Exploring the Different Ranges of Credit Scores and Their Significance in Financial Health

Many individuals often find themselves navigating the complex world of financial evaluations. These numeric indicators play a significant role in determining an individual’s borrowing potential and can influence crucial decisions. It’s essential to grasp the nuances of these metrics, as they can directly affect loan approvals, interest rates, and even renting opportunities.

When diving into this topic, it’s interesting to explore how these evaluations function and what factors contribute to their calculations. From payment history to outstanding balances, each element holds weight in the overall assessment. Knowing where one stands on this scale can empower individuals to make informed financial choices and improve their standing over time.

In this exploration, we will uncover the various thresholds that exist in these assessments, shedding light on what different categories signify. Understanding these distinctions provides clarity on improving one’s financial health and making wiser economic decisions. Let’s break it down and see how these numbers can impact everyday life.

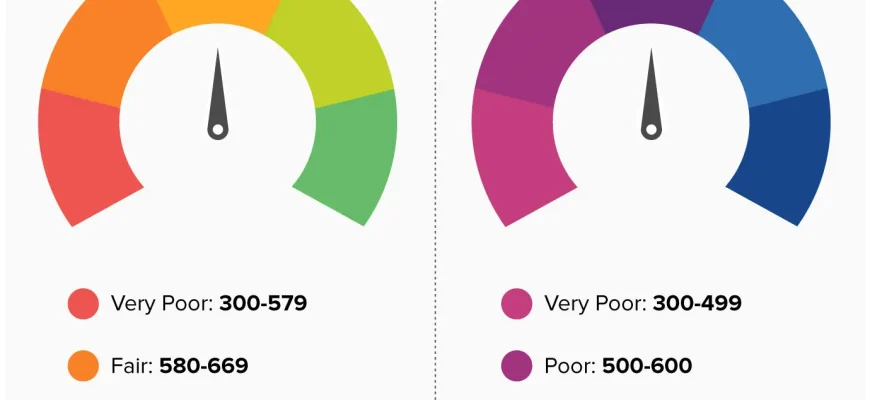

Understanding Credit Score Levels

When it comes to assessing financial health, knowing how to interpret numeric assessments is crucial. These figures can significantly influence lending decisions, interest rates, and even rental agreements. Understanding what these values mean helps individuals manage their finances more effectively and make informed choices.

The evaluation typically sits on a scale that is divided into distinct segments. Each segment indicates different levels of trustworthiness and reliability as a borrower. In general, lower values may suggest higher risk, while elevated figures often reflect fiscal responsibility. Grasping these classifications can empower people to take actionable steps toward improvement.

Exceptional standings are marked by impressive values, signaling to lenders that an individual is a low-risk candidate. Those in this category may benefit from better loan options and lower interest rates. On the flip side, poor ratings indicate a greater risk, which can lead to challenges when seeking financial assistance. Individuals in this group often face higher costs and may have limited choices.

Therefore, keeping an eye on one’s standing is not just a good idea but a necessity for mastering personal finance. Awareness of these levels enables proactive measures, turning ambitions of better borrowing conditions into achievable goals.

Factors Influencing Credit Score Ranges

Numerous elements come into play when determining where individuals fall within an evaluation scale used by lenders and financial institutions. Understanding these components can help people navigate their financial journeys more effectively and make informed decisions regarding their borrowing capabilities.

One major aspect relates to payment history. Consistently meeting payment deadlines can significantly boost rankings, while late or missed payments can lead to a downward spiral. Similarly, amounts owed on existing debts play a crucial role; high balances compared to available limits can signal risk to lenders.

Length of credit history also contributes. A longer, well-maintained record typically suggests stability and reliability, making one more appealing to potential lenders. Furthermore, types of credit utilized, such as revolving accounts versus installment loans, can either enhance or detract from the overall assessment.

Finally, new inquiries into borrowing capability can impact evaluations as well. Each request for credit can generate a temporary decline, signaling risk if someone appears to be seeking too much financing at once. A balanced approach to managing debt and credit utilization strengthens one’s financial profile, leading to more favorable considerations in the lending process.

Impact of Credit Scores on Finances

Many people underestimate how much these numerical values influence personal finances. Maintaining a healthy figure can open doors to better loan options, lower interest rates, and even favorable renting terms. On the other hand, a less-than-stellar number can lead to missed opportunities and additional expenses.

Access to Loans: Lenders heavily consider these assessments when deciding whether to approve applications. A higher figure signals to banks that a borrower is trustworthy, increasing the likelihood of obtaining favorable terms. Conversely, those with lower assessments might not only face rejection but can also be offered loans with exorbitant interest rates.

Interest Rates: Individuals boasting impressive ratings often enjoy significantly reduced interest rates. Over time, this not only results in lower monthly payments but also accumulates substantial savings. In stark contrast, those with poorer ratings might find themselves locked into higher rates, translating to larger financial burdens.

Rental Applications: Landlords frequently check these assessments when potential tenants apply. A solid rating can enhance chances of securing a desired property, while a flawed one can lead to outright denial or the need to pay larger security deposits.

Insurance Premiums: Surprisingly, insurance companies may also evaluate these figures when determining premiums. Individuals with better ratings could enjoy lower costs for policies, reflecting their perceived reliability.

Clearly, these numbers hold significant weight in determining financial pathways. Understanding their impact is essential for making informed choices and fostering a secure financial future.