Understanding the Concept of Financial Assistance in Micro Small and Medium Enterprises

In today’s dynamic economy, many small-scale enterprises face numerous challenges that can hinder their growth and sustainability. These businesses often require a helping hand to overcome financial hurdles, improve operations, and thrive in competitive markets. Support mechanisms play a crucial role in nurturing these entities, enabling them to unlock their full potential.

Assistance tailored for budding ventures encompasses a variety of programs and resources designed to ease the financial burden. From loans and grants to specialized training and advisory services, the landscape of aid is diverse and adaptable to differing needs. Such support can empower small operators to innovate, expand, and create job opportunities, ultimately contributing to the broader economic landscape.

Understanding the various forms of aid available can be a game-changer for entrepreneurs. By tapping into these resources, they can not only survive but also flourish, positioning themselves for long-term success. In this article, we’ll delve into the essential elements of this support system and explore how it can make a significant difference in the journey of small businesses.

Types of Financial Support for MSMEs

Small and medium enterprises (SMEs) often require various types of funding to thrive and grow in a competitive environment. There are numerous avenues to pursue, each catering to different needs and circumstances. These resources can significantly impact the development and sustainability of businesses, enabling them to seize opportunities and overcome challenges.

One popular method is bank loans, offering an essential source of capital. Institutions typically assess the creditworthiness of the applicant, and depending on that evaluation, they provide significant amounts at competitive interest rates. Another option is government grants, which can be particularly beneficial as they don’t require repayment. These funds are often linked to specific projects or initiatives aimed at fostering innovation and economic growth.

Additionally, venture capital can be an enticing choice for startups, providing not just funds but also mentorship and expertise. Investors usually seek a stake in the company, supporting tangible growth while sharing risks. Similarly, angel investors often step in with their personal wealth to support ambitious projects, particularly during the early stages.

Online crowdfunding platforms have gained popularity, allowing entrepreneurs to gather small contributions from a large number of people. This approach not only raises funds but also engages potential customers and builds a community around the product. Finally, peer-to-peer lending networks have emerged, connecting borrowers directly with individual lenders, often resulting in lower interest rates and more flexible terms.

Exploring these options enables small and medium businesses to tailor their funding strategies, ensuring a better chance at success and sustainability in their respective industries.

Importance of Funding for Small Enterprises

When it comes to small businesses, having access to resources can make all the difference. Whether it’s starting fresh or expanding to new horizons, proper capital helps in overcoming various hurdles that entrepreneurs face. Let’s dive into why securing capital is crucial for the growth and sustainability of these enterprises.

- Boosting Operations: Adequate funding allows businesses to acquire essential tools, hire skilled personnel, and maintain inventory levels. This ensures that operations run smoothly and efficiently.

- Supporting Innovation: Financial backing enables small enterprises to invest in research and development. This can lead to innovative products or services that set them apart from competitors.

- Market Expansion: With sufficient capital, small firms can explore new markets. They can enhance marketing strategies or even open new locations to reach a broader audience.

- Improving Cash Flow: Having funds available helps businesses manage day-to-day expenses without the stress of cash flow issues. This stability allows for better planning and execution of business strategies.

- Building Credit History: Accessing funds and repaying them responsibly helps small businesses build a credit profile. This becomes advantageous for securing larger investments in the future.

In conclusion, the significance of securing financial resources for small enterprises cannot be overstated. It empowers them to innovate, grow, and thrive in a competitive market, laying the foundation for long-term success.

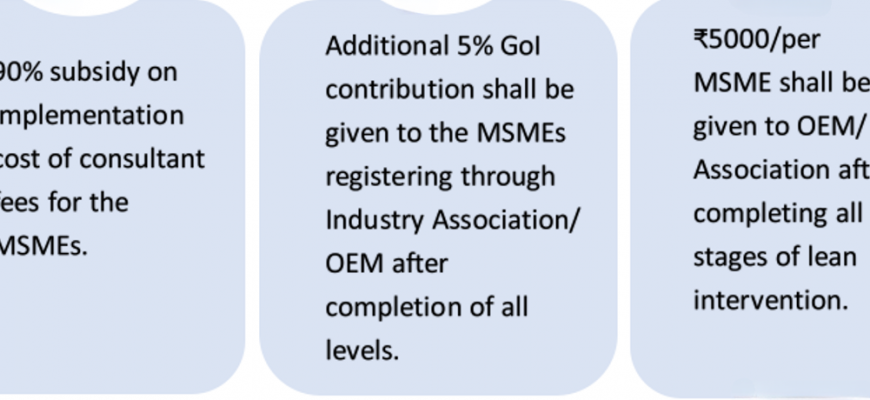

Government Schemes and Initiatives for Small and Medium Enterprises

In today’s fast-paced world, various organizations recognize the crucial role that small and medium-sized businesses play in driving economic growth and innovation. To support these enterprises, numerous programs and initiatives have been launched by the government, aimed at providing a boost to their operations and ensuring their sustainable development.

These programs often encompass a broad array of resources, ranging from financial aid to skill development, and they cater to the unique needs of entrepreneurs. The government has established favorable policies that not only enhance access to credit but also improve market visibility for small businesses. Additionally, mentorship and training initiatives are designed to empower business owners with the necessary skills for effective management and growth.

Particularly noteworthy are the schemes that facilitate easy registration, reduce compliance burdens, and promote technological adoption. By focusing on these key areas, government entities aim to create an environment where innovation flourishes and new job opportunities arise. This collaborative effort not only benefits individual enterprises but also strengthens the economy as a whole.