Understanding Your American Express Credit Limit and How to Find It

Have you ever wondered about the boundaries of your purchasing power with certain financial institutions? Knowing how much you can spend without having to worry about exceeding your available resources is crucial in managing not just everyday expenses, but also larger investments. This information can help you plan your finances effectively and avoid unnecessary fees or penalties.

For individuals using specific service providers, it’s important to be aware of how these organizations assess your eligibility for transactions. Various factors contribute to determining your available resources, which can fluctuate over time based on your spending behavior and payment history. Understanding this aspect can assist you in making informed financial decisions.

Learning to navigate your financial allowance can greatly enhance your budgeting skills. By staying informed about your standing with financial entities, you can optimize your spending habits and leverage potential rewards. After all, it’s not just about how much you can spend, but also about managing your finances wisely.

Understanding Your American Express Credit Limit

Getting a grasp on what you can spend with your American Express card is crucial for managing your finances effectively. It’s important to know the boundaries set for your spending habits to avoid potential pitfalls. By understanding the factors that influence this amount, you can make informed decisions that support your financial health.

Your available spending range is shaped by several elements, including your account history, payment behavior, and overall financial profile. American Express considers these aspects to determine how much you can comfortably use. Knowing these factors can help you plan your expenses and avoid overspending.

Additionally, it’s a good idea to regularly check for updates regarding your available funds. Changes in your personal financial situation or adjustments in the policies of your provider can lead to shifts in your accessible balance. Staying informed about these alterations ensures that you are always aware of your options.

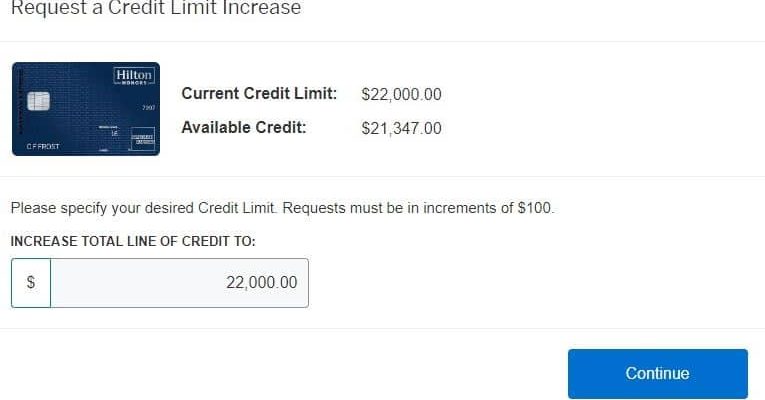

In case you feel the need for an increase, you can reach out to customer service. They often review your request thoroughly, taking into account your history and relationship with the company. Just remember to be prepared with details about your financial habits, as this information can strengthen your case.

In conclusion, understanding the guidelines that govern your spending can enhance your financial savvy. Keeping track of your account and being proactive about your needs will ultimately lead to smarter choices and a more rewarding experience with your card.

How to Check Your Available Balance

Understanding how much you can spend without exceeding your allowance is essential for effective financial management. Whether you’re planning a big purchase or just want to keep track of your finances, knowing your available amount is key to making informed decisions.

The simplest way to find out this information is to log into your online account. Most institutions provide a clear overview of your spending capacity right on the main dashboard. It’s quick and convenient, allowing you to check anytime, anywhere.

If you prefer a more traditional approach, you can also call customer service. Just dial the number on the back of your card and a representative will assist you in finding the information you need. It’s a reliable option if you have questions or need further assistance.

Finally, mobile apps can be a great tool for keeping tabs on your financial resources. Many financial institutions offer apps that give you instant access to your balance and transaction history. This can help you stay on top of your spending and avoid any surprises when it comes to your purchasing power.

Factors Influencing Your Credit Limit

When it comes to determining how much borrowing power you have, several elements come into play. Understanding these factors can give you insights into how lenders view your financial behavior and profile.

Payment History: One of the most crucial aspects is your past payment behavior. Consistently making payments on time signals responsibility, while missed or late payments can raise red flags.

Income Level: Lenders often consider your earnings to gauge how much you can afford to borrow. A higher income typically suggests greater repayment capacity, leading to a more favorable assessment.

Credit Utilization: This refers to the ratio of your current balances to your total available borrowing resources. Keeping this percentage low is wise, as it shows you aren’t overextending yourself financially.

Length of Credit History: A longer financial track record can positively influence your standing. Lenders like to see how you’ve managed your accounts over time, so having diverse and well-managed accounts can boost your profile.

New Inquiries: Frequent applications for new accounts can indicate financial stress, which may concern lenders. It’s best to limit these inquiries to maintain a healthy perception of your financial management.

Type of Accounts: The mix of accounts you hold, such as revolving and installment loans, can also affect your standing. A balanced blend suggests a well-rounded approach to handling debt.

By keeping these factors in mind, you can better understand what influences your ability to access funds when needed.