Understanding the Concept of Financial Aid Refund Checks and Their Significance

Navigating the world of education expenses can be overwhelming, especially when it comes to the support systems in place to ease the financial burden. Students often find themselves in a maze of confusing terminologies and processes, making it crucial to grasp the essentials of these programs. One area that garners attention is the reimbursement process associated with education funding, where money often flows in unexpected directions.

Once the financial assistance has been applied to tuition costs and other fees, there may be a leftover sum. This leftover amount opens a conversation about how it can be returned to students, providing them with a financial boost. Understanding the nature of this return can not only help in budgeting but also in making informed choices about expenses along the educational journey.

For many, this reimbursement can serve various purposes, from covering essential living expenses to purchasing books or supplies. It’s an important aspect of managing educational finances, and recognizing the implications is key for any student aiming to maximize their resources. This guide offers insight into this process, ultimately enhancing your financial literacy during your academic career.

Understanding Financial Aid Refund Checks

When students receive assistance for their education, they often find themselves with extra funds after covering tuition and other necessary expenses. This surplus can lead to some confusion, as many wonder how to handle this unexpected windfall. Knowing how it works can help you manage your finances better and make informed decisions about your educational journey.

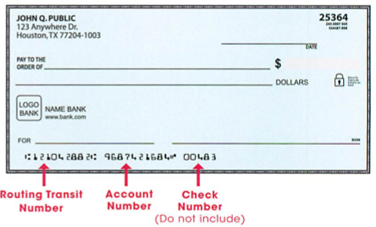

Once your tuition, fees, and related costs are settled, the remaining amount is issued back to you. This sum can be spent on essential items such as books, supplies, or living expenses, allowing you to focus more on your studies and less on financial stress. Understanding this process and how the funds are disbursed is crucial for every student navigating higher education.

It’s important to keep track of the funding sources and their specific guidelines. Sometimes, the institution’s policies dictate the timing and the amount received, which can vary greatly from one semester to another. It’s wise to consult the financial office at your school to clarify any details and to handle your resources effectively.

Ultimately, receiving this extra funding means you have more control over your educational expenses. Being proactive about managing these resources can lead to a smoother academic experience. Always remember to budget wisely and prioritize your needs during your time in school.

How Refund Amounts Are Calculated

Calculating excess funds can seem a bit tricky at first, but it boils down to understanding a few key elements. The process generally involves assessing the total costs associated with enrollment and determining the amount of assistance received. Once these figures are established, it’s easier to see if there’s any leftover balance.

First, the total expenses include tuition, fees, and sometimes housing costs. Then, you’ll want to factor in any scholarships or loans awarded. By subtracting the sum of the financial support from the overall expenses, you can get a clearer picture of whether there are funds remaining. If the aid exceeds the expenses, a surplus is created, which is typically disbursed to the student.

This balance isn’t just handed out randomly. Institutions often have guidelines they follow, which can differ depending on the type of funding involved. Therefore, familiarizing oneself with these regulations can provide additional clarity on how much can be expected. Understanding the calculations can empower students to plan their finances better and make the most out of their educational investments.

Using Your Refund Check Wisely

Receiving that extra sum can feel like a windfall, offering a chance to ease your financial burdens or even splurge a little. However, it’s crucial to approach it with foresight to ensure that it serves you well in the long run. Smart decisions can help you maximize the benefits, allowing you to invest in your future or manage immediate expenses effectively.

Start by prioritizing your needs. Make a list of your financial obligations, such as bills or student loans, and address them first. By taking care of these essentials, you’ll create a less stressful environment for yourself and free up funds for other endeavors down the road.

Consider setting aside a portion for emergencies. Life is unpredictable, and having a financial cushion can provide valuable peace of mind. Aim for at least a small reserve to prepare for any unexpected situations that may arise, ensuring that you can handle challenges without scrambling.

If there’s still some left, think about investing in your education or personal development. Courses, workshops, or books can be worthwhile expenditures that enhance your skills and knowledge base, potentially leading to better opportunities in the future.

Lastly, don’t forget to treat yourself responsibly. It’s perfectly fine to indulge a little, but balance is key. A small reward for your hard work can lift your spirits and motivate you to keep pushing towards your goals.

Approaching this situation with mindfulness can transform a temporary boost into lasting benefits, positioning you for greater success and stability.