Understanding Your Business Credit Score and Its Importance for Your Company

Navigating the financial landscape can sometimes feel like walking a tightrope. Whether you’re planning to expand your operations or simply looking to secure favorable terms with suppliers, having a solid grasp of your financial standing can make all the difference. This aspect of your financial health influences how others perceive your reliability and trustworthiness. Knowing where you stand in this regard is crucial for making informed decisions.

Many factors contribute to this evaluation, which examines your past performance in managing financial obligations. Lenders and partners often rely on this assessment to gauge the risks associated with doing business with you. It’s an essential metric that can open doors to new opportunities or, conversely, create obstacles if it falls short.

So, how can you keep a finger on the pulse of your financial reputation? Understanding the elements that shape this appraisal allows you to take proactive steps toward improvement. With the right knowledge and approach, you can enhance your standing and unlock a world of potential for growth and success.

Understanding Business Credit Scores

Many entrepreneurs might wonder about their financial reputation in the eyes of lenders and suppliers. This measure can play a crucial role in securing funding, getting favorable payment terms, or even attracting clients. A solid grasp of this rating can make a significant difference in how one is perceived in the marketplace.

This particular evaluation is generated based on various data points that reflect the financial health of a company. Factors such as payment history, outstanding debts, and even public records can influence this measurement. It functions much like a personal rating, but with distinct characteristics specific to the commercial world.

Understanding how your standing is calculated can help in making informed decisions. Monitoring trends over time can give valuable insights into where improvements can be made. Being proactive about maintaining a strong rating is essential for any aspiring enterprise looking to grow and thrive.

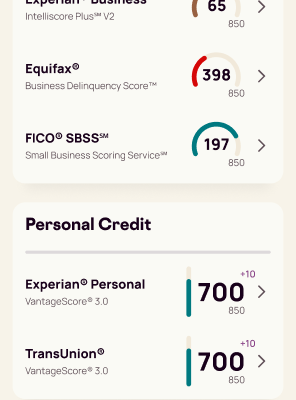

Different agencies may use varying methods to determine this measure, which is why checking multiple sources can provide a comprehensive view. Knowing where you stand allows for strategic planning and better financial management. Ultimately, having a robust financial track record can open numerous doors and foster trust in future relationships.

How to Check Your Score

Knowing where you stand in terms of financial reputation is crucial for any entrepreneurial venture. It gives insight into how others perceive your reliability, which can significantly impact your opportunities for funding and partnerships. Thankfully, reviewing this information is a straightforward process that can be done in just a few steps.

First, identify the major reporting agencies that provide assessments related to entrepreneurial financial health. Some well-known names in the field include Dun & Bradstreet, Experian, and Equifax. Each has its own set of criteria and methods for evaluating entities, so it’s beneficial to check multiple sources to get a well-rounded understanding.

Next, access their websites and locate the section dedicated to assessments. Typically, you’ll need to create an account or log in. Be prepared to input some basic details about your organization, such as the legal name, address, and perhaps your Employer Identification Number (EIN).

Once logged in, you can request a report. Some agencies may provide a free summary, while others might charge a fee for more detailed insights. Review your report carefully; look for any discrepancies or issues that may need addressing.

Lastly, stay proactive by checking this information regularly. Continuous monitoring helps you maintain a solid image and quickly rectify any inaccuracies that could hinder your prospects. Remember, understanding and managing your reputation is key to unlocking new opportunities.

Factors Influencing Your Rating

When it comes to evaluating your financial health, several elements come into play that can significantly impact the overall assessment. Understanding how these variables interact can empower you to make better decisions and improve your situation. There are numerous aspects to consider, and each plays a unique role in shaping the final evaluation.

One crucial factor is your payment history. Consistent, on-time payments demonstrate reliability and can boost your standing tremendously. Conversely, missed or late payments not only tarnish your record but may also lead to decreased trust from lenders. Another important element is the amount of outstanding debt. High levels of debt relative to your limits can signal potential risk, while lower balances might indicate responsible management.

The length of your financial history is also a significant contributor. A longer track record can provide more data points, allowing for a more nuanced assessment. New accounts and inquiries can have a short-term impact, as lenders may see these as signs of potential financial strain or poor planning. Lastly, the mix of different types of accounts, such as loans, lines of credit, and other financial products, can also affect your overall profile, illustrating your ability to handle various forms of credit.