Exploring the Highest Possible Credit Score and Its Implications for Financial Health

Navigating the world of personal finances can often feel overwhelming, especially when it comes to assessing your standing in the eyes of lenders and institutions. A significant aspect of this assessment revolves around numerical values that represent your overall monetary reliability. Achieving a peak level in this system can open doors to better loans, lower interest rates, and more favorable terms in various transactions.

Many individuals wonder exactly how high these numerical values can rise and what it takes to reach that ideal threshold. This inquiry is not merely academic; understanding these benchmarks is crucial for anyone who is serious about managing their financial future. There’s a sense of achievement that comes with knowing you have excelled in maintaining a healthy financial profile.

As we delve into this topic, we’ll explore various factors that contribute to reaching that desirable point. From payment history to credit utilization, numerous elements come into play that can either propel you toward or away from that coveted achievement. Join us as we unpack what it means to reach this pinnacle and how you can work towards it!

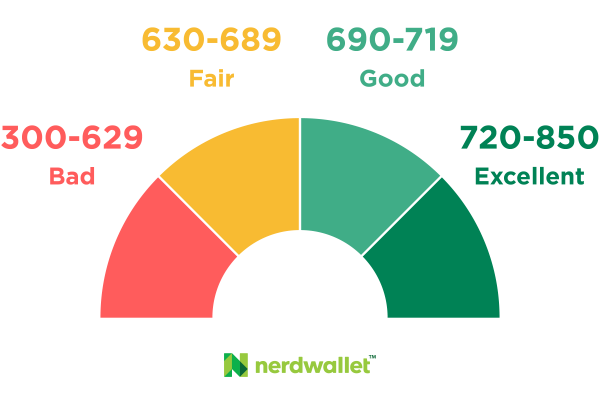

Understanding Credit Score Ranges

Navigating the landscape of financial ratings can be a bit daunting, but grasping the concept of different ranges is vital. These ratings reflect reliability in meeting financial obligations, and they play a crucial role in determining loan approvals and interest rates.

Your numerical representation of financial trustworthiness is shaped by a variety of elements. Understanding these components can significantly impact your financial health and open doors to better lending opportunities.

Firstly, payment history plays a crucial role. Lenders want reassurance that you’ll meet your obligations on time. Late payments or defaults can severely dent your standing. Additionally, the amount of credit utilized against the total limits also matters. Keeping balances low relative to available credit showcases responsible borrowing habits.

Another important aspect is the length of your credit history. Longevity suggests stability and experience in managing finances effectively. A mixture of different types of credit accounts, like revolving accounts and installment loans, can further enhance your profile. It demonstrates versatility in handling various financial products.

Finally, inquiries into your financial background can have a temporary effect. Frequent requests for new credit may raise red flags, suggesting riskier behavior. Keeping these factors in mind enables you to make informed decisions about your financial journey.

Max Credit Score: What You Need to Know

Understanding top ratings can be quite fascinating. Achieving a superior classification plays an essential role in personal finance and offers numerous benefits. Many people wonder what constitutes an ideal benchmark and how it can influence various aspects of their financial lives.

Generally, these ratings range within a defined scale, typically reaching up to 850 in popular evaluation systems. The closer you are to this pinnacle, the more favorable your financial opportunities can become. Lenders usually regard an elevated rating as a sign of reliability, potentially leading to lower interest rates and enhanced approval chances.

Factors determining this exceptional evaluation often include payment history, debt levels, length of credit history, and types of accounts held. To maintain or improve your standing, it’s crucial to manage debts responsibly, make timely payments, and monitor your financial profile regularly.

Achieving a stellar rating isn’t an impossible quest; it takes dedication and informed choices. By prioritizing good financial habits, you can pave the way towards reaching that coveted high mark and reaping the rewards that come with it.