Understanding the Components and Importance of Your Credit File

When it comes to managing your finances, one crucial aspect often overlooked is the documentation that reflects your borrowing habits and payment history. This record serves as a comprehensive summary of various financial activities, and it plays a vital role in your overall financial health. The information contained within is essential for anyone looking to make informed decisions about their economic future.

Many individuals might not realize the impact of this documentation on their ability to secure loans or credit solutions. Just as a report card reflects a student’s performance, this record highlights your financial behavior over time. It influences the terms of loans, interest rates, and even your eligibility for certain financial products.

In essence, understanding your personal financial history is the key to navigating the world of borrowing and lending successfully. With this knowledge, you can take proactive steps to improve your standing, ensuring that you present yourself in the best light to potential lenders.

Understanding Your Credit Report

Diving into your financial history can feel like unrolling a scroll of your past. This document is a key to understanding how you’ve managed your financial responsibilities over time. It reflects your habits, choices, and the reliability you bring to lenders when seeking funds.

Your financial overview typically includes various elements. It showcases your account status, payment patterns, and any outstanding obligations. Additionally, it sheds light on inquiries made by potential lenders, giving a complete picture of your financial dealings. Understanding these facets empowers you to take control of your monetary health.

Remember, this document is not just about numbers; it’s about storytelling. Each entry reveals a chapter of your financial journey. Monitoring your history can help you make informed decisions, especially when planning for future investments or loans. The insights gleaned from this documentation can be invaluable in navigating your fiscal life.

By familiarizing yourself with the contents and implications of your financial record, you can better understand how your behaviors impact your opportunities and choices. This knowledge equips you to improve your standing, allowing for enhanced peace of mind when dealing with future commitments.

Components of a Credit File

When it comes to your financial history, there are several key elements that come together to create a complete picture of your standing. Understanding these components can help you navigate your financial journey more effectively. Each aspect plays a vital role in how lenders see you and your ability to manage funds.

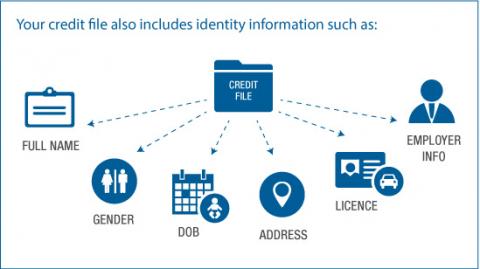

First up is the personal information section. This includes your name, address, date of birth, and Social Security number. This data is essential for identifying you and ensuring that your information is accurate and up-to-date.

Next, we have the account details, which outline your various loans, credit lines, and payment histories. This section reveals how responsible you are in managing your obligations. Timely payments reflect positively, while late payments can raise red flags.

Then there are inquiries, which show who has checked your report and when. There are soft inquiries, like checking your own standing, and hard inquiries, which happen when a lender assesses your profile for potential credit. Too many hard inquiries can suggest financial distress and can impact your overall evaluation.

Lastly, there may be public records, which include bankruptcies, foreclosures, and other legal events. These entries can significantly influence how lenders perceive your reliability and may linger for several years. Keeping an eye on all these components can help you maintain a strong financial reputation.

How Scores Are Calculated

Understanding the way your financial standing is assessed can feel like navigating a maze. Various factors come into play, shaping that all-important number that influences loans, leasing, and even job opportunities. Let’s break it down into simpler terms and explore how all those elements combine to reflect your financial behavior.

First and foremost, your payment history holds significant weight. This means paying your bills on time is crucial. Lenders want to see a track record that proves you can manage your obligations responsibly. Late or missed payments can negatively impact this aspect, so consistency is key.

Next up is the amount you owe versus your available credit. It’s not just about how much you’ve borrowed but also how much credit you have accessible. Keeping your balances in check and avoiding maxing out your lines of credit showcases good financial management.

Another important aspect is the length of your credit experience. The longer you’ve been managing your financial accounts, the better it reflects on you. It demonstrates stability and gives lenders a wider view of your habits over time.

Additionally, the mix of accounts you hold plays a part. Having different types of credit, such as revolving accounts like cards and installment loans like mortgages, can enhance your profile. It shows that you can handle diverse financial responsibilities.

Lastly, new inquiries on your report can affect your score as well. Every time you apply for new credit, a hard inquiry is made. While a few inquiries within a short period aren’t usually detrimental, many can signal risk to lenders.

By keeping these facets in mind and managing them thoughtfully, you can work towards maintaining a favorable rating, opening doors to better financial opportunities in the future.