Exploring the Latest Trends and Developments in Financial Aid Options for Students

Navigating the world of education can often feel overwhelming, especially when it comes to finding the necessary resources to achieve your academic goals. Many individuals find themselves wondering where to turn for assistance, whether it’s figuring out how to cover tuition costs or accessing essential materials for study. This journey toward knowledge shouldn’t be a burden, and that’s where various forms of support come into play.

These resources are designed to help students bridge the gap between their aspirations and the financial realities they face. From grants that don’t need to be repaid to low-interest loans, there are numerous options available to alleviate some of the pressures associated with pursuing higher education. Understanding these mechanisms can empower scholars, ensuring they have the opportunity to thrive and focus on what truly matters: learning.

As we delve deeper into the subject, we’ll uncover the different types of opportunities available today. By breaking down the specifics and offering straight talk about each option, you’ll be better equipped to make informed decisions that enhance your educational journey. Let’s explore how these resources can transform your academic experience and pave the way for future success!

Understanding Financial Aid Options

Diving into the world of education assistance can feel overwhelming at first, but it’s essential to explore the various avenues available to you. These resources can help ease the burden of tuition and related expenses, making your academic journey more accessible. From government programs to institutional support, knowing your options is a key step in navigating this landscape.

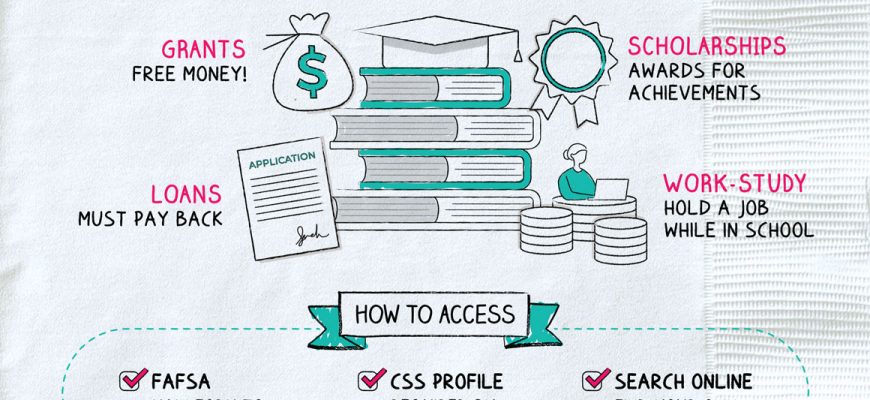

Various types of programs exist to provide monetary support. Scholarships often reward students for academic achievements, talents, or community service, while grants typically offer funds based on need without requiring repayment. Loans, on the other hand, help cover costs but require careful consideration of future repayments. Understanding the differences between these opportunities can empower you to make informed choices.

Additionally, institutions often have their own programs designed to assist their students. Applying for these unique opportunities can significantly enhance your support system during your studies. Make sure to research and reach out to financial offices at your school–they can provide tailored advice and often have information about local resources as well.

Don’t forget to leverage online tools and platforms that match students with potential resources. These can streamline the process and provide guidance on what’s available in your area or field of study. Being aware of deadlines and required documents will enhance your chances of receiving the support you seek.

How to Apply for Financial Support

Getting assistance to fund your education can seem overwhelming, but it doesn’t have to be. The journey begins with understanding the steps required to secure the resources you need. It’s essential to gather information, prepare documents, and submit applications that reflect your situation accurately.

Step 1: Start by researching the different types of support available. Scholarships, grants, and loans often come with various criteria, so knowing what’s out there can simplify your search.

Step 2: Once you identify potential options, compile any necessary documentation. This might include tax returns, academic records, and personal essays. Being organized will make the process smoother.

Step 3: Fill out the required application forms carefully. Provide all requested details and don’t hesitate to seek help if you stumble on any section. Accuracy is key, and even minor mistakes can lead to delays.

Step 4: After submitting your applications, keep track of your status. Some programs might require additional information or an interview. Staying proactive shows your commitment.

Step 5: Lastly, don’t forget to follow up. Whether it’s a thank-you note or status inquiry, reaching out maintains your engagement and can leave a positive impression.

By taking these steps, you can navigate the process with confidence and increase your chances of receiving the support you deserve.

Types of Assistance Available

When it comes to pursuing education, there are various forms of support that can help lighten the financial burden. These options cater to different needs and eligibility, allowing students to choose what suits them best. Understanding the different types available can empower individuals to make informed decisions about their educational journey.

Grants are often the most sought-after option. They’re typically based on need and do not require repayment. You can think of them as gifts to help you along the way. Scholarships, on the other hand, are awarded based on merit, whether it’s academic achievements, talents, or community service. Just like grants, they don’t need to be paid back, making them a coveted source of support.

Then, we have loans, which provide funds that must be repaid with interest. They can come from federal programs or private institutions. While loans can ease immediate costs, it’s essential to plan for the future repayment. Lastly, consider work-study programs, where you can earn money by working part-time while attending school. This can be an excellent way to manage expenses and gain valuable work experience simultaneously.