Understanding the Components and Benefits of a Financial Aid Package

When it comes to pursuing higher learning, many aspiring students find themselves faced with various options to help ease the burden of expenses. Alternative resources exist to provide assistance, making education more accessible for a diverse range of individuals. These offerings can significantly influence one’s ability to achieve academic goals without overwhelming debt.

Learning about various forms of support can feel like navigating a maze. From grants and scholarships to loans and work-study opportunities, understanding differences and benefits is crucial. Each type of resource has its own unique features, often tailored to meet specific needs and circumstances, which can align perfectly with individual situations.

Diving into this subject reveals a plethora of options that might seem complicated at first glance. However, once students comprehend their choices, they can make informed decisions that lead to successful educational experiences. Embracing these opportunities can pave the way for personal growth and future success in one’s chosen career path.

Understanding Financial Aid Packages

Navigating through options for covering educational expenses can feel overwhelming. A support structure exists to help students manage costs associated with tuition, books, and living expenses. Getting familiar with different components and how they fit together is essential for making informed decisions about your educational journey.

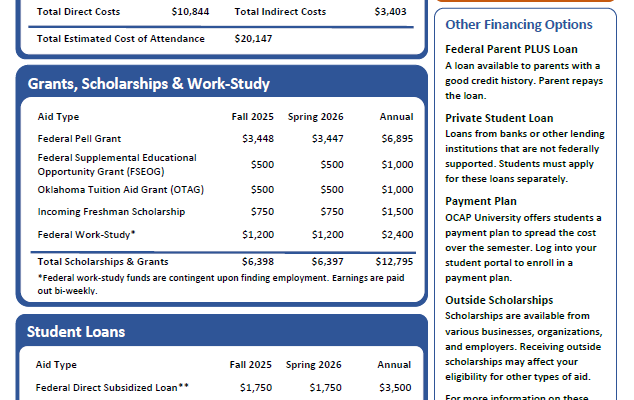

These funding arrangements often come in various forms, including grants, scholarships, work-study, and loans. Each one has unique characteristics that can significantly influence a student’s financial situation. Grants and scholarships typically don’t require repayment, while loans do come with obligations and interest rates. Understanding these distinctions is crucial for effective budgeting and planning.

When examining these offers, it’s important to consider total expenses against available resources. A comprehensive assessment can reveal gaps in coverage and help identify whether additional funding is necessary. Keeping track of deadlines and requirements is equally vital for maximizing these opportunities, as missing a step can lead to lost funding.

In summary, being well-informed about the various components involved in funding education can empower students to make smart choices. Ultimately, this knowledge not only alleviates financial burdens but also enhances the overall academic experience.

Components of Financial Assistance Offers

Assistance opportunities come in various forms, each playing a crucial role in helping students achieve their academic aspirations. Understanding these different elements can empower individuals to make informed decisions about their education funding.

One significant part often included is grants, which provide money that doesn’t need to be repaid. This form of support is typically awarded based on financial need, making it a critical resource for many. On the flip side, scholarships can also play a vital role; they are merit-based and recognize talent or achievement in various fields, from academics to sports.

Another aspect to consider is loans. Unlike grants and scholarships, funds received through loans must be repaid after graduation, usually with interest. While this might seem daunting, many students find them to be a practical solution to cover expenses. Additionally, work-study opportunities allow students to earn funds through part-time employment, helping them offset their costs while gaining valuable experience.

Finally, each offer may include specific terms and conditions that will guide how these resources can be utilized. Understanding these stipulations is essential, as they can significantly impact a student’s overall financial planning.

In summary, exploring different types of support can make a huge difference in managing educational expenses. By familiarizing oneself with available options, students can unlock opportunities and take control of their financial futures.

How to Apply for Financial Support

Navigating the journey for assistance can feel overwhelming, but it doesn’t have to be. Gaining access to resources that can ease your financial burden involves a few straightforward steps. Let’s break it down into manageable parts so you can feel confident in seeking support.

First off, gather all necessary documents. Here’s a quick checklist to help you prepare:

- Identification proof, like a driver’s license or passport

- Income statements for you and your family

- Tax returns from previous years

- Bank statements

- Any other relevant financial records

Once you have everything together, it’s time to start the application process. Follow these steps to ensure you don’t miss anything crucial:

- Research available options that suit your needs.

- Complete the necessary forms accurately. Double-check for errors.

- Submit your application before the deadline. Early submissions are often beneficial.

- Follow up with the respective organizations to confirm receipt of your application.

After submitting, patience is key. It may take some time for decisions to be made. Remember to remain proactive; if you haven’t received communication by the expected timeline, reaching out can help clarify your status.

With these steps, you’ll be well on your way to accessing the resources needed to support your ambitions and ease any financial strain you may be facing.