Exploring the Financial Thresholds for FAFSA Eligibility

When it comes to accessing educational resources, numerous factors play a role in determining how funding is allocated. Many students and families find themselves navigating a complex landscape of requirements and limitations that can significantly impact their ability to receive assistance. Exploring these elements can help clarify what is needed to maximize potential support.

This discussion aims to shed light on essential benchmarks that can influence eligibility for aid programs, making it easier to understand where you might stand in the application process. Different programs have varying measures of need, and knowing where you fit can guide your financial planning and decisions.

As you delve deeper into this topic, you will discover insights that can empower you to assess your situation more effectively. Whether you’re a student applying for the first time or a parent supporting your child through the process, familiarizing yourself with these guidelines can pave the way for smoother sailing ahead.

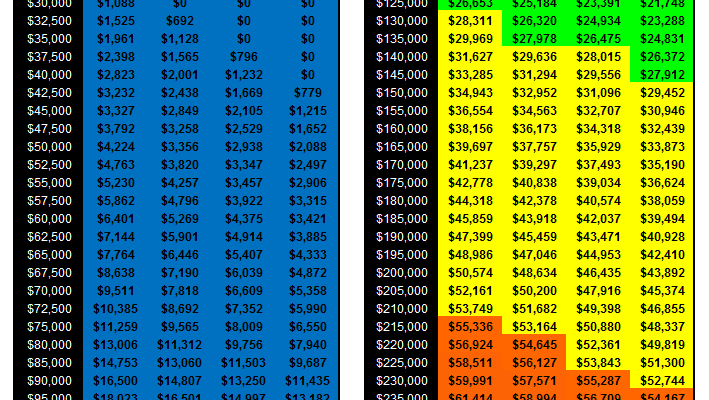

Understanding FAFSA Income Limits

Navigating the world of financial aid can be overwhelming, especially when it comes to income thresholds that determine eligibility. It’s important to grasp how various income levels play a role in shaping your prospects for receiving support. Knowing the ins and outs of these limits can make all the difference in securing the necessary funds for your educational journey.

Each academic year, authorities set specific income parameters that guide the assessment process for assistance programs. These figures vary, considering aspects like household size and dependency status. Getting a grasp on these benchmarks not only helps you understand your position but also informs your strategies for maximizing aid opportunities.

Your financial situation isn’t just about your earnings. Parsing through detailed criteria enables students and families to strategize and potentially leverage unusual circumstances. In some cases, special considerations might apply, potentially altering eligibility based on unique situations.

Ultimately, being aware of these income criteria streamlines the planning process for your educational investments. By preparing in advance and considering your financial landscape, you open doors to funding possibilities that might otherwise remain closed. Make informed decisions, and embark on your academic adventure with confidence.

Impact of Income Threshold on Aid

Understanding how income limits influence financial assistance can significantly shape a student’s educational journey. When eligibility guidelines are set, they determine who qualifies for various forms of support, affecting not only tuition costs but also overall college experience. Many students and families may find themselves wrestling with the implications of these restrictions, which can sometimes feel like an invisible barrier to higher education.

Lower income brackets often open doors to grants, scholarships, and subsidized loans, making education more accessible. Conversely, those above certain income levels might miss out on these opportunities, leading to increased reliance on private loans and potential financial strain. This disparity can create a sense of inequality, as some students may receive robust assistance while others are left to navigate the costs independently.

Moreover, these income thresholds can evolve yearly based on various economic factors, leaving families in a state of uncertainty as they plan for college expenses. Staying informed about changes helps in making strategic decisions regarding educational financing. By recognizing how these limits impact eligibility, students can better prepare and seek alternative funding sources if necessary. Awareness leads to empowerment, enabling families to explore all available avenues to support education funding.

Navigating FAFSA Eligibility Criteria

Understanding eligibility requirements can feel overwhelming, but breaking it down into simpler parts makes it easier. Each individual’s situation is unique, and recognizing the different aspects that influence approval is crucial. Whether you’re a student or helping someone else, being informed can lead to better financial planning.

Income plays a significant role in determining who qualifies. Generally, there are brackets that assess overall financial health, which helps institutions gauge the level of aid a student may need. However, it’s not just about money; other factors come into play as well.

Citizenship status and residency can also impact eligibility. Most applicants need to be U.S. citizens or eligible non-citizens to be considered. Additionally, the age and enrollment status, such as whether a student is attending full-time or part-time, influence potential support levels.

Another critical point involves prior educational history. Those who have not been convicted of certain offenses or who have satisfactory academic progress generally find it easier to meet requirements. It’s all about presenting a comprehensive picture of your educational and financial journey.

Lastly, don’t forget about dependent status! If someone is considered a dependent, their parents’ financial resources will also factor into the equation. Understanding these components ensures that you approach the application process with clarity and confidence.