Understanding the Essentials of Financial Aid Notification and Its Importance for Students

As you navigate the intricate world of education expenses, you’ll likely come across a critical piece of information that can significantly impact your journey. This segment focuses on how institutions communicate their support options to students and families, ensuring that no one is left in the dark. It’s all about empowering individuals with the knowledge they need to make informed decisions regarding their funding opportunities.

When the time comes for educational personal to consider financing their studies, they often receive a structured overview of available resources. This announcement serves as a guiding light, illuminating the various forms of support one might qualify for. With different types of offerings on the table, understanding this process can be a game changer in managing costs and maximizing access to education.

Delving into the details of these communications reveals the essential components that students must grasp. It’s important to look closely at the specifics provided within these documents, as they outline the necessary steps to secure monetary assistance. Through clear and concise messaging, institutions aim to demystify the funding landscape, enabling students to confidently pursue their academic aspirations.

Understanding Financial Aid Notification Process

Getting assistance for education can feel overwhelming, especially when it comes to interpreting the message you receive regarding funding options. This communication serves as a crucial element of the collegiate journey, offering insights into the resources available to help alleviate some of the financial burdens. Understanding this process can make a significant difference in making informed decisions about your educational path.

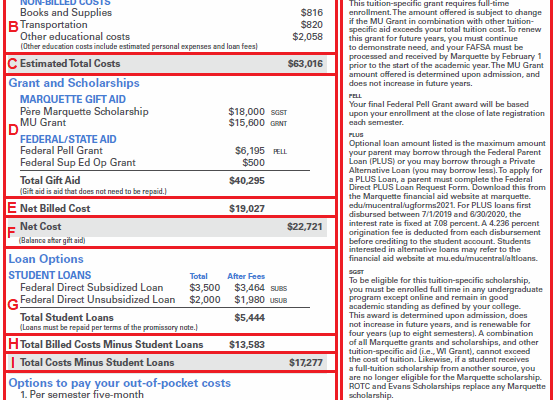

Initially, after submitting necessary documentation, an applicant will receive a detailed report outlining the awards and resources for which they qualify. This message typically breaks down the types of support offered, whether they are grants, scholarships, or loans. Clarity is essential here, as it allows individuals to grasp not only the amount of money available but also the terms and conditions attached to each type of support.

It’s important to review this report carefully. Each component has specific requirements, and understanding these can help you stay on track. Pay attention to deadlines and any obligations that might come with accepting the offers. Engaging with advisors or financial consultants can further enhance your comprehension and assist in navigating any complexities.

After reviewing the options, individuals must make decisions about what assistance they are willing to accept. This step is significant, as it impacts future financial commitments and educational expenses. Keep communication open with the institution, as they often provide resources to help clarify any questions or confusing aspects.

In summary, navigating through this initial correspondence is a critical step in securing support for your studies. By taking the time to understand what is offered and aligning it with your educational goals, you can set a solid foundation for your academic experience and future endeavors.

Types of Support Available

When it comes to funding your education, there are several options to explore. Each type offers unique benefits to help students manage their expenses while pursuing their academic goals. Understanding these varieties can make a significant difference in your financial strategy.

Firstly, grants are a popular choice since they don’t require repayment. These are often awarded based on need or specific criteria such as academic performance or community service. Scholarships also fall into the same category, providing funds that students don’t have to pay back, often based on merit, talent, or other achievements.

Then, we have loans, which come with specific terms and conditions for repayment. They can be federal or private, and while they offer larger sums, it’s crucial to understand the interest rates and repayment plans attached. For those who are employed while studying, work-study programs can be a great way to earn money while gaining valuable experience in your field.

Lastly, fellowships and assistantships are beneficial for graduate students, allowing them to work closely with faculty while receiving tuition discounts or stipends. It’s essential to research and apply for these opportunities early to maximize your chances of receiving the support you need.

How to Interpret Your Notification Letter

Receiving your letter can elicit a whirlwind of emotions, from excitement to anxiety. It’s essential to approach this document with a clear mindset, as understanding its contents can greatly impact your academic journey and financial planning. Each section holds meaning, and deciphering it correctly will help you make informed decisions.

Start with the summary of support offered; this typically lays out the total amount you may receive. Keep an eye out for any distinctions made between types of assistance, such as grants, scholarships, or loans. Knowing the difference is crucial, as some funds do not require repayment while others do.

Next, familiarize yourself with any conditions attached to the offered support. Many institutions outline specific criteria that must be met for continued eligibility. These may include maintaining a certain GPA or enrolling in a minimum number of credits. Understanding these stipulations ensures you remain compliant and can maximize your resource potential.

Don’t overlook the breakdown of costs, either. Look carefully at tuition, fees, and estimated living expenses. This will provide a clearer picture of your overall financial situation and help you determine how much additional funding you might need. Cross-referencing this with your personal budget can aid in planning effectively.

Lastly, if there are any unclear aspects, reach out! Institutions typically have a dedicated office ready to assist you with inquiries. A little guidance can go a long way in making sure you’re on the right path financially as you pursue your educational goals.