Exploring the Details of the Newly Introduced Child Tax Credit

In recent times, families have been offered an exciting opportunity to ease their financial burdens. Several initiatives have been implemented to support households, particularly those with young ones at home. These measures aim to provide relief during challenging economic periods, ensuring that parents can better manage their expenses while raising their little ones.

One of the standout features of this initiative involves a significant allowance designed to assist caregivers. This assistance can make a meaningful difference, giving families extra resources to invest in their loved ones. With the ever-rising costs of education, healthcare, and everyday necessities, having access to this form of support can feel like a breath of fresh air for many.

As we delve deeper into this topic, it’s essential to understand the specifics of this allowance, including eligibility criteria and potential benefits. It’s all about making life a bit easier and providing families with the tools they need to thrive. So let’s explore how this initiative can help nurture future generations!

Understanding the New Child Tax Credit

In recent times, a significant initiative has emerged aimed at providing financial assistance to families, particularly those raising young ones. This program aims to ease some monetary burdens, making it a bit simpler to manage everyday expenses associated with nurturing kids. It’s designed with families in mind, aiming to create a supportive environment for their growth and development.

Families can benefit greatly, as this initiative seeks to provide extra support based on specific criteria. By understanding this offering, parents can take full advantage of available opportunities to enhance their financial well-being. This can lead to improvements in overall quality of life, helping to cover costs such as education, health care, and daily necessities.

Moreover, eligibility requirements play an essential role in determining who can take part in this initiative. It’s crucial for caregivers to stay informed about qualifications, as this can significantly impact their potential benefits. Ensuring awareness of deadlines and applications processes is equally important in making the most of these offerings.

In conclusion, this initiative presents noteworthy advantages for families, serving as a constructive resource to assist in raising children. By familiarizing themselves with the ins and outs, parents can navigate this landscape more effectively, ultimately leading to a smoother journey in their caregiving roles.

Eligibility Requirements for Families

Understanding who qualifies for this financial benefit can be quite enlightening. It’s essential to know what conditions families must meet to take advantage of this opportunity. A few key factors play a significant role in determining eligibility, and recognizing these can greatly influence how families plan their finances.

First off, income levels are crucial. Families need to fall within certain income brackets to qualify. Additionally, the number of dependents usually impacts the amount that can be received. The specific criteria vary, so it’s a good idea to review the guidelines closely.

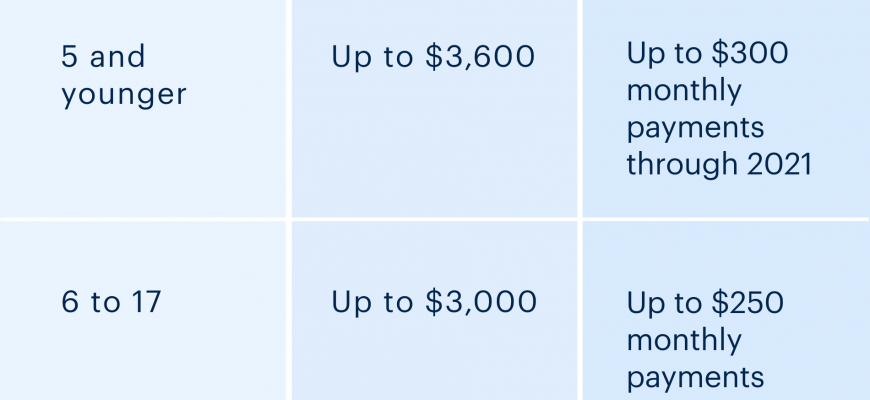

Another important aspect involves citizenship status. Families must have valid residency within the country to access this assistance. Furthermore, age of dependents is also a factor that can’t be overlooked, as it determines the amount of support available.

Lastly, it’s worth mentioning that filing status can make a difference. Various categories exist, and these contribute to how assistance is calculated. Keeping these elements in mind helps families navigate the eligibility landscape more effectively.

Impact on Household Finances and Budgeting

Navigating family expenses can be a challenge, especially when it comes to allocating resources effectively. Recent adjustments in financial incentives provide a helpful boost, making it easier for parents to manage their budgets. Understanding how these benefits influence overall financial health can lead to smarter decisions and a brighter outlook for families.

With additional support, families may find it simpler to cover essential costs such as education, healthcare, and daily needs. This extra influx can alleviate stress, allowing parents to focus on other priorities. It also opens the door to potential savings or investments, which can enhance long-term financial stability and growth.

As households reevaluate their budgets, the newfound flexibility can lead to better planning. Families can now prioritize areas that matter most, whether it’s setting aside funds for future goals or ensuring that day-to-day expenses are managed more comfortably. This strategic approach helps create a more secure financial environment, laying the groundwork for a healthier economic future.