Understanding the Differences Between Financial Aid and Student Loans in Higher Education

When it comes to pursuing higher education, navigating the world of funding can feel overwhelming. There are various options available, each with its own nuances and implications. It’s essential to grasp the differences between assistance programs and borrowed funds to make informed choices that align with your financial goals.

Assistance programs typically provide support that does not require repayment, aimed at helping students alleviate the costs associated with tuition, books, and living expenses. On the other hand, borrowed money comes with responsibilities, as it involves repaying the amount received along with possible interest over time. Recognizing these distinctions is crucial for any prospective learner looking to manage educational expenses effectively.

In the following sections, we will explore these concepts in greater detail, shedding light on how each option can impact your overall financial landscape. Understanding the advantages and drawbacks will empower you to embark on your academic journey with confidence and clarity.

Understanding Financial Aid Options

When it comes to pursuing higher education, there are several resources available to support learners in covering their expenses. These avenues can greatly ease the financial burden, enabling individuals to focus on their studies rather than worrying about costs. In this section, we’ll explore the various types of assistance one might consider when planning for educational expenses.

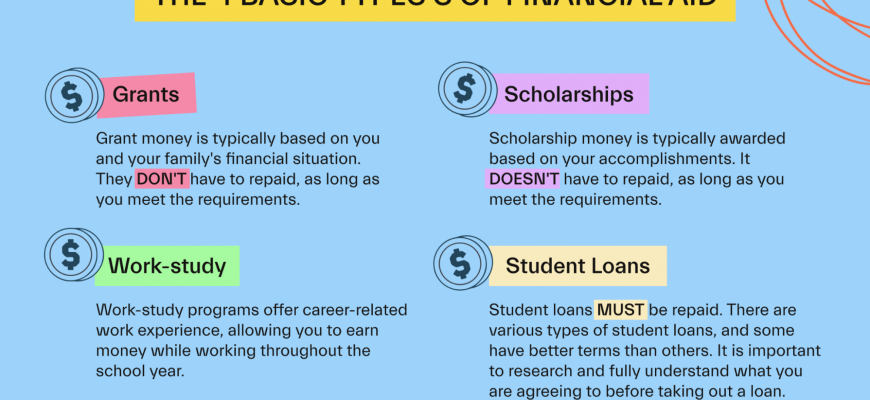

Different programs can provide diverse forms of support, ranging from grants and scholarships that do not require repayment, to options that involve borrowing funds. Each choice comes with its own set of eligibility criteria, application processes, and conditions. It’s essential to navigate this landscape carefully to determine the best fit for individual circumstances and goals.

Additionally, many institutions offer specific resources or packages tailored to their students’ needs. Understanding these offerings can lead to discovering hidden opportunities that may significantly reduce the overall cost of education. With a little research and effort, accessing the right kind of support becomes not only achievable but also a strategic advantage for academic success.

Explaining Education Financing in Detail

Navigating the world of educational funding can feel overwhelming, but understanding the different options available is crucial for prospective learners. This section delves into the mechanics behind borrowed resources that can help achieve academic goals. These monetary supports allow individuals to access quality education, often leading to enhanced career prospects.

The Basics: Funds acquired from lenders can be used for various educational expenses, such as tuition fees, books, and living costs. They provide a vital solution for those who may not have sufficient savings to cover the financial burden of higher learning. However, it’s essential to recognize that this assistance usually comes with obligations.

Types of Assistance: There are generally two varieties: those sourced through governmental programs, which may offer benefits like lower interest rates or deferment options, and private entities, which could have different terms. Understanding these distinctions helps borrowers make informed decisions about their commitments.

Repayment Plans: Once studies are completed, it’s time to focus on repayment strategies. This involves monthly payments that include both principal and accrued interest. Various plans cater to individual financial circumstances, ranging from standard to income-driven arrangements. Grasping these alternatives can relieve stress as one transitions from education to employment.

Long-term Impact: It’s important to consider how this financial obligation influences one’s future. While these funds can unlock educational opportunities, they also necessitate careful planning to ensure that post-graduate life remains financially manageable. Knowledge about interest rates and repayment timelines is essential in making wise choices that won’t lead to undue hardship.

Differences Between Grants and Loans

When considering options to help cover educational expenses, it’s essential to understand how various solutions differ. One type might provide funds that don’t require repayment, while another type usually involves borrowing money that must be paid back with interest over time. This distinction plays a significant role in how individuals manage their finances during and after their academic journey.

Typically, the first category is designed to assist those who meet specific criteria, often based on need or merit. Recipients of these funds generally don’t have to worry about returning the money, which can be a relief for those balancing tuition fees and living costs. This feature makes it a sought-after option for many aspiring scholars.

On the other hand, the second category usually entails a borrowing arrangement. Individuals receive a sum of money that they will need to repay later, often with additional fees. This can be beneficial for those who need immediate resources but may lead to financial strain once repayment begins. Understanding these variations can help students make informed decisions about their funding strategies.