Understanding Xfinity Credit and Its Benefits for Customers

In the realm of telecommunications services, understanding how a company assesses its users’ financial reliability can seem quite complex. Many people might wonder how these evaluations impact their ability to access various services and promotions. This analysis involves examining a customer’s past financial behavior and determining the potential for future transactions.

This important mechanism not only influences the type of services available but can also dictate whether one might need to put down a deposit or secure a promotional offer. Familiarity with these assessments is crucial for anyone looking to engage with service providers effectively. Knowing what to expect can foster a smoother experience when signing up for new plans or upgrades.

There’s often more than meets the eye when it comes to these evaluations. Customers are encouraged to explore how these assessments work and what factors come into play. Being informed can lead to better decision-making and allow for a more tailored approach to one’s specific needs in the vast world of telecommunications.

Understanding Credit Basics

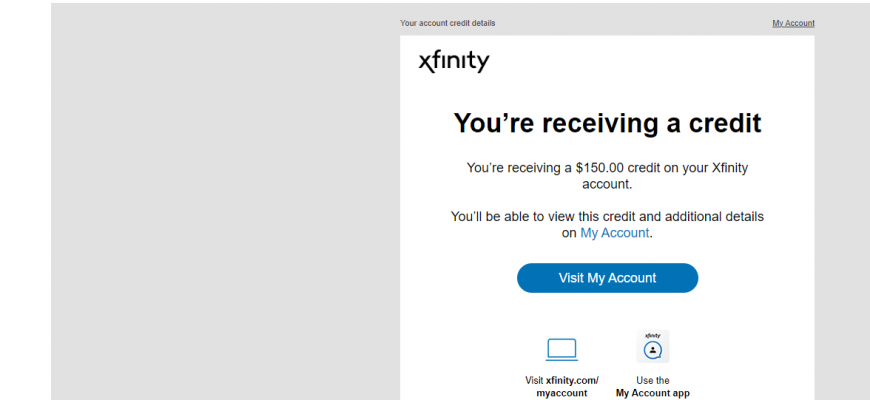

Grasping the fundamental principles behind financial rewards can be quite enlightening. This concept often serves as a means for service providers to enhance customer satisfaction. Whether you’re new to this idea or have encountered it before, getting to the heart of how these perks work can be beneficial for managing your expenses.

Essentially, these financial incentives can manifest in various forms, such as discounts or adjustments on your upcoming bills. They are typically offered based on specific actions or agreements, allowing users to enjoy some cost relief. If you delve into the specifics, you’ll discover that utilizing these benefits wisely can lead to significant savings over time.

Understanding the conditions and how to maximize these rewards is crucial. Different providers might have their unique guidelines, but the underlying purpose remains the same: to create enhanced value for you as a user. By becoming familiar with these aspects, you can make informed decisions and potentially improve your overall financial situation.

Benefits of Financial Flexibility for Customers

Having access to financial support can significantly enhance the experience for users of various services. It’s not just about easing the burden of upfront costs; it creates opportunities for better budgeting and spending management. Through tailored financing options, individuals can enjoy the services they need without immediate financial strain.

Convenience is one of the primary advantages. With flexible payment plans, customers can align their expenses according to their own schedules. This means less worry about how to fit hefty bills into tight budgets. After all, everyone appreciates the comfort of manageable monthly payments.

Additionally, such financial structures may lead to improved access to essential services and products. For many, the initial investment can be a barrier, and alternative options can open up doors that were previously closed. This not only increases customer satisfaction but also fosters loyalty, as users feel valued and understood.

Moreover, the opportunity to build a positive financial history is another significant perk. Regular, on-time payments can boost credit scores, providing a pathway for future purchases or investments. As customers navigate their financial journeys, these benefits can play a crucial role in their overall well-being.

In summary, embracing flexible financial options can transform the interaction between services and customers. It empowers individuals to make informed choices while enjoying the conveniences of modern living, ensuring that they feel supported every step of the way.

How to Apply for Financial Assistance

Looking to secure some financial help? The process isn’t as complicated as it may seem. With the right steps, you can easily explore available options to support your expenses. Let’s walk through the application procedure together, making it simple and straightforward.

First, you’ll want to gather all necessary documents that outline your financial situation. This often includes proof of income, identification, and any bills you might need assistance with. Having everything organized will streamline the process and ensure that your application is complete.

Next, visit your service provider’s website or contact their customer service for specific guidelines. Each company might have its unique requirements, so it’s crucial to get the correct information. Look for the section that details options for assistance to find the application form.

Once you locate the application, fill it out meticulously. Be honest and accurate in your responses to avoid any delays. If there are sections that are confusing, don’t hesitate to reach out for clarification. It’s better to ask questions upfront than to struggle later on.

After submitting your application, keep an eye on your email or messages for any updates. It may take a few days for the review process, so patience is key. If approved, you’ll receive details about the assistance you are eligible for, which can make a big difference in managing your expenses.

In case of denial, don’t be discouraged. Many times, you can appeal the decision or reapply. Understanding the reasons for denial can help improve your chances next time around. With determination and the right approach, you might just find the support you need.