Understanding the Student Aid Index of 1500 and Its Implications for Financial Support

In today’s world, navigating the complicated landscape of financial support for education can be a daunting task. With a variety of programs, calculators, and guidelines, it’s easy to feel overwhelmed. Yet, grasping the essentials can make a significant difference in accessing necessary resources and ensuring a smooth journey through academic pursuits.

Many might find themselves wondering how eligibility for various funding opportunities is determined. This is where specific metrics come into play, serving as a tool that evaluates an individual’s qualifications. By comprehending this concept, you can better prepare for the financial planning that accompanies your educational ambitions.

Exploring this system reveals critical insights into how resources are allocated, making it essential for those seeking support. Understanding this framework enables aspiring scholars to make informed decisions and strategize effectively for their financial futures.

Whether you are a first-time applicant or someone looking to optimize your current funding situation, familiarizing yourself with these concepts will undoubtedly empower you. Let’s dive deeper into how these evaluations work and what they mean for your scholastic endeavors.

Understanding the Student Aid Index

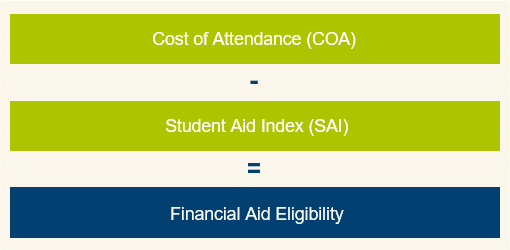

When navigating financial resources for education, many individuals encounter a critical measurement that significantly impacts their eligibility for support. This concept serves as an essential tool to determine how much financial assistance one can receive to facilitate academic pursuits. It underpins the process of allocating funds and resources, aiding aspiring scholars in understanding their position in the funding landscape.

The essence of this metric lies in its ability to quantify a family’s financial situation. Various elements, such as income, assets, and household size, come together to form this comprehensive figure. It acts as a bridge between aspirations for higher learning and the practical implications of financing those dreams.

Diving deeper, this figure plays a pivotal role in the application processes for diverse financial programs. Familiarizing oneself with this calculation can empower students to make informed decisions about their future. Acceptance of this value can significantly influence the overall educational journey, from choosing institutions to determining budgetary constraints.

In essence, grasping the nuances of this financial metric enhances transparency and provides a clearer roadmap in the quest for educational funding. Ultimately, it enables individuals to strategically plan their approach to funding options, ensuring that financial resources align with their personal ambitions and educational goals.

How to Calculate Your Score

Figuring out your financial score can seem daunting, but once you break it down, it’s quite manageable. This score plays a crucial role in determining how much assistance you can receive for your education. Understanding the components that contribute to this figure allows you to be better prepared when it comes to funding your academic journey.

Start by gathering your financial information. This includes details about your income, assets, and any other relevant financial aspects. Make sure to be thorough in collecting accurate data, as any discrepancies can affect your final calculation.

Next, familiarize yourself with the specific formulas used. Different factors are weighted differently, and knowing how each component impacts your overall score is essential. Look for resources that provide clear explanations of these calculations.

Once you have your numbers and understanding in place, input everything into the calculation process. This might involve using an online calculator or manually computing your score based on the formula. Double-check your results to ensure accuracy.

Lastly, keep track of any changes that may occur. Your financial situation can fluctuate due to various reasons, and it’s wise to recalculate periodically to stay informed about your circumstances. Being proactive will help you make better decisions regarding your education financing.

Impact of the Index on Financial Assistance

The recent adjustments in financial support evaluation systems have stirred up discussions about their effects on affordability for students pursuing higher education. Understanding how these changes influence funding opportunities is crucial for both prospective learners and institutions alike.

Many individuals heavily rely on various forms of financial support to help with tuition and related expenses. As evaluation metrics evolve, students may face different calculations of their financial need, which can ultimately affect the assistance they receive. This transformation could mean increased or decreased aid packages, making it vital for students to stay informed about how these new standards impact their funding scenarios.

Additionally, institutions are adapting to these shifts in assessment criteria, which can lead to adjustments in their own financial assistance programs. By re-evaluating their resources and strategies, schools aim to ensure that they can still support their populations effectively while complying with the new frameworks.

The influence of these changes ripples through various aspects of student life, from enrollment decisions to the overall financial health of educational establishments. As the implications unfold, both students and institutions will need to navigate this evolving landscape together.