Understanding Your Credit Score in Canada and Its Importance

In today’s world, knowing where you stand financially is crucial. Many individuals often find themselves pondering the nuances of their financial standing, as it plays a significant role in shaping future opportunities. Whether you’re considering a loan, a mortgage, or simply trying to manage your budget, being aware of your financial ratings can help you make informed decisions.

The process of evaluating one’s financial profile can feel overwhelming at times. Various factors contribute to this assessment, from your payment history to the total amount owed. Understanding these elements is essential, as they emphasize the importance of maintaining a healthy financial life and working toward your goals.

It’s not just about obtaining a figure; it’s also about grasping how different aspects of your finances intertwine. This insight empowers you to take proactive steps to enhance your financial well-being and opens doors to better deals and lower interest rates on future endeavors. So, let’s dive deeper into this topic and explore the essentials that affect your financial standing!

Understanding Credit Scores in Canada

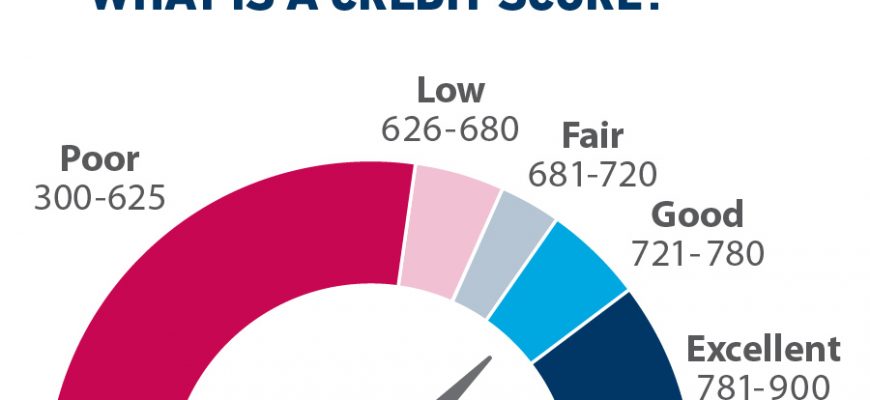

When it comes to your financial health, there’s an important number that plays a significant role in various aspects of your life. It can influence your ability to secure loans, rent an apartment, or even land a job. This figure reflects your borrowing habits and trustworthiness in the eyes of lenders and institutions.

Numerous factors contribute to this numerical representation of your financial behavior. Payment history, outstanding liabilities, length of credit history, types of accounts, and recent inquiries all weave together to create a detailed picture of your financial habits. Knowing how these components interact can empower you to manage your finances more effectively.

Those who are aware of their standing often take steps to improve their situations. Monitoring your financial health periodically is a wise practice, as a positive assessment can open doors to better interest rates and favorable terms when seeking financial products. If you’re not sure where to start, consider exploring various tools available to assess your financial profile.

In conclusion, understanding this essential number provides numerous benefits, from optimizing your loan applications to improving your spending habits. By staying informed and proactive, you can build a robust financial future with greater confidence.

Factors Influencing Your Rating

Your personal financial standing is shaped by a variety of elements that work together to create a comprehensive picture. Understanding these components can provide valuable insights into how lenders perceive you, ultimately affecting your ability to secure loans and favorable interest rates. It’s essential to recognize that each factor contributes uniquely to your overall profile.

Firstly, payment history plays a crucial role. Consistently making payments on time demonstrates reliability and responsibility, earning you more favorable assessments. On the flip side, any missed or late payments can significantly diminish your standing. Similarly, the amount of debt owed is another key aspect. Lenders analyze your outstanding balances compared to your available credit, giving them an idea of how much you rely on borrowed funds.

Another important factor is the length of your credit history. A longer track record can reflect stability, while a shorter history might raise concerns. Additionally, the types of accounts you hold matter; having a mix of loans and revolving accounts can showcase your capability to manage different financial products effectively.

Finally, new inquiries into your financial background can affect your standing as well. Frequent applications for new accounts may signal to lenders that you are in a precarious financial situation, prompting them to view you as a higher risk. By staying informed about these aspects, you can take proactive steps to improve your overall financial profile.

How to Check Your Score

Understanding where you stand financially is crucial for making informed decisions. Keeping an eye on your standing can help you identify areas for improvement and can guide you in managing your financial health more effectively.

To begin with, you can access your standing through various online platforms that provide free services. These websites typically require you to create an account, where you’ll need to input your personal information for verification. Once authenticated, you can view your detailed report and see your current standing.

Additionally, many financial institutions offer this information to their clients. It’s worth checking with your bank or credit union to see if they provide this as part of their services. They might even offer personalized advice on how to enhance your financial profile.

For anyone looking for a thorough insight, consider purchasing a report from a reputable agency. This often comes with more comprehensive details, including the factors affecting your financial position. Remember, the more informed you are, the better decisions you can make regarding loans, mortgages, and other financial endeavors.

Keep track of your standing regularly to ensure that you’re on the right path. Mistakes can happen, so it’s wise to review your reports for any inaccuracies. If you spot anything unusual, take action promptly to rectify those issues.

Monitoring your financial situation is a proactive step towards achieving your economic goals. Regular check-ups can empower you to take control of your financial journey.