Explore Your Questions About Financial Aid and Discover the Answers You Need

Navigating the landscape of educational assistance can be a bit overwhelming. Many individuals often find themselves pondering various aspects of this crucial topic. Understanding where to turn for reliable information or advice is essential, especially for those embarking on their academic journey.

Clarifying uncertainties can make a significant difference. Whether it’s concerns about eligibility, application processes, or the types of resources available, a deeper comprehension empowers individuals to make informed choices. Engaging in a conversation about these topics not only demystifies the process but also fosters confidence in pursuing educational opportunities.

It’s essential to explore the diverse options out there. Numerous forms of support exist, from scholarships to loans, and each comes with its own set of rules and guidelines. Having a clear grasp of the various avenues available allows prospective students to tailor a plan that best suits their needs and aspirations.

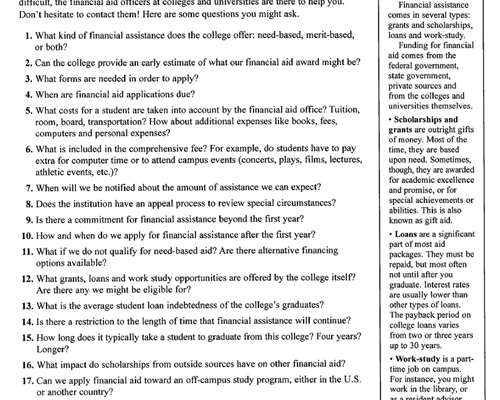

Understanding Types of Financial Aid

Navigating the world of funding for education can feel overwhelming, but getting familiar with various forms of assistance can make the journey smoother. Each type serves a unique purpose and can significantly influence your experience in pursuing academic goals. Knowing the distinctions between these options can empower individuals to make informed decisions regarding their educational investments.

Grants are a fantastic option for those seeking non-repayable support. Typically awarded based on need, these funds cover a portion of tuition and associated costs. Unlike loans, grants do not require repayment, allowing recipients to focus on their studies rather than future debt.

Scholarships are another excellent avenue, often tied to merit or specific achievements. These awards can recognize talent in academics, sports, or the arts, providing assistance that doesn’t demand repayment. Students should consider seeking scholarships that align with their skills and interests to maximize their potential funding.

Loans, unlike the previously mentioned forms, do require repayment after graduation. They may offer lower interest rates and flexible terms, but it’s crucial to approach them with caution, ensuring a detailed understanding of the obligations that accompany borrowing money for education.

Work-study programs provide a unique blend of income and hands-on experience. These initiatives allow students to work part-time while attending classes, offering financial relief and enhancing their resumes. This option not only aids in covering expenses but also fosters valuable skills in a professional setting.

Understanding these distinct categories of support can greatly enhance your approach to paying for education. Each type of assistance can complement the others, creating a comprehensive funding strategy that lightens the financial load while pursuing academic ambitions.

Navigating the Application Process

Embarking on the journey of securing assistance can feel overwhelming at times. Yet, understanding how to maneuver through the various steps will empower individuals to tackle this crucial phase with confidence. Each stage presents opportunities to gather resources, insights, and tips that can significantly impact the outcome.

Researching Options: Begin with investigating different types of support available, from scholarships to grants, tailored for various needs. Familiarizing oneself with eligibility criteria and deadlines ensures a solid foundation for the application journey.

Gathering Documentation: A well-organized collection of necessary papers is key. This may include tax returns, identification documents, and any supporting materials that highlight achievements or circumstances. Keeping everything in one place can streamline the process immensely.

Understanding Forms: Many institutions and organizations require various forms to be filled out. Taking the time to comprehend each form’s purpose and instructions prevents potential mistakes that could delay or hinder progress.

Seeking Guidance: Don’t hesitate to seek help from resources available. Many schools offer workshops, counseling, or one-on-one assistance. Connecting with experienced individuals can make a world of difference in clarifying complicated aspects.

Approaching this endeavor with a proactive mindset will lead to a more manageable experience. Every step taken is a move towards the goal of securing the necessary support for educational pursuits.

Common Myths About Financial Assistance

Many misconceptions circulate around the topic of support options available for students. These misunderstandings can lead to confusion and unnecessary stress when trying to explore possibilities for funding education. It’s essential to clear the air and separate fact from fiction.

One prevalent myth suggests that only students from low-income families qualify for assistance. In reality, numerous resources are available for individuals from various financial backgrounds. Eligibility often depends on factors such as academic performance, field of study, and other specific circumstances.

Another common belief is that applying for support is a waste of time, as the process is too complicated and tedious. While the application may seem daunting at first, many resources exist to help simplify the experience. Various organizations and institutions provide guidance, making the journey more approachable.

Many think that receiving assistance means giving up personal independence. In truth, support can empower students to focus on their studies rather than stressing over financial burdens. This relief can lead to better academic performance and overall well-being.

Finally, some individuals believe that loans are the only option available. While borrowing may be necessary for some, scholarships and grants are abundant and often go unnoticed. Seeking out these opportunities can significantly reduce the financial load on students.