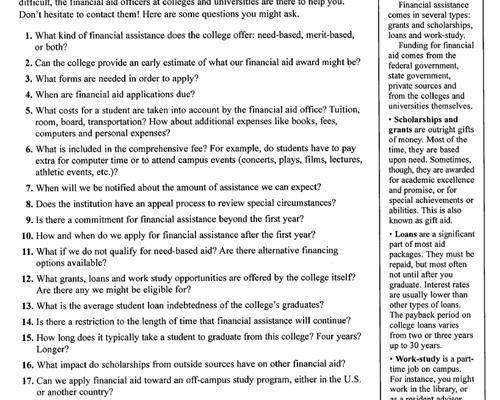

When diving into the details of monetary support, clarity is key. Seeking clarifications on eligibility, application procedures, and potential obligations can significantly influence your experience. Understanding the various forms of help available, from grants to loans, can empower you to assemble a solid plan to finance your educational aspirations.

As you embark on this quest for guidance, consider the significance of specific considerations that may arise. Delving into the intricacies of each available option will provide a clearer picture of how to approach your funding strategy. This is an essential step in ensuring that you harness the resources necessary for a successful academic venture.

Understanding Types of Financial Aid

Diving into the world of funding for education can feel overwhelming, especially with the variety of options available. It’s essential to navigate through the different kinds, each designed to meet specific needs and circumstances. Knowing the distinctions helps you make informed choices that best suit your aspirations and situation.

Grants stand out as a popular choice, often provided by government entities or educational institutions. These funds typically do not require repayment, which makes them appealing for students seeking to minimize debt. They are often awarded based on financial need or academic merit, depending on the program.

Scholarships, like grants, are another avenue worth exploring. These awards can come from various sources, including schools, private organizations, and community groups. Unlike loans, they do not need to be paid back, making them highly sought after by students aiming to ease their financial burdens.

Then there are loans, which involve borrowing money that must be repaid with interest over time. They can offer substantial support but come with the responsibility of repayment after completing your education. Understanding the terms and conditions is crucial to avoid potential pitfalls down the line.

Work-study programs provide a unique blend of earning while learning, allowing students to gain practical experience and reduce their tuition expenses. Participating in such programs can also enhance resumes, giving students a competitive edge in the job market.

Lastly, considering the different types of aid available can empower you in your pursuit of education. By understanding each option’s benefits and obligations, you can craft a funding strategy that aligns with your academic goals and financial situation.

Key Eligibility Criteria for Assistance

Understanding the fundamental requirements for receiving support can significantly simplify the application process. Various factors come into play, influencing who qualifies for different types of assistance. By grasping these essentials, individuals can better navigate their options and identify what suits their specific circumstances.

First, many programs consider financial circumstances, including income levels and family resources. Assessments of assets and liabilities often form a crucial part of the eligibility evaluation. Additionally, the student’s enrollment status–whether part-time or full-time–can impact access to certain benefits.

Academic performance commonly plays a role as well. Many organizations set minimum GPA standards or require proof of satisfactory progress towards a degree. This criterion underscores the importance of maintaining good grades while pursuing educational goals.

Lastly, citizenship or residency status is typically a key factor. Many resources are limited to applicants who are citizens or legal residents, which can shape the support available. Understanding these fundamental elements can empower individuals to make informed decisions about their educational funding opportunities.

Application Process and Deadlines

Navigating the journey of securing assistance can feel overwhelming, but understanding the sequence of steps involved can make a significant difference. From the initial stage of collecting necessary documents to the final submission, it’s essential to stay organized and informed throughout the entire procedure.

First and foremost, familiarizing yourself with critical dates is paramount. Each institution may have its own timeline, and missing these deadlines could hinder your chances of receiving support. Be sure to keep an eye on both the early application dates and final submissions to ensure that you’re on track.

Additionally, pay attention to the specific forms required for documentation. Different programs might require unique applications or supplementary materials. It’s beneficial to have a checklist handy to make sure you don’t overlook anything important.

Lastly, don’t hesitate to reach out to support services at your school. They can provide valuable insights and guidance as you navigate through the process, ensuring that you have all the information needed to complete your application successfully.