Exploring the Various Types of Financial Aid Options Available to Students and Families

When embarking on the journey of higher education, many individuals find themselves navigating a landscape filled with various resources designed to ease the burden of expenses. It can sometimes feel overwhelming, but rest assured, there are numerous paths to explore that can help lighten the load. From scholarships to loans, the opportunities are abundant.

As you delve deeper into the options, you’ll discover that not all support mechanisms are created equal. Each type offers unique benefits and possibilities, tailored to fit different needs and situations. Understanding these distinctions can empower you to make informed decisions and maximize your potential for success.

Whether you are a recent high school graduate or an adult learner, it’s essential to stay informed about the various possibilities for assistance. Knowing what resources are at your disposal can drastically change your academic experience, making education more accessible and attainable. So let’s break it down and uncover the support systems that can help you thrive on your educational path.

Types of Financial Assistance Programs

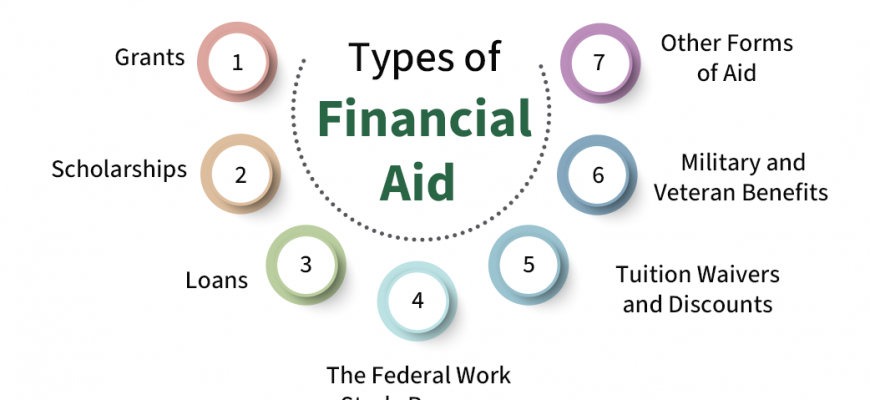

When it comes to funding your education or other needs, there are various avenues to explore. These programs can offer support through different mechanisms, making it possible for individuals to access the resources they require. It’s important to understand the distinctions between each option and how they can fit into your personal situation.

One prevalent option includes grants, which are essentially gifts that don’t need to be repaid. These can be awarded based on various criteria, including financial situation, academic performance, or specific talents. Another choice is scholarships, often awarded for academic excellence or outstanding achievements in specific fields, providing funds that can lighten the burden of expenses.

Loans also play a crucial role in this landscape. Unlike grants or scholarships, these funds must be paid back, typically with interest, but they can still offer a vital lifeline for many students. Additionally, work-study programs allow individuals to earn money while gaining valuable experience through part-time employment during their studies.

Moreover, state and federal initiatives often provide support tailored to specific demographics, such as low-income families, veterans, or individuals pursuing particular careers. These tailored programs can significantly ease the path toward achieving personal and academic goals.

In summary, understanding the various types of assistance options can empower you to make informed decisions about managing educational and living costs. Each program offers unique benefits, aiding many in pursuing their aspirations with greater ease.

Understanding Scholarships and Grants

When it comes to pursuing education, many students find themselves exploring various ways to lighten their financial burdens. Among the most appealing options are scholarships and grants, which serve as fantastic resources for those looking to fund their studies without the burden of repayment. These opportunities can greatly enhance a student’s experience while easing some of the monetary stress associated with higher learning.

Scholarships are typically awarded based on merit, recognizing achievements in academics, sports, arts, or community service. They can come from numerous sources, including schools, private organizations, and government entities. On the other hand, grants often take into consideration the financial circumstances of the student and are commonly associated with need-based assistance. Both avenues offer significant advantages and can vary widely in terms of eligibility criteria and application processes.

Ultimately, understanding these options and how they differ can empower individuals to seek the resources they need. Researching the various opportunities available, preparing compelling applications, and meeting deadlines are essential steps toward securing these valuable forms of support. With some effort and dedication, students can discover how scholarships and grants can pave the way for their educational aspirations.

Loans and Other Financial Support Options

When it comes to funding your education or pursuing other ventures, there are various avenues to explore. From borrowing money to alternative resources, individuals can find suitable solutions tailored to their needs. Understanding the options available can help in making sound choices that align with personal circumstances.

One popular route is loans, which allow students or individuals to obtain capital for their goals. These come in different forms, such as federal and private loans, each with its unique terms and interest rates. Federal loans typically offer lower rates and more flexible repayment plans, making them a favorable option for many. On the other hand, private loans may sometimes provide larger amounts but often come with stricter conditions.

Besides loans, several organizations and institutions offer grants and scholarships, which don’t require repayment. These can significantly alleviate the financial burden and often have specific criteria, such as academic achievements or community involvement. It’s worth researching what is accessible locally or through various programs to maximize opportunities.

Lastly, work-study programs and part-time employment also serve as excellent ways to support expenses. By balancing work with studies, individuals can gain practical experience while earning money to assist with costs. Overall, exploring a combination of these resources can create a well-rounded approach to meeting financial needs effectively.