Understanding the Criteria Required to Qualify for Financial Aid Opportunities

Many individuals find themselves navigating through various opportunities aimed at providing support during times of need. These programs often come with specific standards that determine who can benefit from them. Knowing these standards is essential for anyone aiming to secure such resources.

In essence, it’s all about assessing a person’s situation to see if they meet certain benchmarks. Factors like income levels, family dynamics, and even educational pursuits can play a crucial role in this process. Getting familiar with these elements can empower potential recipients as they explore their options.

Ultimately, understanding these parameters can guide you in making informed decisions. Whether you’re a student, a parent, or just someone seeking assistance, grasping these nuances can pave the way toward better opportunities. Being proactive in learning about these criteria ensures that you are not only prepared but also hopeful about what lies ahead.

Eligibility Criteria for Financial Assistance

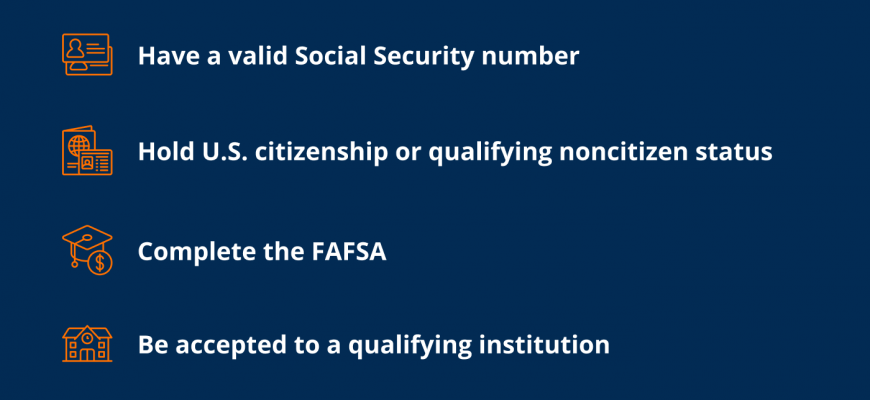

When considering support options, it’s essential to understand who can benefit from various programs. Eligibility often varies among different schemes, but certain common aspects typically play a vital role in determining who qualifies. This section explores those key requirements that help identify individuals most in need of support.

Firstly, income level is a significant factor. Many programs assess annual earnings to ensure assistance reaches those with limited resources. Additionally, family size can influence qualification, as larger households may have different needs compared to smaller ones.

Furthermore, residency status often comes into play. Some initiatives specifically cater to residents of certain regions or countries, while others might have broader eligibility. It’s always wise to confirm your local regulations and specifics before proceeding.

Finally, academic performance or enrollment status might be considered, especially in education-related assistance programs. Maintaining a particular grade point average or being a full-time student can sometimes be prerequisites. Understanding these aspects can help navigate available options and find the right support.

Understanding Different Types of Aid

When it comes to funding education, numerous options exist that cater to various needs and situations. Individuals can tap into a blend of resources designed to alleviate financial burdens, each with its own unique characteristics. Recognizing these distinctions can empower students to make informed decisions about their funding pathways.

Grants are typically awarded based on need and don’t require repayment. These funds can be essential for those who demonstrate financial hardship. On the other hand, scholarships may be based on academic achievement, talent, or specific interests. Unlike grants, scholarships are also non-repayable, making them highly sought after.

Furthermore, work-study programs provide an opportunity for students to earn income while gaining work experience. This arrangement not only helps cover costs but also enriches resumes. Meanwhile, loans can be necessary for many; however, these funds must be repaid, often with interest, adding a layer of responsibility.

In addition to these traditional sources, many institutions and private organizations offer unique programs that cater to specific demographics or fields of study. Exploring all available options ensures that individuals can find the most suitable solution for their educational journey.

Application Process and Requirements

Getting support to fund your education can feel overwhelming at times, but understanding how to navigate the steps can make it a lot easier. The process typically involves several key actions that help determine your eligibility and provide institutions with necessary information. Being prepared can help simplify everything from filling out forms to gathering documents that demonstrate your needs.

First off, it’s essential to complete the required applications correctly and thoroughly. Most places will ask you to provide some basic personal information, your financial situation, and possibly details about your academic history. It’s also a good idea to have your tax returns and any other financial documents on hand to support your application.

Next, many institutions might require additional information or forms. This could include letters of recommendation or specific essays that demonstrate why you are seeking assistance. Pay close attention to deadlines, as timely submission is often crucial in securing any form of support. Be sure to check all specific requirements detailed by each institution, as they can vary widely.

Finally, once you’ve submitted everything, keep track of your application status. Some organizations will want to follow up with you for additional documentation or information, so staying organized will help you respond promptly. This proactive approach can go a long way in ensuring you receive the resources you need for your studies.