Exploring the Concept of Financial Assistance and Its Impact on Business Growth and Sustainability

In the realm of commerce, countless entrepreneurs encounter various challenges that can hinder their growth and sustainability. Navigating through these obstacles often requires more than just hard work and determination. Whether you’re a start-up with a grand vision or an established entity in need of a financial boost, recognizing the various forms of support available can be pivotal to your success.

Engaging with different types of resources can provide a safety net during difficult times. These resources can come in several forms, whether it’s through grants, loans, or collaborative initiatives designed to ease the pressure off struggling ventures. Understanding these options is crucial, as they can deliver the necessary leverage to propel a venture forward.

In this discussion, we will explore the myriad of avenues that offer relief and growth opportunities. From governmental programs to private initiatives, the landscape is rich with possibilities. It’s all about finding the right match for your unique situation and using it to your advantage.

Understanding Financial Aid for Businesses

When it comes to navigating the world of commerce, many entrepreneurs encounter times when they need an extra boost to keep their ventures thriving. This kind of support can come in various forms, helping companies manage cash flow, invest in growth, or overcome unexpected challenges. Grasping the available options is crucial for any venture looking to enhance its potential and ensure sustainability.

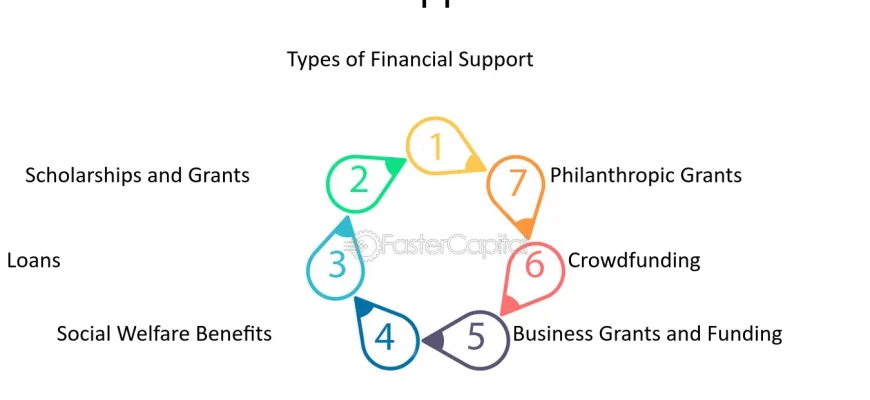

Different kinds of support include loans, grants, and even private investments. Each has its perks and considerations, depending on the specific needs of a company. For instance, loans often require repayment with interest, while grants may provide funds that do not need to be returned, offering a more forgiving route for many. Understanding these distinctions can empower company leaders to make informed decisions that align with their long-term goals.

Aside from traditional sources, many entrepreneurs explore modern solutions like crowdfunding and angel investing. These avenues not only offer opportunities for funding but also foster community engagement and support. By tapping into a wider network, new avenues of growth and collaboration may open up, making the journey not just financially viable but also enriching.

Ultimately, whether it’s seeking help from governmental programs, private entities, or innovative funding platforms, being proactive in exploring all options can lead to transformative outcomes. The right support can truly make a difference in shaping the success story of any enterprise.

Types of Support Available for Companies

When it comes to running a venture, there are various forms of encouragement and resources that can help organizations thrive. These resources can come from different sources and are designed to meet the diverse needs of companies at various stages of their journey. By understanding the different types of support available, entrepreneurs can make informed decisions that align with their goals.

Grants are a popular option, often provided by government entities or private foundations. They are typically non-repayable funds aimed at fostering growth in specific industries or regions. The application process can be competitive, but the benefits can be substantial for eligible organizations.

Loans represent another avenue for funding. These come from banks, credit unions, or alternative lenders. They require repayment, often with interest, but can provide the necessary capital to expand operations or finance new projects. It’s crucial for companies to assess their repayment capabilities before taking on this type of support.

Equity investment involves selling a portion of the business in exchange for funding. This can come from venture capitalists, angel investors, or crowdfunding platforms. While this can provide significant cash flow, it often results in sharing decision-making power with investors.

Sponsorships and partnerships can also be a game changer. Collaborating with other organizations can lead to shared resources, knowledge, and market access. These relationships can boost visibility and credibility while easing operational burdens.

Professional services often play a vital role too. Access to legal advice, marketing expertise, and financial consulting can enhance a company’s capabilities and help navigate complex challenges. Many organizations offer these services at reduced rates or even pro bono, especially for startups.

Training and mentorship programs provide invaluable knowledge and guidance. These initiatives often come from industry leaders and networks dedicated to fostering entrepreneurship. Learning from the experiences of others can help avoid common pitfalls and guide strategic decision-making.

In conclusion, the landscape of support options is broad and varied. By tapping into these resources, companies can enhance their chances of success and navigate the complexities of their respective industries more effectively.

Benefits of Support Programs

Access to various funding initiatives can be a game-changer for many entrepreneurs. These programs often provide the necessary resources to help companies grow, overcome obstacles, or launch innovative projects. The advantages of such support can be significant, enabling ventures to take calculated risks and thrive in competitive environments.

One major benefit is the reduction of financial strain. Entrepreneurs often face numerous costs, and these initiatives can alleviate some of that burden, freeing up capital for essential operations and strategic investments. With additional resources at their disposal, businesses can focus more on scaling and less on merely surviving.

Moreover, these programs frequently come with guidance and mentorship. It’s not just about the money; it’s about having access to experienced professionals who can offer valuable insights, share knowledge, and help navigate challenges. This mentorship can prove invaluable as it often leads to better decision-making and enhanced operational efficiency.

Additionally, being part of a support initiative can boost credibility and visibility. Associations with respected funding sources or government programs can elevate a company’s profile, attracting more customers, partners, and additional investors. This credibility often translates into increased trust from the market and potential collaborators.

Lastly, these programs can foster innovation. By providing the necessary resources and encouragement, they instigate creativity and allow businesses to experiment and develop groundbreaking products or services. Such innovation can set a brand apart, ensuring long-term success and market relevance.