Exploring the Concepts of Financial Assets and Liabilities in Modern Economics

In today’s economy, it’s crucial to grasp the different components that contribute to one’s financial standing. These components serve as the building blocks for personal or organizational financial health. They encompass a variety of elements that can either enhance or detract from overall stability and growth.

When we talk about wealth, we refer to resources that hold value and can generate future benefits. On the flip side, there are also commitments that can place a strain on one’s resources, often creating a balancing act for both individuals and businesses. Navigating through these dynamics lays the foundation for effective monetary management.

Recognizing the interplay between these two categories is essential for making informed decisions. By understanding how resources can be maximized while effectively managing commitments, you set the stage for long-term success and financial wellbeing. Whether you’re a seasoned investor or just starting on your financial journey, grasping these concepts is key to building a secure future.

Understanding Financial Assets Explained

When diving into the world of money management, there are key components that play a pivotal role in building wealth and ensuring financial stability. These elements serve as tools for individuals and organizations looking to grow their net worth and navigate the complexities of the economic landscape. Grasping the nuances of these components is essential for anyone aiming to enhance their financial literacy.

Investments, such as stocks and bonds, often come to mind first. These are not just numbers on a screen; they represent a claim to future income or value. The excitement of watching your portfolio grow is like nurturing a garden–patience and strategy are crucial. Over time, with the right choices, these can yield substantial returns.

Cash equivalents also play a significant role in ensuring liquidity. Having ready access to funds allows for quick decision-making when opportunities arise. This flexibility can be a game-changer, especially in unpredictable markets. Being prepared with these resources can set one apart from the competition.

On the other hand, it’s important to recognize obligations that can impact overall financial health. Balancing responsibilities with available resources allows for a more sustainable approach to wealth management. Understanding the interplay between what one possesses and what one owes is vital for maintaining a favorable financial situation.

In conclusion, becoming well-versed in these critical components equips individuals with the knowledge to make informed choices. It’s not just about accumulating wealth; it’s about managing it wisely to secure a prosperous future.

Differentiating Between Assets and Liabilities

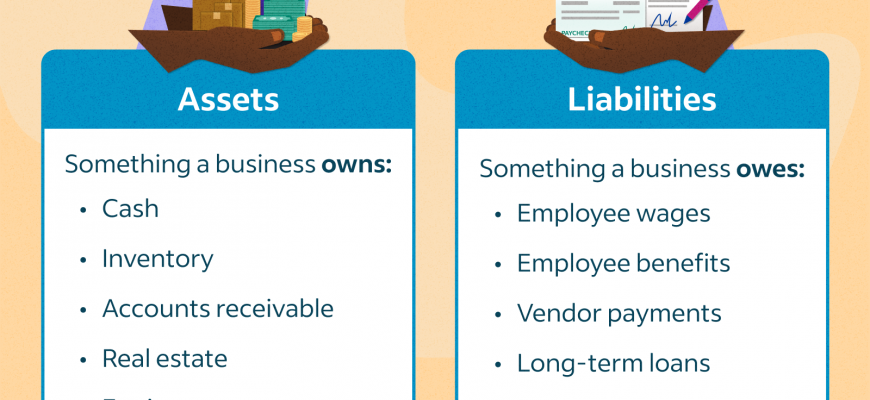

Understanding the distinction between resources and obligations is crucial for anyone looking to manage their finances effectively. Each of these components plays a vital role in shaping a person’s or organization’s financial landscape. Recognizing how they interact can lead to smarter decisions and better overall financial health.

Resources typically represent something of value that can generate income or appreciate over time. They can be tangible items like property or intangible things such as stocks. On the flip side, obligations refer to commitments that require future outflows of funds. These might include loans, credit card debt, or any other form of economic duty someone needs to fulfill down the line.

In essence, viewing resources as potential wealth creators and obligations as responsibilities to be managed can clarify financial planning. Prioritizing the growth of valuable resources while minimizing burdensome obligations can lead to stronger financial foundations. Knowing how to balance these two elements is key to achieving long-term financial stability.

The Role of Financial Instruments in Accounting

In the realm of accounting, various tools play a crucial part in recording and interpreting the economic activities of an entity. These instruments serve as essential components for measuring performance, ensuring transparency, and facilitating informed decision-making. They not only help in tracking wealth but also in navigating the complex landscape of monetary interactions.

Instruments can be categorized into several types, each providing unique insights into an organization’s financial health. They offer mechanisms for managing resources, evaluating risks, and gauging profitability. This diversity allows accountants to present a holistic view of resources and obligations, thereby enhancing the credibility of reported figures.

For instance, derivatives, stocks, bonds, and other market tools enable stakeholders to evaluate potential outcomes and make strategic choices. Proper utilization of these elements can lead to optimized management of existing resources and a clearer understanding of future obligations. By appropriately categorizing these tools, professionals can paint an accurate picture of an entity’s economic position.

Ultimately, the mastery of these instruments transforms the often-chaotic world of numbers into comprehensible insights. This understanding fosters trust among investors, regulators, and other interested parties, reinforcing the foundation of sound economic practices.