Understanding the Various Digits Found on Your Credit Card and Their Significance

Ever found yourself glancing at that plastic piece of convenience in your wallet and wondering what all those symbols and digits actually mean? It’s a fascinating world hidden beneath the surface, filled with specific combinations that serve particular purposes. Navigating through this information can shed light on how transactions are processed, how security is maintained, and even how to maximize the benefits of using this financial tool.

Each element plays a vital role in ensuring that your purchasing experiences are seamless and secure. From the unique identifiers that link you to your financial institution to the codes that keep your data safe, there’s more than meets the eye. In this exploration, we’ll decipher those intricacies, bringing clarity to what could otherwise seem like a jumble of figures and letters.

So, let’s dive into the particulars that make this payment solution work, unraveling the meaning behind each segment and highlighting why they matter in the broader context of modern transactions.

Understanding Credit Card Digits

Diving into the world of plastic payment methods reveals various intriguing components that make up these essential financial tools. Each section serves a unique purpose, ensuring transactions are secure and efficient. Let’s break down what each segment signifies, offering clarity on this vital aspect of modern finance.

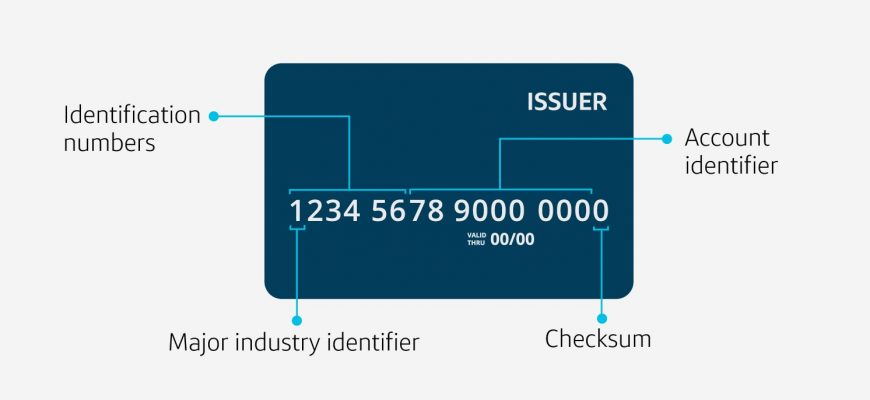

The initial group of figures indicates the network’s identity, guiding merchants to interpret the issuer flawlessly. Following that, you’ll find essential details that help guarantee authenticity and protect users from fraud. This sequence culminates in a final digit that’s not just a random choice but plays a crucial role in validating the entire set.

Furthermore, some portions of this string offer insights into the account holder, often reflecting the institution behind the issuance. Understanding these elements can empower users, enhancing their confidence when navigating various purchasing environments.

Significance of the Issuer Identifier

The issuer identifier plays a crucial role in the world of payment methods. This component provides essential information that helps in recognizing the institution responsible for issuing the financial instrument. By looking at this identifier, businesses can efficiently verify transactions and ensure they are authorized, which ultimately enhances security for all parties involved.

Such identifiers often serve as the backbone of fraud prevention systems, allowing for quick assessments of the legitimacy of a transaction. This feature not only aids merchants in reducing chargebacks but also offers consumers peace of mind knowing their transactions are monitored closely. Overall, the issuer identifier is a fundamental aspect that streamlines operations and safeguards financial exchanges.

Insights from Additional Digits

Diving into the realm of payment methods reveals fascinating details beyond the surface. Each sequence of symbols carries unique information that can shed light on spending behavior, transaction history, and even the level of risk involved in a financial operation. Understanding these details can empower users to make informed choices and enhance their financial management strategies.

Such elegance and confidence! She’s absolutely stunning;and this video captures her charm perfectly.